(UPDATED to INCLUDE CC – see below)

International law firm, Taylor Wessing, has launched a new expert system business development (BD) tool with tech company Rainbird. This time the firm has created a rules-based Q&A system that helps companies with new financial sector regulation.

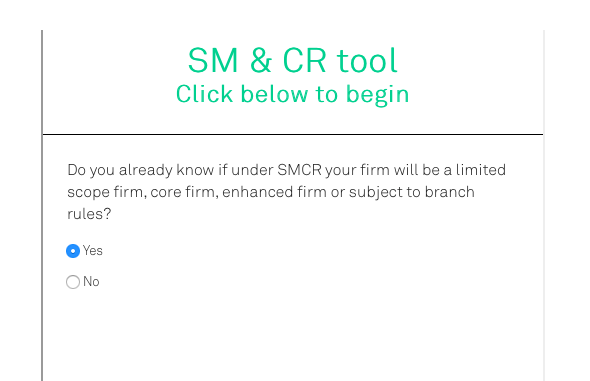

In this case the tool focuses on the Senior Managers and Certification Regime (SM&CR), which is the new framework for individual accountability in the finance sector, and which replaces the previous ‘Approved Persons’ regime.

Meanwhile global law firm, Clifford Chance, is also making what looks to be an expert system to help clients with the same issue (see below for details.)

The Taylor Wessing move follows a similar tool launch in 2017 which focused on the UK’s Modern Slavery Act.

As with the previous tool, this expert system, designed by Rainbird, walks a client through a series of questions about the new SMCR regime and then provides them with a short statement about their situation and then….as one would naturally expect..…it suggests you contact a lawyer at the firm, for whom it provides contact details.

Is this expert system especially complex? Nope. Artificial Lawyer has done several run throughs and in many cases you quickly reach the end point. In some of the more complex examples there were five or six steps. But, this is not a long process.

Either way, it helped the user – it’s presumed – to know some more about their situation. And as can be seen above, there is then a click ‘here’ link to take you to further help.

Could they have added a fancy chat bot on top to make it more interactive? Sure. But, this is designed to be a tool focused on business users, rather than the general public.

Could they have called this a legal bot? For sure also. But, perhaps that’s not necessary. At the end of the day it’s a pre-programmed expert system, operating via a Q&A rules-based logic tree.

All in all, a neat tool that delivers legal information and hopefully generates some new clients for the firm.

—

UPDATE (10.12.18)

Meanwhile Clifford Chance (CC) is also developing an application to help clients with the same issue.

Regulatory enforcement partner, Dorian Drew, at CC, said: ‘To assist firms and ease implementation [of the SMCR] we are pioneering an SMCR Manager interactive product, one of the first from our new Applied Solutions team, which fuses legal expertise with innovative technology to solve business problems. We are already demonstrating early versions of the product to a number of global asset managers, as we fine tune the development ahead of launch in 2019.’

‘We believe this will be indispensable as firms start grappling with the SMCR’s maze of administrative, regulatory and conduct requirements. The product will deploy the quality of thinking clients expect from Clifford Chance quickly, at scale, and cost-effectively, complementing bespoke advice where it really matters,’ he added.

The firm told Artificial Lawyer that the SMCR Manager will be able to advise if a firm falls within the scope of the new regime and work through key SMCR requirements with built-in tailored guidance.

It can also assign senior manager functions while identifying and maintaining a register of certified persons, they added

For further information about the product, please see here: https://www.cliffordchance.com/hubs/innovation-and-best-delivery-hub/SMCR.html