One of the challenges of legal tech is that there is an understandable tendency to only focus on what is happening inside the legal community. But there is plenty to learn from other professions and sectors.

For example, Artificial Lawyer chaired a round table yesterday where there were lawyers, accountants and enterprise technology consultants. All were largely unaware of what the other professions were up to with regard to the adoption of business-tranformative tech, such as machine learning and natural language processing (NLP) systems to provide better data analysis or to help execute client work. That is one reason why this report by financial sector tech consultants, Celent, on the use of ‘InsurTech’ is so interesting.

The report by Celent, ‘Finding Value in InsurTech, Part One,’ looks at how these major pillars of the commercial world are approaching new forms of tech to help their business and in some cases totally transform the way they conduct business and relate to their clients. Not all of this can be directly mapped over to the legal world, but nevertheless, Artificial Lawyer thought it might be interesting to have a look.

–

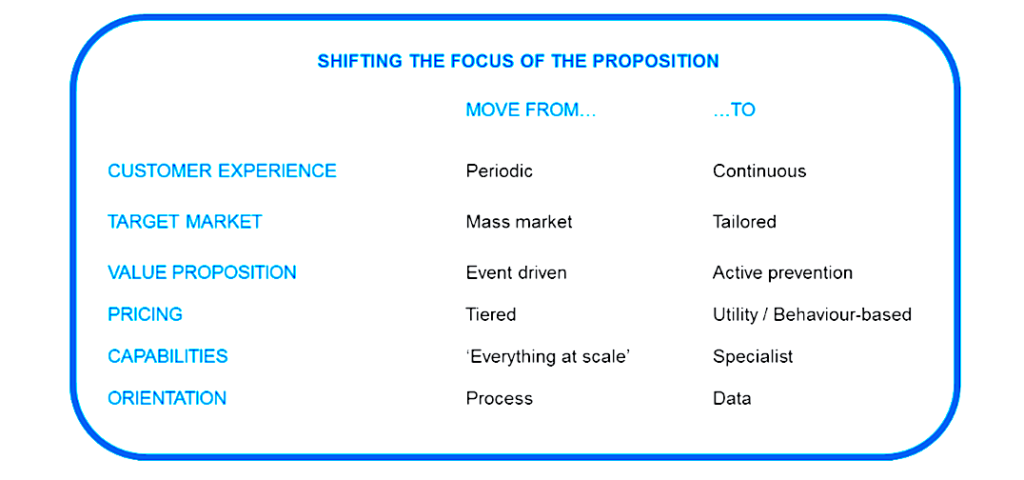

So, what are insurance companies looking at? Celent, with their kind permission, has allowed some of this info to be presented. First, check out the table below.

As you can see, the core of these change areas is related to data capture and analysis. For example, moving from periodic ‘customer experience’ i.e. collecting data at the time of policy renewal to a scenario where data is collected continually (naturally with the client’s permission, especially with GDPR looming).

This certainly makes sense for lawyers working with large clients. Why not have a GC permit the panel firms to have a continuous legal data flow to these external advisers? Maybe develop dashboards that allow panel firms to monitor activity and then feedback insights to the client in real time? Perhaps some of those feedback elements can also be automated?

Another aspect is tailoring. Because data is easier to capture now, it is also easier to tailor policies automatically to clients, or by understanding their needs due to past analysis of similar client needs, an insurer can provide the best-fitting policies. For example, we see a similar trend in the medical world by using data crunching and analysis capabilities to study thousands of patients and their response to certain cancer treatments, which then helps doctors to better decide what drugs and treatment to use for new patients.

In legal this relates to using data analysis to have a better understanding of client needs, whether this is spending time in their contract stack and dispute record to provide better advice, or automatically modelling what similar clients have needed in the past in a way that speeds up the provision of KM services to lawyers on the front line of giving advice. This also connects to the point above about litigation prediction advice.

The development of ‘behaviour-based pricing’ is another fascinating area. In this case it’s the insurance company effectively rewarding the client for ‘good behaviour’, such as driving safely, or perhaps logging plenty of exercise on a fitness tracker. Or in other words: leveraging big data and IoT to change their economic modelling.

Could that be used by lawyers? Probably not in this direct way. But, are there ways that law firms and clients’ legal teams could work together to map patterns in legal activity, cost and risk on a continuous basis and have automated remedies in place for these eventualities….? Could be. We’re already seeing legal AI companies work with the corporates to analyse their sales and procurement contracts to surface business insight. Maybe this can go a step further? Maybe the idea of continuous data dashboards above is indeed doable.

And, while it seems unlikely for now that lawyers would start changing prices on an automated basis that responds to a client’s previous legal need level, this is not an entirely out of this world idea. We already have some very good legal tech companies working on pricing analysis, can this be taken to the next level of automation?

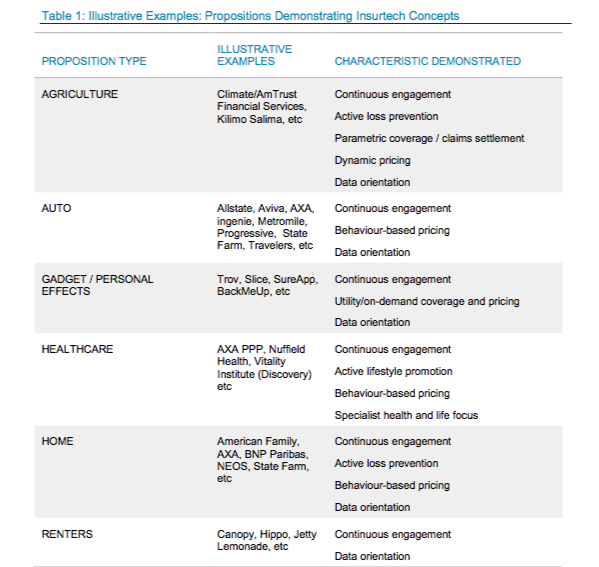

There are many ideas that come to mind once one starts to consider how insurance companies are focusing on data and in many ways living with a ‘continuous client relationship’, rather than an event-led one. Below is a summary of some of the companies involved in InsurTech adoption, either as supplier, users or new entrants.

The report also provides a lot of discussion about how and when insure tech companies will get value out of this tech and how long insurance companies think it will take to change. These areas are backed up by a survey of insurance companies and related experts.

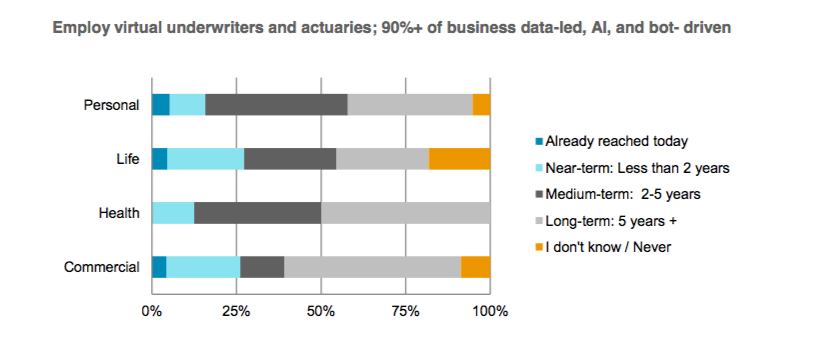

Check out the two charts below that relate to the automation of work.

What these tables show is that insurance companies are adopting automation not just for retail client relationships via bots, but also partly automating the underwriting and actuarial services, which are fundamentally data-led professional services.

For example, with regard to automating underwriting to the point where 90% of work is ‘data-led and bot-driven’, around one quarter of life insurers said they expect to reach that point in just two more years, with around two-thirds expecting to get there within five years.

With regard to using bots to handle 90% of customer relations, a quarter of insurance companies in the health sector said they expect to get there within two years.

Interestingly, the percentages of insurance companies not expecting to ever automate, or that simply didn’t know how to answer the question, was very low (as seen above), in most cases less than 15%.

–

Celent rounds off the report with some wise words for insurance companies on tech strategy.

‘If insurers are to respond to the opportunities and threats presented by these insurtech concepts, they will need to:

- Flex their innovation activities to address different perceived levels of change for different business lines. A “one-size-fits all” model will not be sufficient to reflect the nuances of each line of business. For some lines of business and insurtech concepts, the urgency is high, while in others it is low.

- Continue to focus on distribution as a distinct area of focus for innovation. Distribution remains a significant battleground across most lines of business, and traditional retail distribution patterns remain under threat from digital initiatives both inside and outside the industry. Greater levels of activity may see greater results in the short term.

- Develop a portfolio view towards assembling a market response. Ultimately, it will be the combination of insurtech concepts that need to be assembled together to deliver a winning proposition. However, looking at each concept individually may provide some earlier clues with respect to market traction and the delivery of customer value.’

This looks like very sound advice, and uncannily would be very sound advice to the legal sector as well. For example, not assuming a one size fits all model will work and that different business lines need different tech, such as, in a legal context, a private client team may not need the same document crunching tech that the firm’s M&A team needs, but may need tech of a different nature.

–

So, there you go. Many thanks to Celent and their PR team for allowing Artificial Lawyer to reproduce parts of their report.