The annual PwC survey of UK 100 law firms has revealed a picture of increased tech spending for 60% of firms across the 2021 Financial Year (FY) relative to revenue, with a notable minority reducing tech spending slightly in proportion to income.

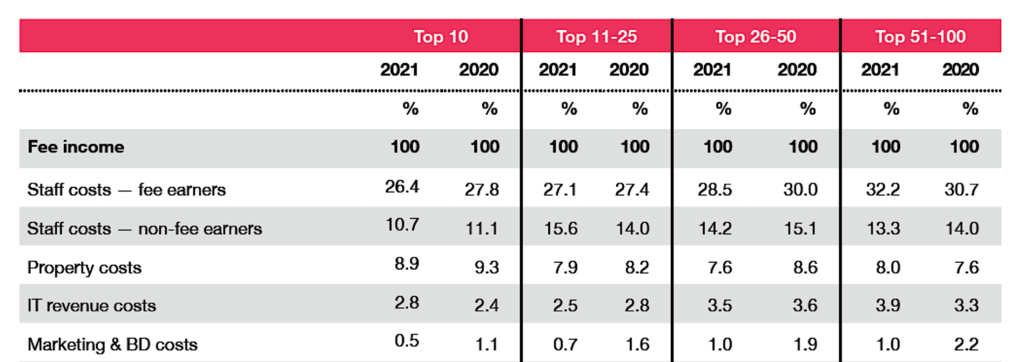

The greatest increase in ‘IT revenue costs’, i.e. the cost of a law firm’s investment in technology as a proportion of total revenue, is among the Top 100 to 51 firms, (see below). Firms in this group saw tech spending grow from 3.3% of revenue to 3.9%. This is significant given that their property needs – often seen as one of the key burdens for any firm – were just 8% of revenue. I.e. tech needs now cost the partners almost as much as half of what a firm’s premises cost. This just shows how central tech is now to the functioning of law firms.

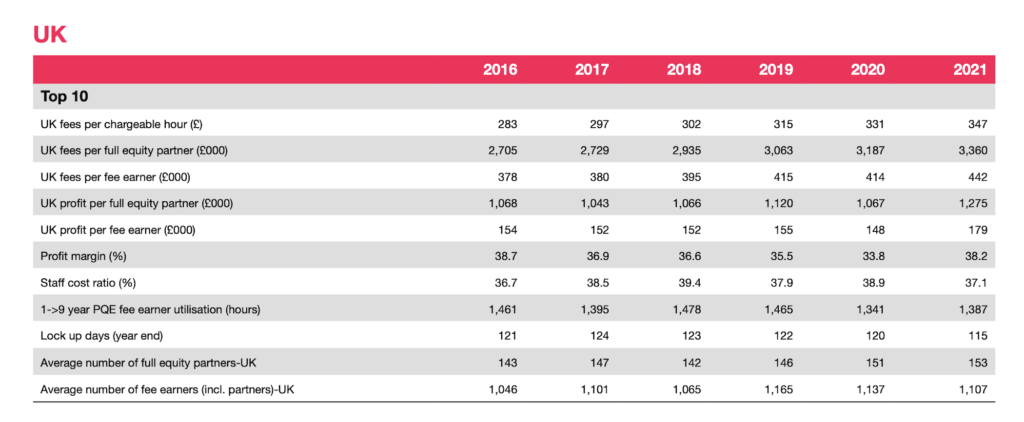

But, the biggest cost of all was people, which for firms in this group amounted to 45.5% of revenue. For the Top 10 firms, total staff costs were just 37.1%. This is because despite their huge size, their proportionally larger per lawyer revenues make staff costs relatively smaller.

As can be seen in the table above, IT expenditure for the Top 10 largest UK-based firms, e.g. firms such as Linklaters, Clifford Chance and their peers, rose from 2.4% to 2.8% from 2020 FY to 2021 FY.

Some of this increase can perhaps be attributed to more use of video conferencing, but not all of it. So, this suggests more tech spending in general for those firms.

And yet…..for a significant slice of the market that sits between 11th and 50th place by revenue, tech spending shrank a little relative to revenue. E.g. 11 to 25 firms saw tech spending drop by 0.3%, and 26 to 50 firms saw a small 0.1% drop relative to revenue.

This could suggest that while many parts of the market had a good 2021 in terms of revenue growth, the Top 10 firms are pulling away now with their investment in technology, i.e. while many firms grew their revenues, the Top 10 are now spending even more on tech. And given their far larger size (often in the £1bn range) this may move them further ahead.

[Note: outside of the Top 10, annual total revenues fall rapidly, so that by the time you reach 50th place, you are down to revenues of around £100m compared to £1bn to £2bn at the top of the market. Spending 2.8% of a billion-plus revenue is clearly way more than spending 3.5% for firms with revenues in the tens of millions.]

Meanwhile for some of the smaller firms in the ‘bottom 50’, the increase in relative tech spending may also indicate greater tech needs vs slower increases in revenue generation.

Priorities

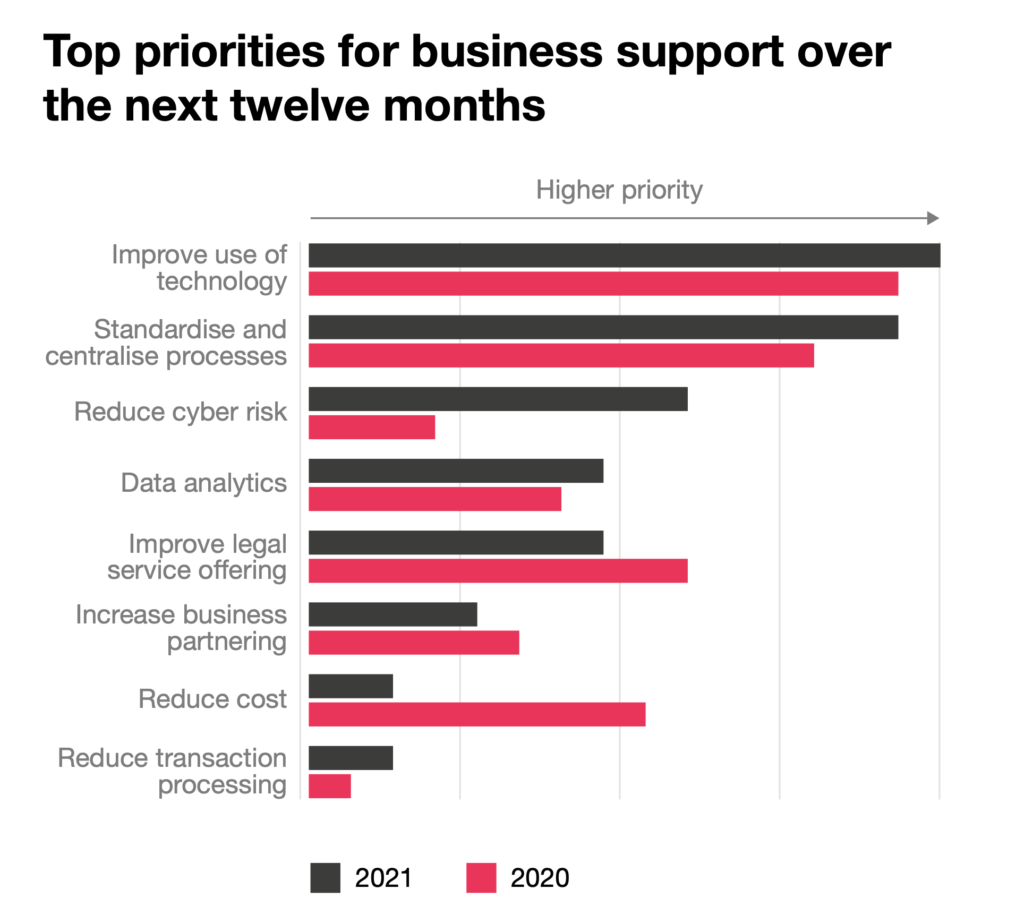

More broadly, several of the top priorities of business support teams at the UK 100 firms connected to tech. As seen below, ‘improve use of tech’ and ‘standardise and centralise processes’ figured strongly.

Also, data analytics saw an increase in interest. This is all very good news. Putting aside spending, firms are clearly focusing more on getting better outputs from that tech, and also putting in place systems and standards to also help drive efficiency and data transparency.

What Are They Spending On?

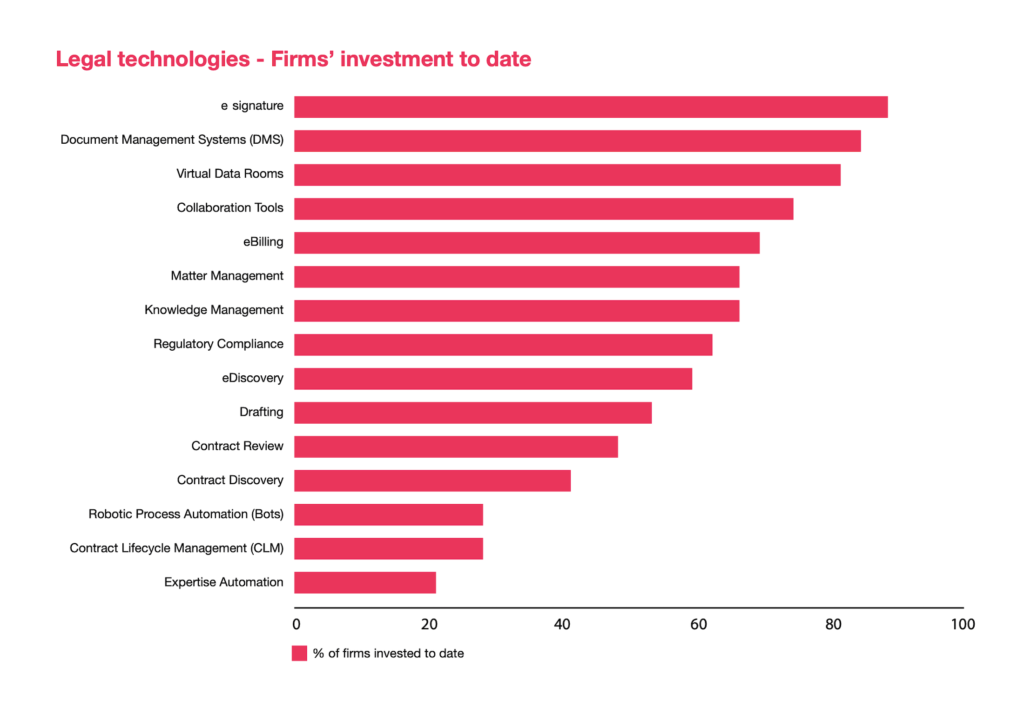

In terms of what the UK 100 are spending on, things such as eSignature and DMSs are predictably at the top. But it’s very good to see around 50% of the UK 100 say that they have invested in contract review technology, i.e. NLP systems used for things such as M&A due diligence and many other uses.

Also, around 20% of firms had invested in expertise automation, i.e. no-code/low-code systems that create expert systems that automate the delivery of legal knowledge.

Another positive was that around 70% of firms have invested in KM, a central foundation for any meaningful change in how law firms approach tech and data.

Future Concerns

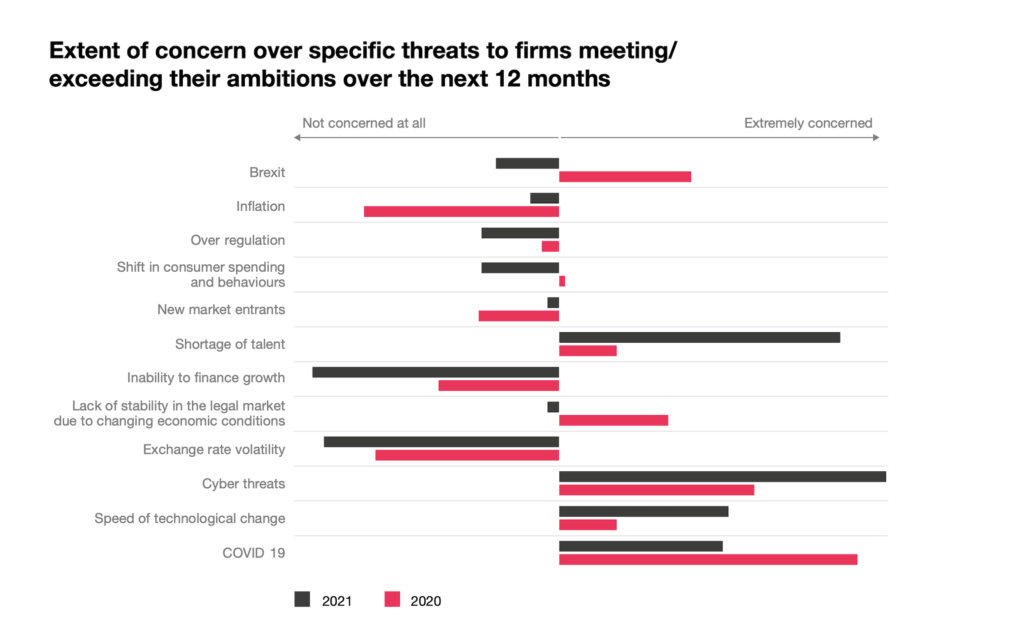

When it came to what law firms are most focused on as both threats and competitive opportunities across the market, a shortage of talent was very high on the list, along with cyber threats.

But, ‘speed of tech change’ was also pronounced, and far higher in 2021 than in 2020. This suggests that the reality of how much tech is changing the delivery of legal services is really being felt now.

Interestingly, despite all the fear-mongering about the Big Four – which are very present in the UK – the survey found that the UK 100 is really not concerned by ‘new market entrants’. This area saw a negative result, although a bit less than in 2020.

This may be because firms here have got used to the Big Four’s legal divisions operating in the UK and have realised it’s not the end of the world – and as other surveys have found, many firms have a very close and positive working relationship with the Big Four and a wide range of ALSPs.

A Good Year For Many

Overall, data shows that many firms did very well, and for the UK Top 10 there were significant increases in revenue generated across all ranks of the firm. Perhaps surprisingly, the total number of UK equity partners increased as well. I.e. profits also went up even though the denominator was greater.

Conclusion

There is more focus on tech now, and the rise of interest in standardising processes and more investment in contract review tools, is also good to see.

However, the data also could be suggesting that the Top 10 is pulling away from the rest of the market in terms of tech investment – potentially increasing their competitive advantage.

For smaller firms in the UK 100, tech is becoming a larger part of their cost base, but this may not always be seen as benign by the partners unless they can also find a way to boost their revenues.

2 Trackbacks / Pingbacks

Comments are closed.