As a new survey on the demand for working from home (WFH) confirms what we knew already: that many lawyers would like to stay home for at least part of the week, even after the pandemic, we are faced with the paradoxical fact that major property investors are pouring billions of pounds into buying up office space in London and other key centres.

For example, a survey by Juro found that ‘70% of general counsel want to remain at least half-remote post-COVID’, i.e. the overall demand for office space will presumably be lower than before. And if feedback from the market is correct, then many others across all sectors feel the same way.

And yet…..the City of London – which is a regular bellwether for attitudes in the financial and legal services market – is seeing a surge in property investment, with big buyers coming in to grab space in this globally important business centre, presumably at knock-down prices given the crisis.

For example, property consultancy JLL reports that: The [London commercial property] investment market saw a resurgence in activity during Q3 of 2020. Over £1 billion of transactions were completed in Q3.’

While CBRE said that ‘provisional data shows that £8.9bn of central London offices, stores and office and retail development sites were traded in 2020. This figure was down 30% [on the previous year], but the firm saw signs of a recovery. Sales totalled £4.5bn for the final quarter, the largest quarterly total for 2020′. I.e. it’s not as great as before, but money in the billions is still arriving.

‘What? Why are people buying office blocks now?’ you may well ask. If offices have been closed because of lockdowns and a lot of people want WFH, why all the interest in buying up those massive towers of empty space?

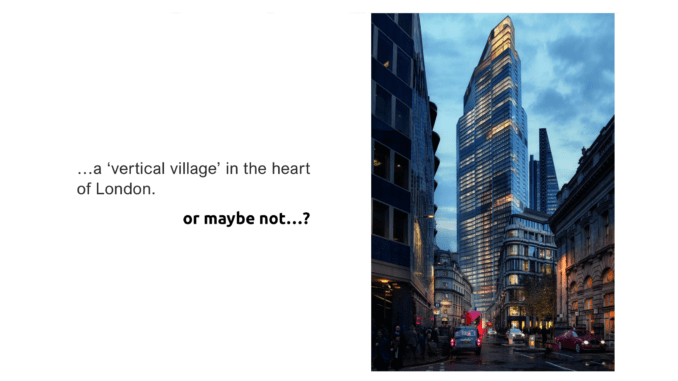

In fact, you may also ask: what is going to happen to huge new office towers such as 22 Bishopsgate, which has just been completed and is being marketed as a ‘vertical village’ in the heart of the City of London and is one of the tallest buildings in the UK?

They have some major tenants, including US law firm, Covington & Burling, who are moving onto several floors of the massive tower. But will people really use all of the space?

In fact, JLL also reports that: ‘Just 941,000 sq ft was let during Q3 2020, which was down 20% on the previous three months and was the lowest quarterly total since Q1 2009. This brought the year-to-date total to 3.8 million sq ft, which was 60% down on the same period last year and 6% below the previous Q1-Q3 low recorded in 2009.‘

I.e. new buildings are going on the market, big investors are buying up entire offices as well, but many of the companies that rent that premium space are backing off right now.

So, what does it all mean? Someone has to be wrong, presumably? A surge away from offices and billions of pounds going into office buildings at the same time indicates a clear mis-match of goals.

The answer is perhaps a question of time and long-term thinking. The big investors who are buying up London’s premium office space are doing so on the basis that they will eventually find tenants, such as law firms, banks, and even some larger legal tech companies as well.

The long-term view is that:

- The pandemic will pass, and the big investors who work on decade-length timescales can wait for a return on investment.

- WFH will remain for many, primarily on a partial basis, but London, and other key global financial centres, will continue to expand – hence there will be a need for more office space overall, eventually.

- That Brexit has not created the feared mass exodus to Paris and Frankfurt of the UK’s financial sector professionals, and that London’s importance as a business centre on the world stage will remain.

Of course, this is a bet they are making. But, history shows us that some cities just keep bouncing back. London has been around since 43 AD, so we have 1,978 years of proof that this city will keep going through all that gets thrown at it. We’ve seen the Black Death, the Great Fire of London, the Blitz, and several financial crises. London will keep going.

So, it’s important not to get too carried away by the idea that we will all be working from home forever and ever. Some of us who really like WFH will find ways to stay that way. Others, as noted in the survey, will find a compromise solution, and others will be back in the office full-time as soon as they are allowed to be there. I.e. the world of office life will be far more flexible, but it’s not going away any time soon nor are all those office buildings.

—

[ Main photo: marketing material for 22 Bishopsgate, with a small modification by AL. ]