A survey of legal tech companies by US PR and marketing agency Baretz + Brunelle has found that very few players in this sector have what it calls a solid ‘go-to-market strategy’, while most don’t know for certain who in a legal organisation they should be selling to.

The survey in the ‘Boom or Bust – the 2018 Legal Tech Go-to-Market Report‘ also found that less than half of respondents knew ‘how profitable their products were’, with just 44% saying they monitor and survey their top clients to gather feedback.

It also found that ‘more than half of respondents felt some level of disconnect between sales and marketing in their organisation’, i.e. that the messaging going out to market and expressed via the legal tech press and advertising, was not necessarily aligned with how the sales team was operating and selling, thus the expertise of a Social Media Marketing Agency may be needed.

Just under half of legal tech companies, 48%, had a ‘fixed budget allocation’ for marketing, the survey also found. And, 41% said that they spent most of their time in terms of growing the business by just ‘seeing what worked’ and then doubling up on that, which suggests many don’t have a clearly set out strategic growth plan, or necessarily a core sales proposition that they are going to stick with and were willing to iterate on the move depending on how feedback played out.

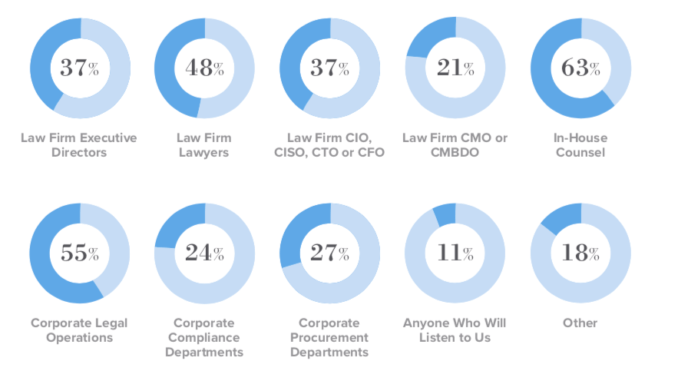

For Artificial Lawyer, the part of the survey that most resonated was the question about to whom a legal tech company should sell to. (See the results below).

The results show that legal tech companies are clearly not certain who to sell to. Or perhaps a better way of saying it is that legal tech, especially newer applications that relate to the ‘New Wave’ of technology that performs work, such as automated systems, may appeal to a wide number of potential buyers, from partners, to IT teams.

What the above also shows is that the procurement system for new technology inside law firms, and perhaps also inside corporates, is still in an undeveloped state. Or at least those selling into legal businesses cannot see a clear procurement pathway.

This is in part likely driven by the reality that law firms are partnerships, and if one equity partner wants to experiment with a certain type of technology most firms are happy to allow this to take place. Meanwhile, IT teams that have a ‘keep the lights on’ role, are not likely to be best placed to decide on whether to deploy an AI doc review system, primarily because such decisions impact client work and therefore partners need to be involved, if not leading the decisions there.

The fact that 11% of respondents said that they will approach ‘anyone who will listen’ in a legal business is also indicative. I.e. it may be a fraction of the total, but in what other sector do businesses feel it’s normal to just approach anyone in any part of a target customer to try and get a sale?

But, the truth is that although this may seem like a critical report by the PR agency, the reality is that when so many new companies are coming to life, to sell emerging new tech, to lawyers who didn’t even know such tech existed a couple of years ago, then it’s quite natural that the above takes place. Artificial Lawyer has also seen great examples of legal tech companies that really are excellent at marketing for legal firms and know exactly what their sales proposition is, though clearly this is not universal, as the survey shows.

Also, areas such as the ‘legal AI sector’, for example, have been in true commercial scale activity for only about two years (even if some of the companies involved have been around for about seven years). It’s hard for a two-year old sector to really have clear sales pathways and strategies, because everyone is still learning, both the buyers and sellers.

Moreover, selling AI tech, for example, is complex, as noted above, because it is about a technology that conducts legal work. This is not operational / utility tech, it’s actually part of the billables of lawyers at a firm. That changes everything about the route to market.

Nevertheless, it’s an interesting and timely report by B+B. Let’s leave this one with a quote from the survey from Kate Boyd, Vice President of Marketing at legal AI company, Kira Systems: ‘You may need to have very different conversations with a law firm partner, or an IT person – and even that is shifting really quickly.’

‘When it comes to personas, there is a lot that we are still figuring out and honing. We are trying to segment a market that is constantly changing. The conversations that you have with elite New York law firms versus smaller regional firms may be completely different,’ she concludes.

Clearly there is everything still to play for, especially for the legal tech companies with new technology and ideas. Is the legal world fully prepped to procure this tech? Nope. Does that matter? In the long run, nope, as things will find their way eventually. In the short term, however, it does look like legal tech marketing is going to go through something of a learning curve, for lawyers and the entrepreneurs.