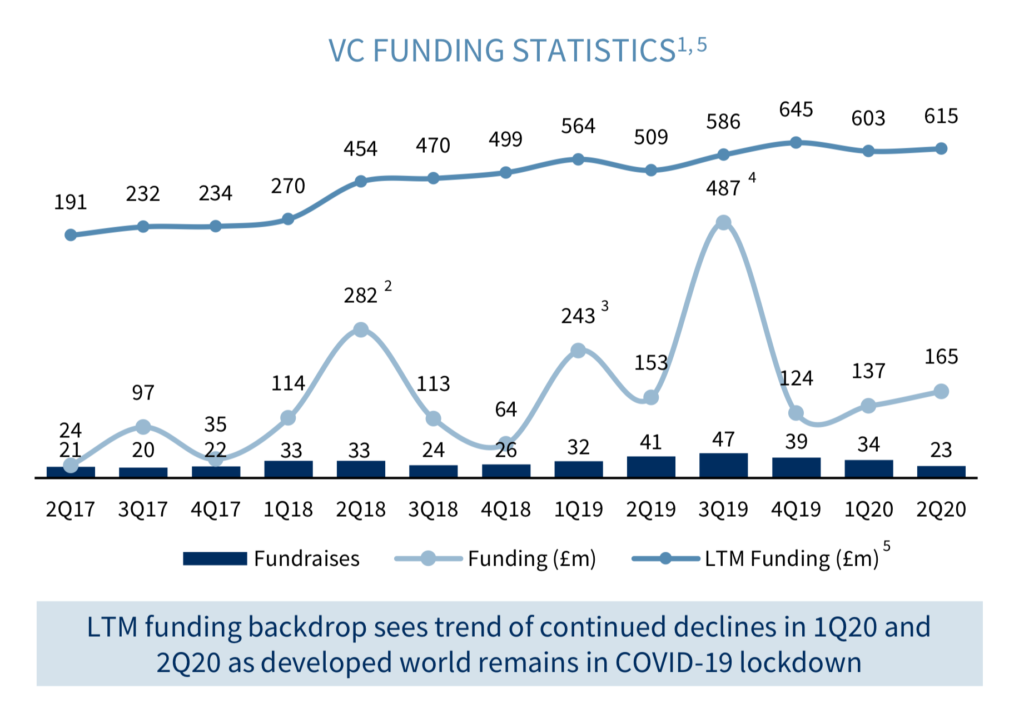

Research on the NewLaw and legal tech market by financial advisory group Raymond James has found that venture capital (VC) investment is still showing signs of health, but that there may well be a bumpy road ahead for some. In fact, Q2 2020 saw a better total VC funding level than all but three of the past Quarters going back to Q2 2017.

Data (see below) shows that in developed countries, 2020 Q2 saw 23 fundraises with a total of £165m raised for NewLaw and legal tech companies – which is not bad at all given the climate.

Q2 2019 saw less raised at £153m, but the following Quarter, Q3 2019, saw 47 funding rounds, with an incredible £487m raised. It will be hard – if not impossible – to see that happen in Q3 this year amid the Coronavirus’s impact.

VC funds still backed 23 rounds in Q2 2020, fewer than Q1 with 34, suggesting more money is going into a smaller group of more mature companies, often where VCs see a real chance for rapid scaling, which again will not be every company searching for funds.

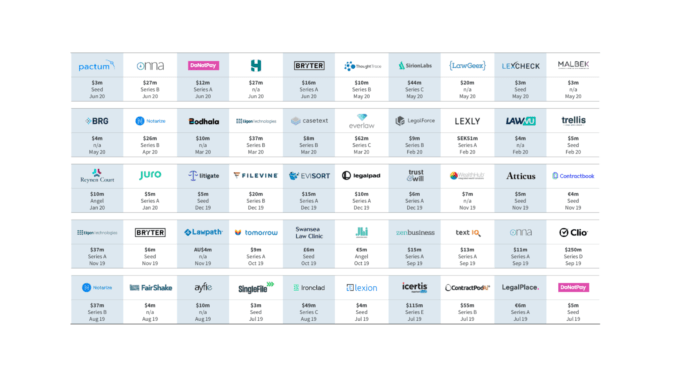

As seen with Onna’s recent $27m raise and Bryter’s $16m Series A raise, and that of LawGeex’s at $20m, there is still a lot of interest in legal tech companies that can meet the scaling demands of investors in the current climate.

And, almost to prove the point, UK-based legal tech/proptech startup Orbital Witness has closed a £3.3m seed funding round led by LocalGlobe and Outward VC with participation from previous investors, including Seedcamp and JLL Spark. This investment round brings Orbital Witness’s total funding to £4.5m. The company has a focus on legal risk assessment for commercial property transactions.

[Note: Clio’s fundraise of $250m and Icertis’s fundraise of $115m are included in the £487m total for Q3 2019, but NOT INCLUDED in the £586m Last Twelve Month analysis rolling total (the top dark blue line) to make sure very large deals don’t skew the overall trend indication.]

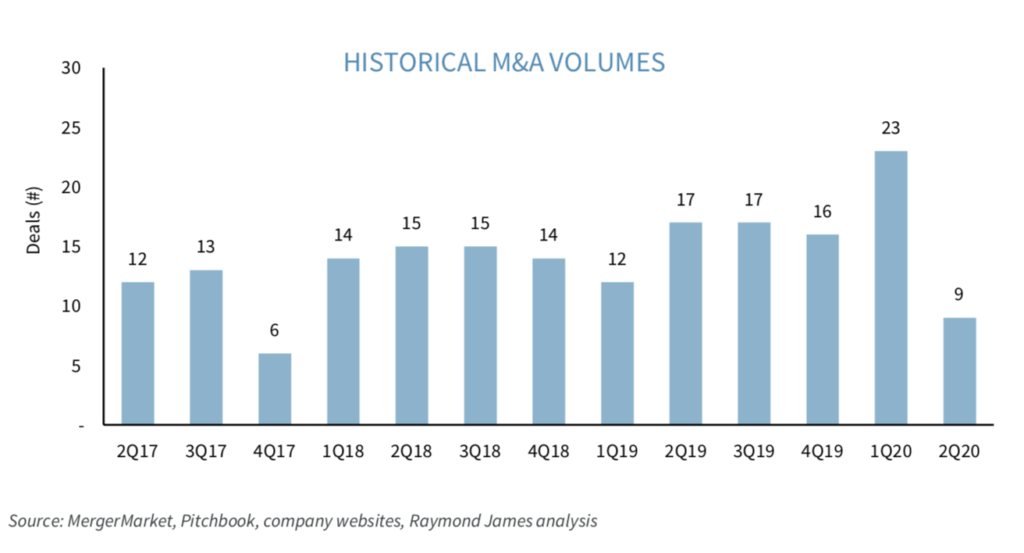

In terms of M&A, (see table below), Q2 2020 also saw a drop, but……Q1 2020 was the best Quarter for legal tech and NewLaw M&A going back three years, with 23 deals.

For example, we have seen Litera making interesting capability-based bolt-on acquisitions, Access bought a PMS solution in Eclipse (which fits Access’ SME focus), and Tikit acquired by Advanced to build out Advanced Legal.

The reality is that in these turbulent times we may well see a spike in M&A later in 2020 as consolidators and platform builders, including the giants such as Thomson Reuters and LexisNexis, see an opportunity to scoop up useful add-ons at good prices. But, we will see…..

–

Junya Iwamoto, Director at Raymond James in London, is part of the team that put together the report. The full list of team members connected with this sector and report are: