In the UK there are several law firms that are listed on the stock market. Artificial Lawyer decided to have a little look at how they are doing.

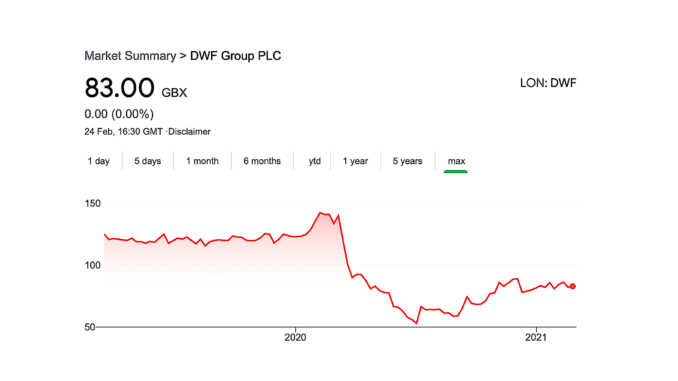

First, DWF PLC,

DWF is headquartered in Manchester, with 31 offices across the world. In March 2019, DWF was listed on the London Stock Exchange. It has revenues of around £297m ($420m). In January 2020, DWF acquired Mindcrest, a legal and managed services business in the US, for $18.5m.

DWF is structured into two legal service areas, covering Commercial Services and Insurance Services, which includes claimant services. DWF also offer a wide range of ‘additional products and services under their Connected Services division that allow clients to consolidate their supply chain’.

They have an innovation group, DWF Ventures, designed to help ‘develop new ideas, prioritise specific R&D priorities and to nurture early prototype services’. This existed before the public listing.

View:

As you can see, the share price tanked at the start of the pandemic, but has now recovered somewhat. This perhaps shows the challenges of putting part of one’s law firm or legal business on the stock market, i.e. short-term investor sentiment that is driven by macro changes can impact your shares, even if the long-term outlook for the firm could be good.

Has the listing made DWF more innovative? Well, the reality is that DWF already had a reputation for innovative work around the application of legal tech long before the listing. In fact, the capital raised seems to have gone toward buying a legal process provider in America.

Is that innovation? Yep. It’s business focus innovation, but listing hasn’t suddenly changed its position as a fairly tech savvy firm, it seems to have just carried on as before on that score.

—

Gateley has over 580 professional advisers and employs around 1,000 people across offices in 11 UK cities. It has revenues of around £110m ($155m).

Like other listed law firms it’s used its additional cash to continue to diversify its offering. It has a wide range of side businesses now, which include among others:

- a consultancy that specialises in advising clients on tax incentives,

- a property consultancy,

- reputation management, privacy, commercial litigation and brand protection advisory services,

- an independent professional trustee company which helps organisations run their pension schemes effectively,

- international investment services group.

View:

Gateley seems to have also suffered a dip with the pandemic, but has bounced back fairly well. Since its listing back in 2015 it has increased its share price substantially, rising from around £100 to now around £177.

Has listing boosted innovation? Again, the corporate change has manifested itself with business diversification and more expansion of those non-traditional legally-related services. As you can see, there has been a big push on consulting services, for example. But cutting edge tech…? Not that is immediately evident.

—

Knights is the smaller of the three considered here, but now has around 930 professional advisors, with revenues of £74.3m ($104m) and 15 offices.

It covers areas such as:

- Real estate

- Low end M&A

- Social housing

- Insolvency

- Employment

As you can see, this is not the most exciting City of London type of work. But clearly it pays, as the firm has steadily grown from one that few had heard of to now becoming part of the UK 100 by revenue.

Again, there doesn’t appear outwardly to have been a surge in tech-led innovation coming from the listing. It’s just motoring along in many ways just as any mid-range law firm does, it just happens to be listed on the stock market.

View:

The share price has performed well, and despite a dip because of the pandemic has now recovered. In fact, of the three it looks to have performed the best over the long term.

But beyond that it’s hard to find much else to say. And perhaps that is the main insight here….(see below).

Conclusion

This is just a sample of listed law firms in the UK, there are others, and also there are some in Australia. But, the main impression is: no fireworks, (no massive ethical issues either), no huge investment in super-duper burning hot tech, no revolution, just life as normal but with more capital to invest in projects the partners want to focus on. It’s all very…well…down to Earth.

The reality is that different corporate structures don’t equate to driving tech innovation, even if in theory more capital on hand would allow that.

In a couple of the cases above, the money appears to have been used to diversify into areas such as process work, or consulting services. And as to ethical challenges, that some once got rather agitated about, life carries on as usual as well – at least as far as can be seen.

To many in other markets, such as the US for example, which is going through a bit of a regulatory rethink in some States, the sheer mundanity of it all may come as a shock. But, it is what it is. Just another way of raising some capital and creating a more long-term approach to legal business ownership. (And it could, in theory, widen ownership across a firm.)

And as to the share prices: the reality is that the listed law firm investor market is likely a fairly small one. These are not super large businesses like Tesla with huge investor followings. But, overall they have done quite well. The dips caused by the pandemic must have been a bit of a roller-coaster for some of the partners who saw their paper wealth diminish very rapidly, but things have now steadied again…..for now.

Overall, the conclusion is that listing law firms doesn’t equate to a big increase in innovation via tech, but it does support business line diversification as it provides more capital, which helps to go beyond the annual cash churn model of traditional partnerships, and it allows firms to invest and support growth in new areas – although, as noted, these areas tend to be ‘law-adjacent’ or just in day to day operations, rather than cool new tech initiatives.

It makes you wonder what all the fuss was about, and also why this is not allowed in every market across the world…?

–

[ Important Note: Naturally, this is just a news story, and any of the thoughts and data shown above are not investment advice. If you ever were inclined to sink your hard-earned money into the stock market you should – as always – get some advice from a professional before you do so. ]