Smart contract pioneer Clause has formed an integration with bank data-sharing platform Plaid – which also now is being acquired by credit card giant VISA for $5.3 billion…! This will allow credit checks to take place via the digital contract system, among other actions.

The move is interesting as it has a much more consumer-level focus and that could help the cause of self-executing smart contracts that are in effect ‘live’ and connected to real-time data streams. Such contracts have in the past tended to be focused on quite complex use cases. And this is one reason why smart contracts of this type have remained a niche pursuit.

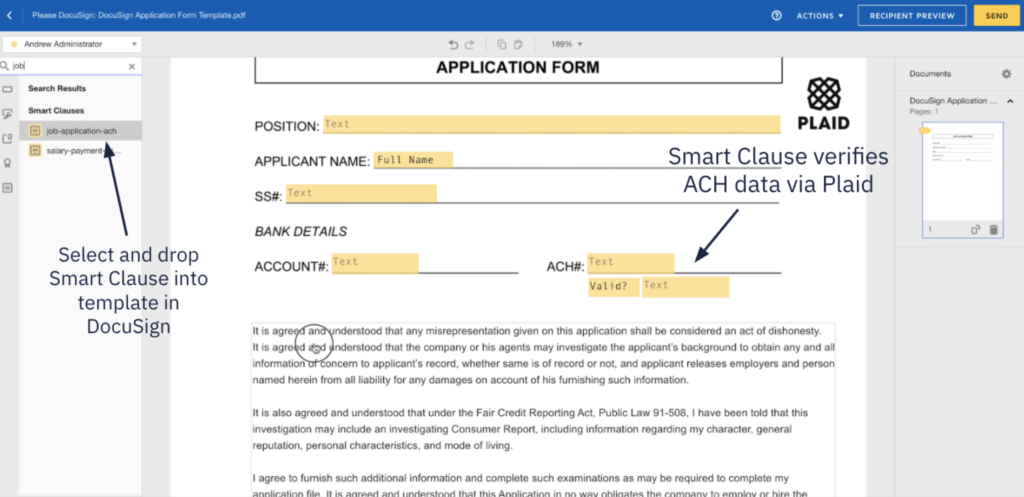

Linking with Plaid, which as noted is about to become part of one of the world’s largest financial sector companies, VISA, is a move to a much broader market. It also ties in with Clause’s integrations with DocuSign, which is also an investor in the smart contract company – see story.

But, what can the Plaid integration do more broadly? Artificial Lawyer asked Dan Selman, CTO at Clause, to explain.

‘The integration of Clause and Plaid is very flexible and allows the smart legal agreement to ‘reach-out’ to a human to request additional bank details as and when necessary.

For example, the smart legal agreement might periodically request saving or mortgage account bank balances, or check credit worthiness during a vendor onboarding process.

During electronic signature, or during the lifetime of the agreement, the signer can login to their bank account; and their bank account details, balances, identity information or transaction history gets pulled into the smart legal agreement.

A basic use case is automating all of the agreements that require people to enter bank account numbers and routing numbers (sort codes), required to set up payments, or direct debits.

This was a technically challenging integration to build, because there are three parties involved and because of the sensitivity of the information:

1. The bank account holder, who is presented with the Plaid user interface and logs into their bank,

2. Plaid, which federates login across thousands of different banks, and

3. Clause which receives the data from Plaid.

At no time does Clause ever have access to the bank account holder’s bank credentials.

To ensure security this requires that the smart legal agreement generates a secure hyperlink that can be sent to the bank account holder via any communication channel (Slack, email, DocuSign envelope … ), and that when the link is clicked that the login using Plaid takes place.

Upon success the requested bank information is then sent to the smart legal agreement using a secure, one-time, encrypted protocol.’

–

So, there you go. And, as explored above, maybe this is the real future for Clause, OpenLaw and others, at least in the short to medium term?

I.e. while the tech has been proven to work, uptake by commercial law firms to actually build contracts for clients using this tech remains limited to a narrow segment of the market. But, with consumer finance areas such as credit checks, and on-the-spot e-signatures for goods and other down-to-Earth uses, smart contracts could really find their home – and their growth market.

Will VISA, or a large bank, one day buy Clause…? It would make a lot of sense. Of course, Clause has made no indication that this is the way they want to go, and they’re still busy developing the product and building outward as an independent company.