A new company, LawAsYouGo, has launched with the goal of increasing access to justice (A2J) by providing ‘legal loans’ to people who otherwise could not fund their legal costs.

For this site, the idea of using debt to improve A2J immediately raises red flags. On one hand it could indeed help some people who are shut out of the justice system, but it could also end up creating a far worse problem and sink already financially unstable individuals and families into a spiral of debt and additional legal challenges if things don’t work out as hoped.

And, importantly, just because you’ve secured finance for a legal case does not mean the lawyers on that matter will operate super-efficiently, nor that they won’t end up handing you a massive hourly-based bill that soaks up the loan; or, for that matter, that the lawyers will succeed in winning your case, or secure any financial compensation to help pay off that loan you now owe.

Plus, this is not a no-win/no-fee system where you can walk away with relatively low or no costs if your case fails. This is for matters that fall outside of the conditional path, and also outside of full legal aid coverage. I.e. it’s just you, your bank balance, and the legal need, and that’s a risky place to be.

Here’s what LawAsYouGo says and also some thoughts on the pros and cons of this approach. First, how the US company, started in 2019, but is now going to market, sees things.

‘LawAsYouGo connects you with affordable financing options that let you pay over time instead of paying thousands upfront,’ their marketing blurb said.

It adds that interest rates are below what ‘most credit cards’ charge. That’s an improvement on the crazy rates charged by many consumer lending groups.

‘Interest rate and loan terms are fixed, you can select a loan and payment amount that fits within your budget, making it easy to mark your calendar with the date your loan will be paid off,’ they added.

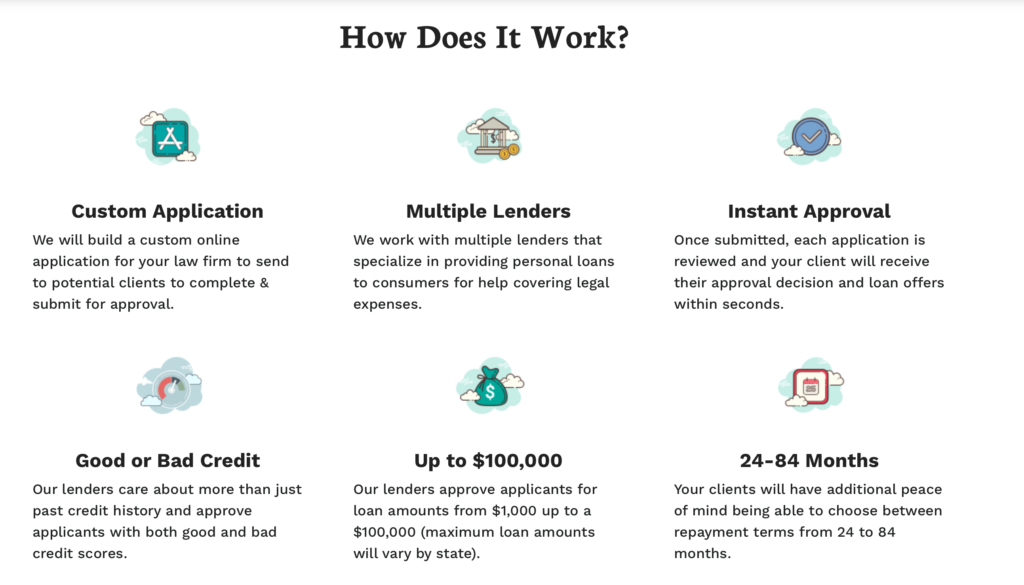

You can go direct to them, but they also work with law firms to spread the word to potential clients who may have asked about financing a matter. The legal services able to be financed include: Family Law, Immigration, Criminal Defense and Civil Litigation.

Co-founder and lawyer, David Koberlein, said: ‘There is no shortage of lawyers or people who need legal help. The problem is lack of affordability.

‘We want to create more opportunity for lawyers while providing more representation to the people who need it that haven’t been able to afford it previously.’

Pros and Cons

OK, so that is the overview. What are the pros?

- For those who see a good chance of winning, but cannot get legal aid or a conditional fee deal, this could in theory help.

- It helps people to fund cases that a bank would never agree to hand out a loan for, and avoids (they say) people ending up with super-high interest rates from unscrupulous lenders.

- If lawyers are not affordable for your matter, and legal tech-based services can only get you so far along in the process, e.g. helping to fill in and send forms, what happens then?

- In many walks of life finance has been a great democratising force; take mortgages for example, without which only the very rich would ever be able to afford to buy a house, as only they would have the cash on hand to make such huge purchases. In that case, loans really have helped – although, as seen in 2008 they can trigger their own serious problems.

Cons:

- The list of cons is very long, especially if we say ‘potential cons’, as much will depend on how things go.

- The main issue is that a person with no legal experience is taking a loan for a matter that may be open-ended and have many unexpected twists and turns. No matter what the lawyers say at the start, the costs may spiral.

- There is no guarantee that the lawyers will win, or that you will get any money out of the other party, leaving you with a large debt. That in turn could trigger new legal and financial problems.

- You could get half-way through a matter and find you need more debt to keep going, for example if there was an appeal.

- While most law firms will clearly be trying to help the client to get the result they need within the bracket of their loaned amount, less benign lawyers could end up doing as much work as amounts to the sum of the loan in terms of fees, and then inform the client they will now need another loan.

- People who take on large loans may already be vulnerable in a variety of ways; getting heavily in debt during a very stressful court case could be the worst thing a person could do.

Conclusion:

Bridging the A2J gap is a huge problem. As explored by this site, deregulation could be a significant help, so too the many A2J legal tech platforms already in the market can help, but a legal matter cannot necessarily be solved affordably just because a lawyer works in an alternative business structure (i.e. new ownership structures don’t guarantee affordability), nor can all of a matter always can be solved by tech solutions alone.

‘Legal loans’ could in theory help bridge part of that gap, which fundamentally is an economic one. However…..as explored above, the risks are potentially very high here, especially as you are lending to people who are not experts in the law, who may have low incomes already – and other debts as well, and are already likely to be in a vulnerable situation.

Legal loans therefore may work for some, but for many others it could simply be too big a risk. However, as the debate over A2J rages the likelihood that more companies such as LawAsYouGo will come to market seems high.

What do you think? Interested to hear your views on this.

[ Important notice: Artificial Lawyer is a news site focused on the legal tech and legal sectors and does not provide advice on legal matters, or give financial advice in relation to legal matters. This news story is not a recommendation that you should use that company or any other for a legal loan – and, as explored above, there may be significant risks to you in doing so. If you do have a legal query you should consult a qualified lawyer or other relevant professional for advice. ]