The tax group within LexisNexis, known as Tolley, has created an NLP-driven, automated tax bot that can answer questions about accounting issues and learn from the feedback you give it. It may prove to be of use to both accountants and lawyers working in this field.

The bot, named Tolley.Ai, is able to respond to natural language questions and learn from the users’ interactions with it and also asks for feedback to keep improving the accuracy of its responses.

Artificial Lawyer got a peek at an early iteration of the UK-based tax bot, which taps into the company’s vast data store of information on tax and accounting rules, rates and regulations.

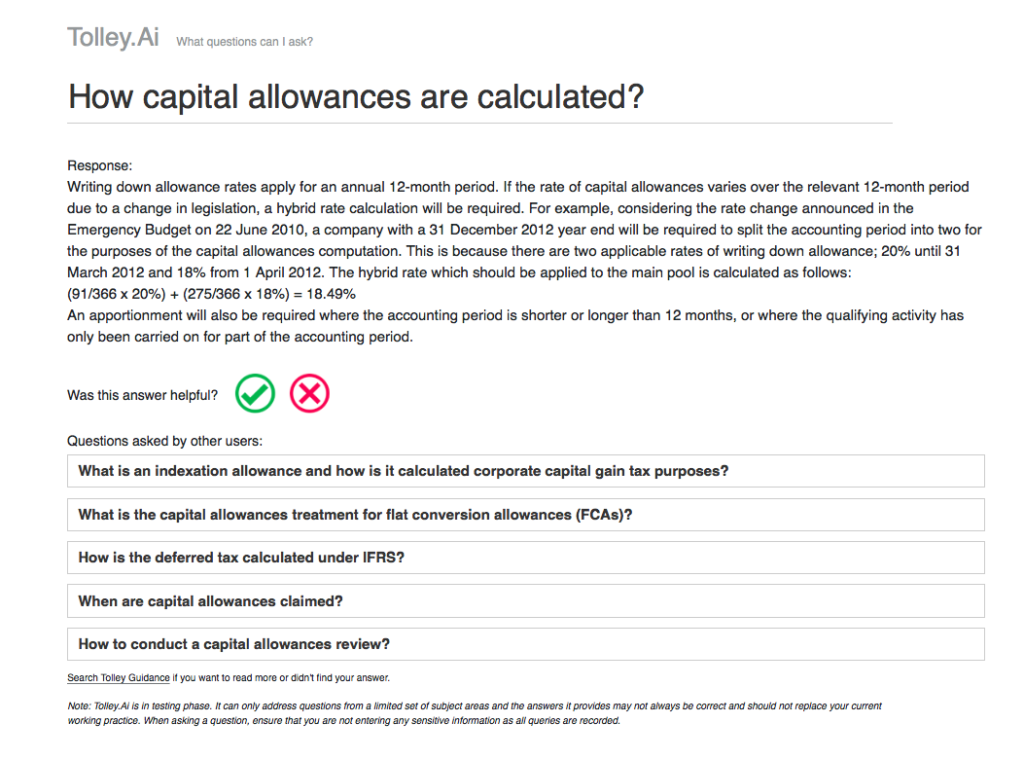

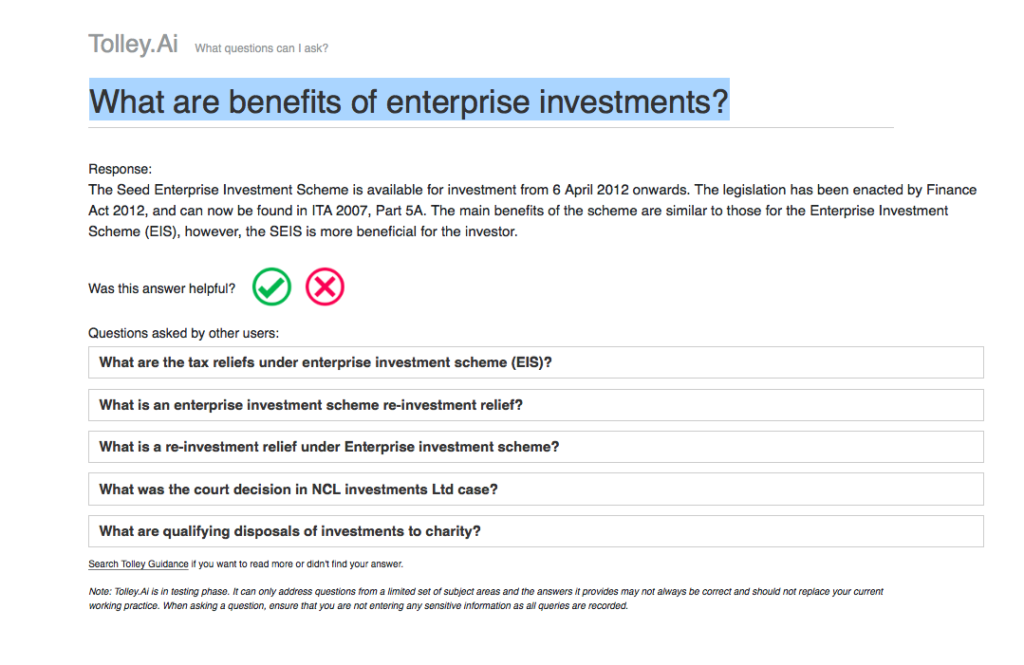

You can now also have a go (see link here) and test out this early version and help it along a bit in its education. As you will see, the system provides you with a set of areas which it can respond to (see top of bot screen), which are fairly comprehensive. When you ask a question, it answers and then asks if you’re happy with the answer, and if not asks for written feedback. It also shows you related questions other people have asked that may lead to a more accurate answer.

Like most bots it is not perfect, but then expecting a bot that is conducting a major data retrieval task to be perfect at this stage is unrealistic. It is still learning.

That said, what Tolley has achieved is impressive – check out some screen grabs of how it responded to different questions at the bottom of the page. And once its learning has reached a certain plateau of capability that ‘knowledge’ that has been coded into the system is not going to be lost. It will continue to be built on.

One of the challenges with machine learning systems is that people tend to expect perfect results from day one. When they see a wrong response they can sometimes dismiss the entire project. But, that’s like dismissing a five-year-old because they aren’t great at advanced English grammar yet. You have to give these systems the time to learn and eventually they will become very useful.

The system will also stay up-to-date, which clearly is essential in relation to tax rates and rules, because the base data it draws from is from Tolley’s own vault of knowledge, which is continually being updated, especially at key moments when the Government rolls out a new Budget.

Commenting on its development, Onwah Tsang, Head of Tax Workflow at Tolley in London told Artificial Lawyer: ‘Tolley.ai is our experiment for providing smart, fast and direct answers to tax technical questions. It can surface responses from Tolley’s authoritative content and datasets to give you narrative answers, tax rates and perform calculations.’

‘We recognise that our customers are under increasing pressure to do more with less. So they look to us to provide smarter products that enable them to work more effectively. With that in mind, we think it’s critical to our approach that our customers play a core part in our experiments to ensure we don’t pursue ideas in a vacuum,’ he added.

Tsang went to say that this is ultimately an example of what the ‘next generation of knowledge and research products’ will look like. While he accepted that this is really ‘early days’ for the tax bot he and the team working on the project at Tolley were genuinely very excited about the benefits.

One of the benefits Artificial Lawyer could see, especially for people who already knew something about tax law and regs, is simply that it would be tremendously fast and useful at giving answers to those fiddly questions you need to know the answer to, but don’t necessarily want to trawl a mass of documents to be sure about.

Even someone who has been trained as an accountant, or a lawyer focused on tax, cannot have everything front of mind. Tolley.ai allows fast responses to questions framed just as they might think that question, i.e. in natural language.

But, is this a threat to accountants? Not really. Individuals and companies could use it in theory, but, the people who will make the most from it will be people who want to give high value advice to clients and not waste their – or their clients’ – time on digging up standard rules and regs in the tax code.

All in all, a great initiative. It’s only about a year old at present, but this looks very likely to come to market once it’s had a bit more educational input during the testing phase. Below are a couple of screen shots of Tolley.Ai in action.