Legal tech start-up PartnerVine has launched an automated legal contract market for corporates, in conjunction with Big Four firm, PwC.

The Swiss venture is the brainchild of Jordan Urstadt, who previously worked as a general counsel and earlier in his career as an associate at White & Case.

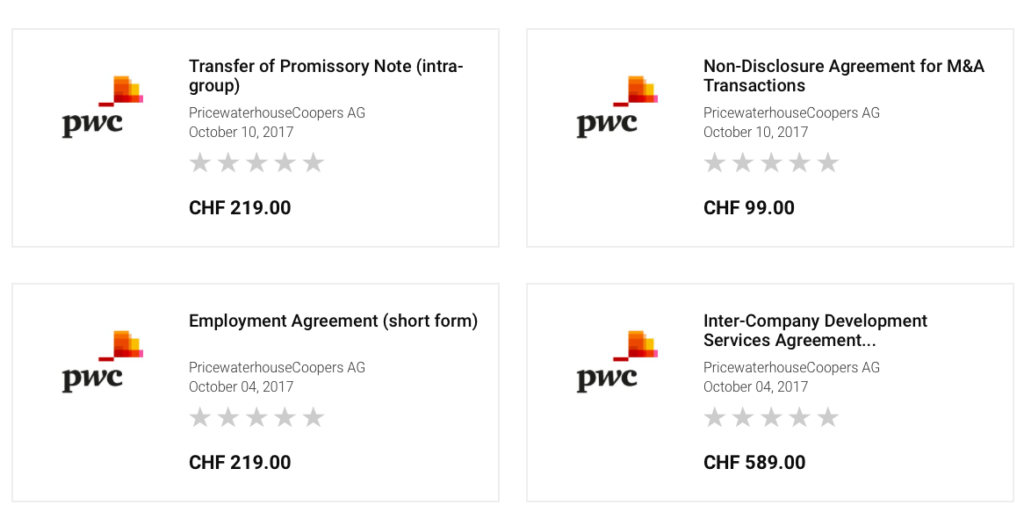

The core offering is a marketplace of automated contractual documents covering a wide range of needs a company may have. The first major seller in the marketplace is the Swiss division of PwC, which has created a range of contracts for sale based on the Exari automation platform.

It is expected that lawyers from other firms will also place automated contracts on the market place in the coming months. The automated contract templates appear to be very reasonably priced, with an automated employment agreement for CHF 219 ($223) and an automated NDA for use during M&A priced at CHF 99 ($100).

Urstadt told Artificial Lawyer that he believed this was the best way for legal tech to ‘add value’ to the work of inhouse legal teams, i.e. to make the completion of standard contracts, faster, cheaper and more efficient.

In turn, the benefit for the providers of the contracts, such as PwC, is that they can generate additional revenue, and also perhaps generate additional work from users of the system who then later want more complex advisory input. In effect, this is both an extra revenue stream and a business development device. It’s also, as noted, a means to achieve greater efficiency and cost savings for inhouse legal teams.

Urstadt explained that he has been in talks with a significant number of law firms, including US and UK firms, about contributing automated contracts to the marketplace.

In terms of the overall value, Urstadt added: ‘We are not selling a commodity. Some of the automated documents can take some time to create. With PwC it’s an institutional effort.’

Of course, Artificial Lawyer then had to ask: ‘Why would a high quality firm that is profitable in part because of its particular expertise, want to sell its knowledge to the wider market like this?’

Urstadt responded that the leading law firms can increase their revenues and boost profits by also doing this in a bid to take market share in the mid-market.

One could see an analogy with luxury fashion brands that also offer ‘consumer level’ goods to a wider audience. I.e. they leverage their great brand and internal knowhow to then create products that are of interest to a wider audience.

Urstadt added that Big Law firms could even create a sub-brand to market these automated contracts through PartnerVine.

Whether major US and UK law firms will play ball remains to be seen, but the core argument makes sense. For example, as Urstadt explained, an inhouse lawyer at an SME may draw up a basic contract and then ask an external law firm to review it. The law firm wants $5,000 just to read it and give back some notes. If there is any issue with the contract’s wording this could mean more money. And that might be for a basic corporate document.

Because of the pricing, the lawyer at the SME decides not to ask for external input, so it’s a lose-lose situation. No firm gets the work, and the company misses out on some useful external knowhow.

In such an environment there has to be a better solution and tapping the knowhow of expert lawyers and crystallising it in automated contracts looks like a good solution.

One other aspect here is the issue of commercial legal services being transparent with regard to price. In the UK for example there is a growing debate about the need for consumer level law firms to be totally upfront about pricing of their ‘legal goods’. However, large commercial firms have so far been largely exempt from the debate on the basis that what they sell is too complex to price, while the buyers are – or so it’s explained – don’t really want ‘shop window’ pricing in this way.

However, if PwC can put a price on a wide range of corporate contracts and put those prices out in public for all to see, then presumably all other major commercial law firms could do this as well? But do they want to?

How this plays out will be very interesting to see.

2 Trackbacks / Pingbacks

Comments are closed.