Aumni, a legal and fintech startup that uses NLP and human lawyers to extract and then dashboard contract data – especially from among other startups – has bagged $50m in fresh funding with investment bank JP Morgan joining the round, and with DLA Piper investing again.

The company was founded by former lawyers, Tony Lewis, previously with Latham & Watkins and Wilson Soninsi, and Kelsey Chase, who was at DLA Piper.

Aumni also previously gained funding from US law firm, Orrick, although it’s not clear if they joined this new Series B round. Other investors in the fresh funding included: Pelion Ventures, Citadel Securities, Invesco Private Capital, among others. Donnelley Financial Solutions, which owns eBrevia, also previously invested in Aumni.

With DLA Piper’s continued involvement it’s another case of lawyers investing in software tools. And it’s also another example of an NLP-based tech company that works closely with a team of subject matter experts to sift through contracts and other documents to create meaningful dashboards of legal and business information for clients.

In this case, Aumni has a special focus on venture capital investments and the legal and financial documents related to it.

The company said it saw its core client base as ‘venture funds, family offices, university endowments, and corporate venture firms’. But, Aumni said they will use the funds to deepen its presence across the market, as well as winning more law firm clients.

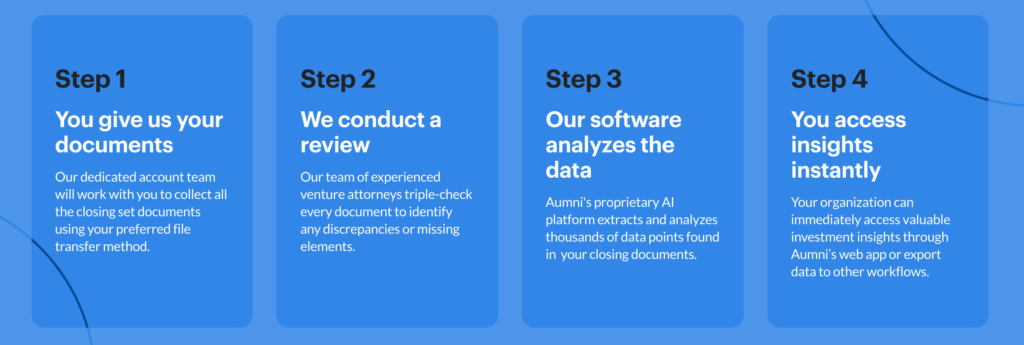

In terms of what it does, they stated that ‘by combining the best of AI and human expertise, Aumni’s platform extracts and analyses critical deal data buried in dense legal agreements.

‘In just a few clicks, Aumni provides comprehensive insights regarding every investment’s financial and legal position.’

They started in 2018 and estimate they have now analysed documents related to over $1 trillion in investments. And, as we all know, the more NLP gets trained on relevant source material, the better it gets. Of course, they are not going ‘tech only’ – they are also fully committed to using lawyers who are subject matter experts.

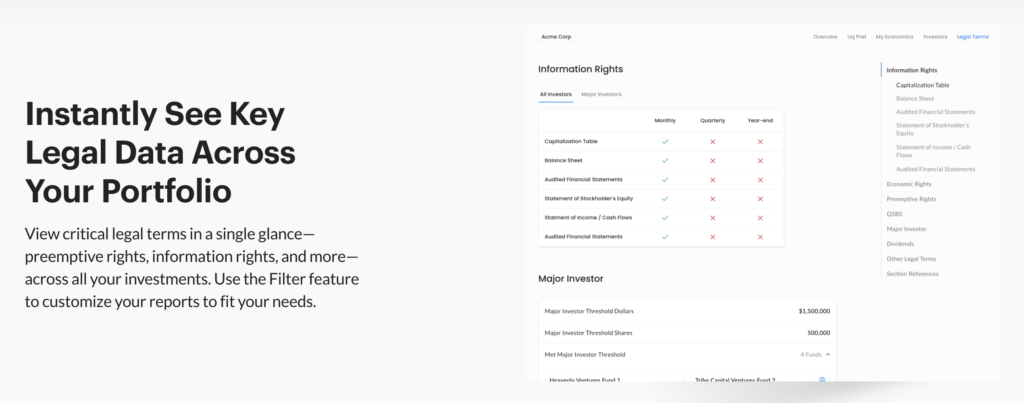

With this approach they not only provide a more efficient means to getting hold of – and keeping in one place – investment data that may be of use to legal teams as well as the investment analysts, but also ‘it can track critical provisions such as key investment rights‘ and also make visible ’emerging investment patterns, providing previously inaccessible insights’.

While investment banks have understandably been interested in fintech, the number of major fundings into legal tech have been limited. One notable one was when Goldman Sachs invested in doc analysis company Eigen Technologies – although Eigen has always focused on more than the legal sector.

A key aspect here is that the company is heavily focused on the human element. As noted, they are not relying on NLP alone and this is not just a case of upload a bunch of documents and press ‘analyse’.

They explain that: ‘Our dedicated account team will work with you to collect all the closing set documents using your preferred file transfer method.’

And then: ‘Our team of experienced venture attorneys triple-check every document to identify any discrepancies or missing elements.’

This combination of providing human talent and NLP in a single package is something that a growing number of companies are doing – and it’s a trend that goes against the old mantra that software companies should only sell software.

For example, we have seen a number of CLM companies take this route, while contract management groups, such as LexisNexis-backed Knowable is also taking this approach. Moreover, LawGeex, which started off focused on using NLP primarily to extract data from contracts also now has a team of lawyers – who additionally in Utah also provide advice on playbooks.

And if we look at this from the other way around, more and more law firm process groups and legal managed services teams at the Big Four or that are part of ALSPs are using the same mixed approach.

One might say that some legal tech companies are becoming more like professional services businesses, while highly resourced process providers are becoming more dependent upon software to perform the heavy lifting.

Michael Elanjian, Head of Digital Innovation, Corporate & Investment Bank, JP Morgan, said: ‘Our strategic investment in Aumni will allow the company to continue to capitalise on its impressive growth trajectory, unlocking data insights that have historically remained inaccessible in the private markets.’

Tony Lewis, CEO and co-founder of Aumni, added: ‘When we launched Aumni four years ago, we understood that access to structured data in the private capital markets simply did not exist at scale. Today, Aumni remains the only analytics solution able to correctly model the legal and economic foundation of these transactions.

‘We are excited to add JP Morgan and Pelion Venture Partners as investors as we continue building products that operate at the intersection of fintech and legal tech to transform the future of the private capital markets.’

Some very welcome analysis of present and possible future developments.

RQ