Mike Lynch, the founder of Luminance, has stepped down from the Board of the legal AI company so that he can focus ‘on fighting his appeals and clearing his name’ in the ongoing extradition battle with America.

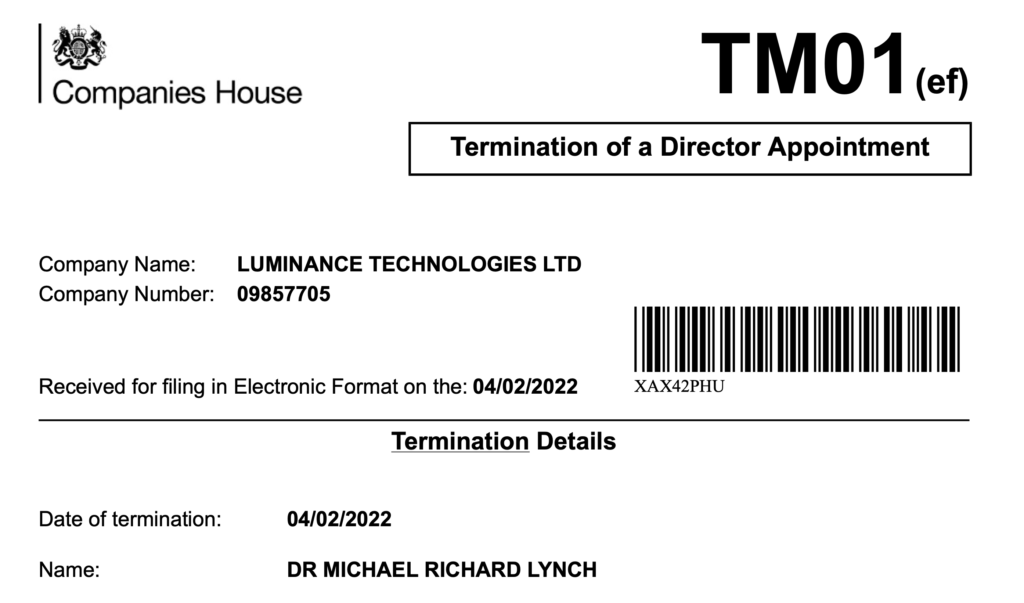

Artificial Lawyer asked the company on Friday evening about why the company Lynch had founded, and then incubated inside Slaughter and May, had issued a formal notice that his directorship of Luminance Technologies Limited had been terminated as of 4th February.

A spokesperson confirmed the departure and added: ‘We can confirm that Mike Lynch offered to step down from the Board whilst he focuses on fighting his appeals and clearing his name. Dr Lynch has been an invaluable advisor to Luminance and we thank him for his contribution. We are pleased to have another Invoke Partner, Charlotte Golunski, join the Board of Directors and welcome Invoke’s continued support for the business.’

Invoke is the investment fund Lynch helped to form following the sale of his earlier company, Autonomy, to HP back in 2011. And it was this sale that has been at the root of his legal problems. As is well documented now, HP was not happy, to put it mildly, after buying the UK company and legal proceedings have dogged Lynch ever since.

At the end of last month, the UK’s Home Secretary ruled that Lynch could be extradited to the US to face accusations of fraud there. However, he intends to fight the extradition.

At the time of the UK announcement, Chris Morvillo of Clifford Chance, a lawyer for Lynch, said: ‘Dr Lynch firmly denies the charges brought against him in the US and will continue to fight to establish his innocence. He is a British citizen who ran a British company in Britain subject to British laws and rules and that is where the matter should be resolved. This is not the end of the battle — far from it. Dr Lynch will now file an appeal to the High Court in London.’

While Lynch has never formally been the CEO of Luminance since it launched under the leadership of Emily Foges back in September 2016, it would be a massive underestimation not to appreciate how influential he has been for the company.

And being realistic, even after stepping down as a Director, his influence will remain substantial, given that Invoke has funded Luminance since the beginning.

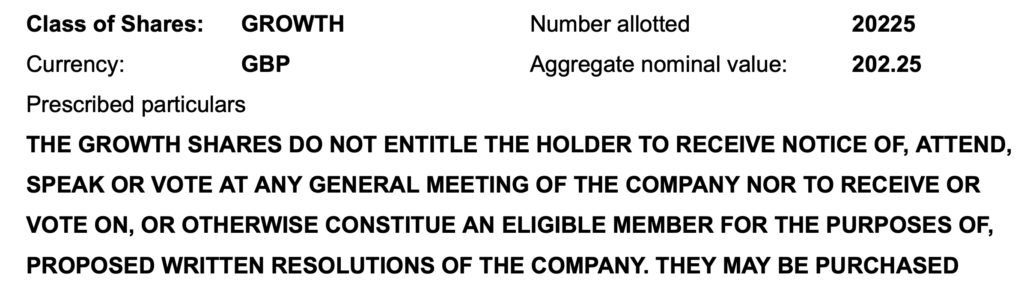

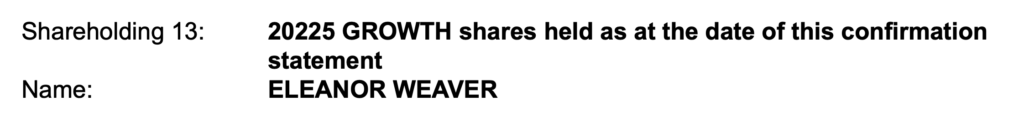

In other news related to Luminance, Companies House data shows that its most recent CEO, Eleanor Weaver, who joined in early 2021 after working at another Lynch company, DarkTrace, was granted 20,225 ‘Growth Shares’ in Luminance Technologies. These shares were granted in Dec 2021, and are not the usual Ordinary Shares that its main shareholders own.

Artificial Lawyer asked the company about why they had granted these new shares, but it did not comment on this point.

Interestingly the Growth shares come with the following conditions: that they grant no voting powers and that ‘in the event of a winding-up, the growth shares entitle the holder to participate in the excess of a hurdle amount set for the shares at the time of issue’.

What Next?

One last point is whether the departure from the Board by Lynch will be the precursor for a sale process of Luminance? I.e. that a buyer would perhaps understandably not want to enter into talks with a target that had a key Board member facing serious charges in the US. But, now, that pathway could be open.

Artificial Lawyer specifically asked Luminance about this point, but they also chose not to respond to it.

Will Lynch’s departure from the Board make it more likely that Luminance will be sold? It’s hard to say, but it would be a bit less complicated. That said, Invoke is clearly very closely connected to Luminance still, and even the new board position, as noted above, is being taken by someone from Invoke…..and Lynch remains listed as the founder of the fund.

However, regardless of Lynch’s position, or what happens with the extradition battle, Luminance could do with some form of a boost, whether that is a takeover by a much larger entity, or a new funding round to power it forwards.

The company made just £2.78m ($3.69m) revenues globally in 2020, with losses of £4.4m ($5.84m). Its average revenue per client, based on 250 clients in December 2020, was £11,112 ($14,753) – which is lower than in 2019, the company’s latest accounts show.

—

Pic credit: Creative Commons – The Royal Society.