Pioneering eDiscovery company, DISCO, is to hold an IPO, joining LegalZoom and Intapp in the rush to go public. In its prospectus document the company claims that there is ‘a significant market opportunity for us, which we estimate to be $42 billion globally’. After Nuix it also now becomes the second eDiscovery company to go for an IPO.

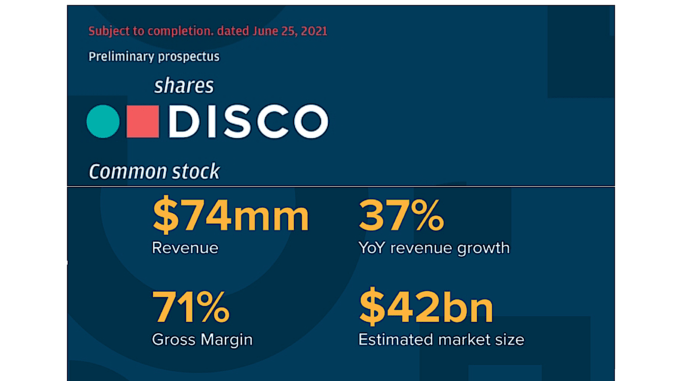

The US-based company also showed in its prospectus that it made $74m in revenue in its last financial year, with 37% year on year growth. The move follows a $40m debt financing in December last year, which also followed a $60m fundraise two months before that in October 2020. In total it has raised over $233m. And now, they’re going for an IPO as well.

The nominal IPO raise is stated as $100m, but this is a standard figure used in SEC documents before specific pricing is set, and this will likely change. (You can find the SEC S-1 prospectus here.)

In the prospectus the company stated that: ‘Our solution is the result of uniquely combining an ability to deliver world-class software engineering with a deep love and respect for the law. Our aim is to create a solution that feels ‘magical’ to lawyers.’

They added that as of March 2021 they held more than 10 billion files and 2.5 petabytes of data.

They also stated that: ‘By automating the manual, time-consuming and error-prone parts of ediscovery, legal document review and case management, we empower legal departments to focus on delivering better legal outcomes.’

The company, which started in 2013 and underwent ‘precautionary’ job cuts at the start of pandemic last year, stressed the importance of AI technology and also claimed that because of growing global needs to review documents for litigation and investigations the potential market for its services were massive, and as mentioned, ‘$42 billion globally’.

Another aspect DISCO underlined – which has its own managed review team – was the focus on working directly with legal functions, adding that: ‘Our team is distinctly well-positioned to execute on our vision of building technology that powers the legal function across companies in every industry.’

Is this a big deal?

The recent financings of DISCO gave it plenty of rocket fuel for growth. And if with all that capital it couldn’t grow rapidly the market would be surprised. Now, they are already taking things up another level and going for an IPO, which will generate even more capital for growth – and as explored before – will also create even more demand for that growth from its investors by going public.

In the eDiscovery and investigations field this raises the stakes for competitors, as DISCO is clearly setting its long-term sights on bagging a significant chunk of what they see as a massive market opportunity. Nuix also listing further adds to the pressure. That said, there are a lot of players in the eDiscovery field, and some very major ones as well, such as Relativity.

More broadly, the fact that we have now had one completed IPO – Nuix late last year, and more recently LegalZoom and Intapp both file for IPO, means we have four large companies recently taking this route. It would seem logical to assume that there will be more, especially if these new listings go well for the companies and investors are happy with the outcomes.

It’s also further evidence that legal tech is looking ambitiously at ‘Big Money’ and asking for its attention.

Of course, as the failure of the Nuix IPO has shown us, going public is not a guaranteed success. But, as more capital flows into these businesses their opportunity to fund growth increases. They can then battle harder to take market share off rival companies, and also break into new areas to win additional market share.

All of that said, the majority of legal tech companies remain what are basically SMEs, mostly with less than 100 staff, and revenues that would make a similar path toward IPO just a pipe dream for now.

That raises the question as to whether the market is pulling apart? I.e. one group of larger legal tech companies are going public and heading – they hope – for huge growth; and then there are the many others that are just steadily chugging along, keeping their founders and investors happy, and maintaining a relatively modest growth trajectory.

As ever, timing is everything. Are some of the companies that are happy to chug along missing the boat? Or, perhaps are these pioneers of legal tech IPOs above going too early? Either way, what happens could reshape the legal tech market in the years to come.

1 Trackback / Pingback

Comments are closed.