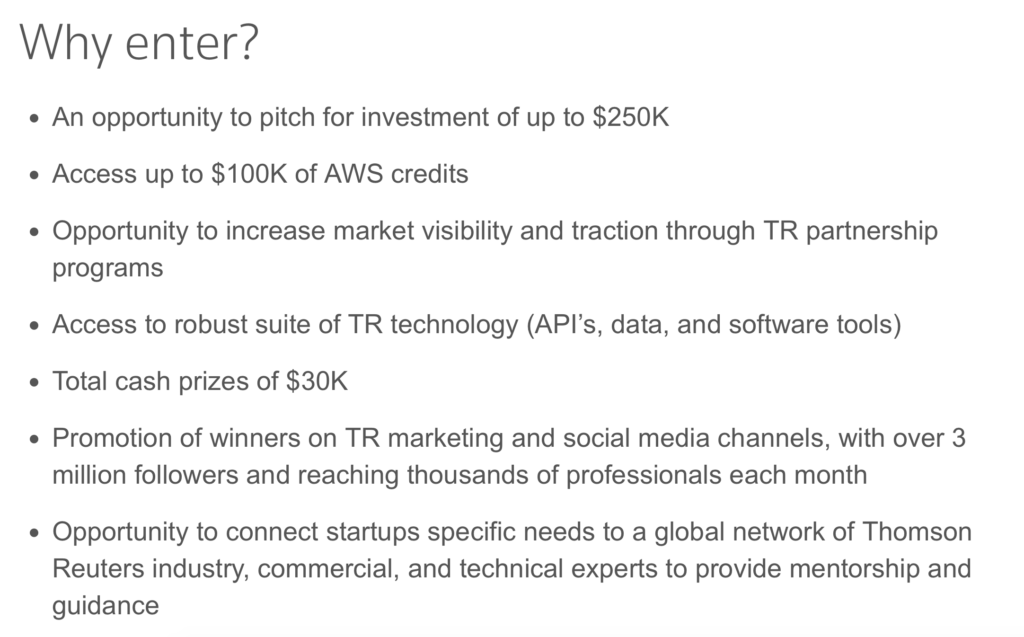

Global legal publisher and tech company, Thomson Reuters (TR), is launching a new prize for RegTech and legal tech companies that could see the winner bag up to a $250,000 investment, partnership with the business, plus $15,000 in additional prize money, and $100,000 in Amazon Web Services (AWS) cloud computing credits.

The maximum total pot could therefore be up to $365,000 in value for the winning company that can show significant innovation through technology in the area of regulation and compliance. Winners may also gain a formal partnership with TR. That said, the competition will also allow those that don’t win to make a pitch for the investment money as long as they are considered to have formally qualified as participants.

Winners will also be promoted by TR to its global client base and gain access to the company’s data and suite of software tools.

Whether any partnership and/or investment following the prize would then result in the winning company being acquired by TR is not set out, although that could be an eventual and logical outcome, at least over the medium to long term. After all, why would a large legal tech company get so close to a startup if the goal is not to eventually acquire it, or if not, to study it in detail and then be inspired to build something very similar?

TR said they are looking for ‘early stage start-ups in the legal, tax and regulatory space‘ and ‘entrants will be judged on criteria that include: the market opportunity, the value proposition of their solution, technical expertise, partnership opportunities and quality of their presentation’.

The new prize comes soon after TR bought legal data sharing company HighQ following a competitive bidding process, and sold its managed legal services arm to Big Four firm, EY.

Nick Jarema, vice president, Thomson Reuters Labs, said: ‘Businesses are increasingly looking to technology and automation to help navigate a rapidly evolving regulatory environment and rising costs of compliance. The global RegTech market segment is expected to nearly triple in size over the next five years to US$12 billion, and we are excited to pair our data, expertise and customer relationships with the innovative spirit of the start-up community to bring solutions to market even faster.’

‘This contest will give early stage companies the opportunity to work with comprehensive, structured data sets as well as domain and technology experts, which we hope will help them validate their offerings and accelerate traction amongst their customers and investors,’ he added.

The comment clearly shows what TR is thinking, i.e. RegTech is going to be massive (and already is in some areas such as banking), so let’s try and see what’s out there by running a competition with a big enough pot to really get the best companies’ attention.

For the companies out there thinking of entering, clearly there is a huge opportunity here to become very close to TR. That could have pros and cons, depending on what your business goals are. But, if tying yourself to TR sounds like a way forward, then this may be for you.

Of course, growing independently, then perhaps in five to seven years’ time selling for a very large sum, may be a better option. $250,000-plus may sound like a huge amount now, but further down the line it may look more like a diversion from your overall business goals. TR’s partnership/investment may not preclude selling to someone else in the future, but having it may make matters a little more complicated.

As with all these types of deals, it’s a question of making a hard decision about what will get you ‘there‘. If you want to be so close to TR and gain the goodies on offer regardless of how it may alter your company’s trajectory, then this is for you. If you want real freedom to do as you want without a multi-billion dollar legal tech company standing right behind you – and potentially owning part of you (…and hence presumably also having some say over your IP…) – then maybe not.

And, of course, you’d still need to compete and win it, for any of the considerations to be relevant. Given what’s on offer it looks likely that the competition will be fierce.

Either way, check out the details below:

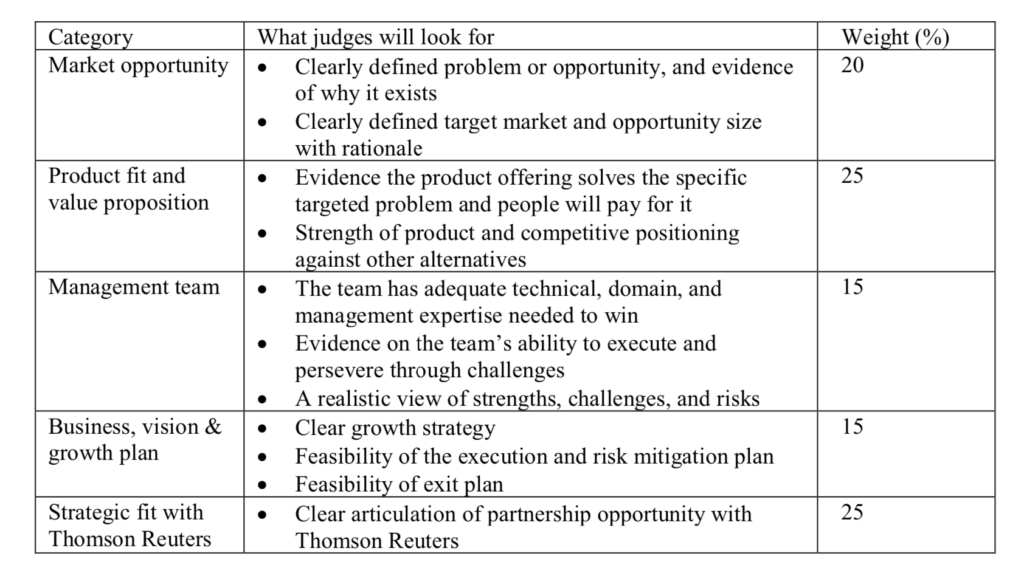

Round 1 Submissions. Each Round 1 Submission will be reviewed by Online Judge(s). Judges may include corporation leaders, and industry experts, including lawyers and entrepreneurs. Judging will take place through the Contest Site using the evaluation criteria listed in the table below. Judging will take place from approximately September 13, 2019 at 9am US ET to September 23, 2019 at 9pm ET.

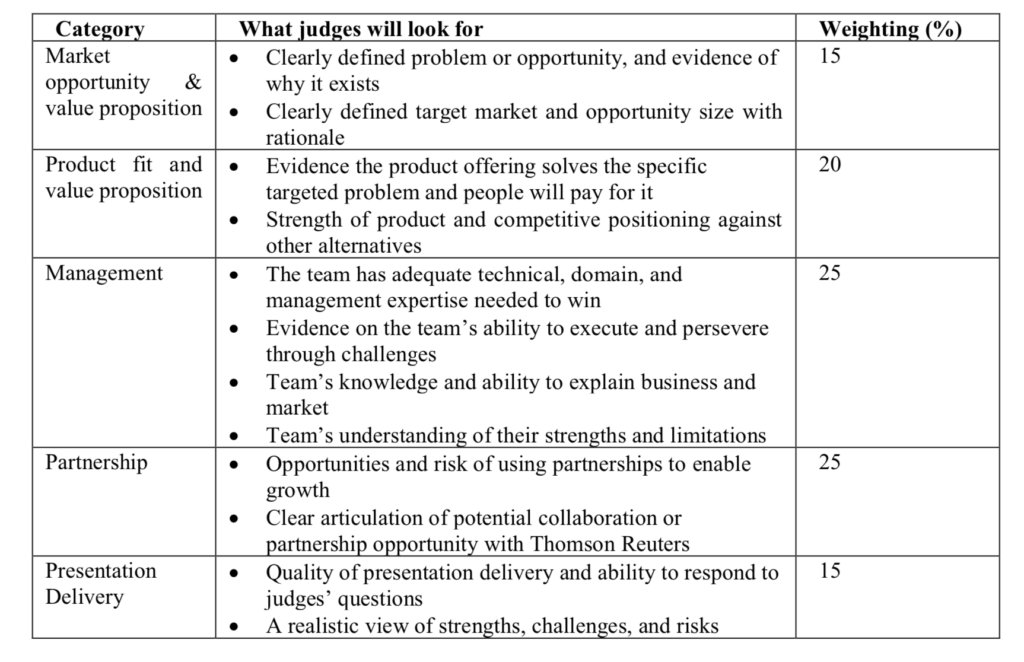

Round 2 Final Live Pitch. Each Round 2 Final Live Pitch from a Round 2 Finalist will be judged by a panel of judges. Live Pitch Judges will include Thomson Reuters executive leadership who will evaluatethe Finalists’ live pitches using the evaluation criteria listed in the table below. Judging and scoring will take place on October 29th, 2019 during the Final Live Pitch Event. Up to three (3) potential “Thomson Reuters Prize Winners” will be announced live at the Final Live Pitch Event from among the Round 2 Finalists.

Award of prize to potential Prize Winner is subject to verification of eligibility and compliance with these Official Rules by potential Prize Winner. In the case of a tie, the Participant among tied Participants whose Submission received the highest score in the “Partnerships” category from the Live Pitch Judges will be deemed the winner.

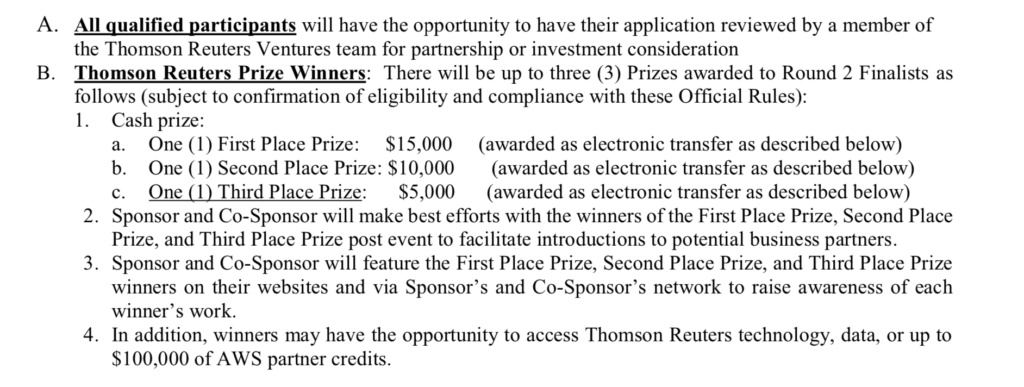

And, the prizes are:

As noted, TR has said that investment can be up to $250,000. Applications are now open and are due by September 9th. And regardless of any investment there is still the bonus of a $15,000 cash prize and plenty of kudos for first place.

Competition criteria:

- You are a founder of an early stage technology startup (seed or series A)

- Your product addresses a regulatory-related use case applicable to legal professionals, tax professionals, corporations, governments, or regulatory agencies

- You have a product launched in market with at least one paying customer

- Your startup is less than 50% owned by outside investors (e.g., Corporations, Venture Capital firms, etc.)

- You are available to present in person in New York on October 29th.

So, there you go. As outlined above, all that glisters isn’t gold, but this could be a great way to get global recognition and partner with one of the leaders in the legal tech market.

Legal Innovators Conference Information and Tickets: