M&A Due Diligence – When Tech Innovation Must Come First

Guest Post by Alex Nordholm, co-founder and Head of Product, DealWIP

Front line changemakers talk about focusing on people and process first, and technology second. I couldn’t agree more with that order of priorities. But sometimes, fixes to process problems are blocked by outmoded technology; in such circumstances, tech innovation must come first. M&A/transactional due diligence represents one such case.

Transactional due diligence is a fundamentally flawed process. Specialized and focused technology is a necessary ingredient of any effective and scalable solution to the problem. What follows is an explanation of how I’ve reached that conclusion. But first, a quick orientation to due diligence.

In M&A/transactional work, due diligence is the ongoing investigation of the assets, liabilities, operations and performance of the target company. It begins prior to the signing of a term sheet and ends hours before the deal closes. Often, when it comes to closing a transaction, it’s the last thing to be completed.

Due diligence notoriously takes a really long time. According to a recent Merrill Corporation whitepaper, current global due diligence project length averages range from 6 to 7 months. That’s a massive problem: the longer due diligence drags on, the more likely the transaction is to die, because the more time lapses, the farther reality (i.e., company performance and market conditions) strays from the underlying facts upon which the deal was struck. As the ground underneath their feet shifts (either for the better or the worse), transaction parties naturally get cold feet.

The fundamental problem with the current due diligence process boils down to what I’ll dub ‘Slowest in Time Communication’. We’ve spoken with dozens of the world’s best law firms and investment banks since we started dealWIP, and each has described to us the same basic set of standard procedures for managing the due diligence process.

First, a standard set of initial requests is collected from the team of deal advisors on the buy-side, which typically consists of 8 to 12 different domain experts. Once each of those domain experts has furnished their requests to a central administrator, that administrator reviews the requests and sends them to the selling side. Then, the same procedure is followed by the seller.

The requests are distributed to a variety of domain experts, each of whom prepares written responses to the buy-side’s requests and sends them back to a central administrator. The central administrator on the sell-side then compiles all of the responses.

Once responses are received from all domain-expert team members, the central administrator reviews the responses and sends them back to the buy side and the process starts anew, kicking off a back-and-forth between buyer and seller that lasts until both parties are satisfied that all outstanding issues have been addressed and resolved.

The fundamental issue with this process is that, in each round of communication, the pace and rate of information exchange is constrained by the slowest requester or responder on the applicable side. In other words, information flows back and forth from one side to the other only as quickly as the slowest domain-expert requester or responder on the applicable side.

I call this ‘Slowest in Time Communication’ because each round of communication across parties occurs at a rate matching the work rate of the slowest individual on a side for that particular round.

Imagine now an alternative paradigm where requests and responses flow from one side to the other as they are prepared by each individual domain expert rather than only once all domain experts have furnished their information to the administrator. In this paradigm, the administrator reviews the information from an individual contributor as it is received and furnishes it to the other side immediately. I’ll call this alternative reality ‘Real-Time Communication’ because each round of communication happens in real-time as it is prepared.

Logic dictates that Real-Time Communication is a faster way to get work done than Slowest in Time Communication. But how significant is the difference? Well, it turns out that the two approaches are very easy to model. Take a look at the table below.

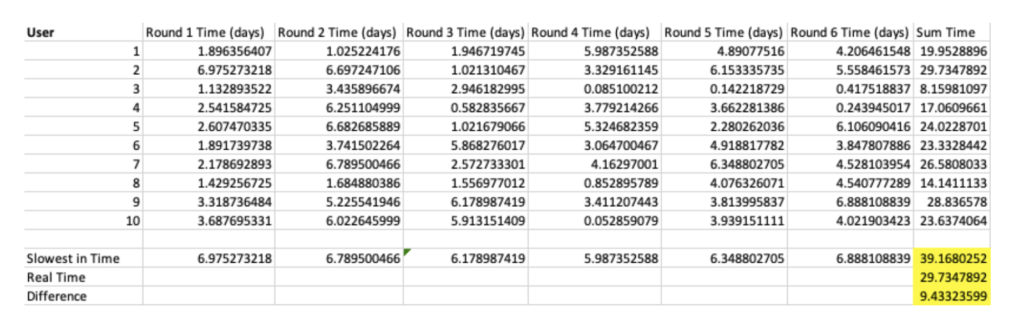

The table assumes 10 individual contributors in each round of communication; 6 rounds of communication (3 cycles of requests and responses); and each individual contributor has been assigned a random amount of time (using the RAND() function in Excel) from zero to a maximum of seven days for each round of communication.

When the amount of time taken in the Slowest in Time (i.e., current) paradigm is tallied (by taking the maximum time taken by any of the 10 domain experts in each column for each ‘Round’), it equals 39.16 days which is quite close to the theoretical maximum 42 days (i.e., 6 Rounds times a maximum of 7 days for each Round).

In contrast, when the amount of time taken in the Real-Time Communication paradigm is tallied (by summing all 6 Rounds for each row for each set of domain experts), it equals 29.73 days, a difference of 9.43 days.

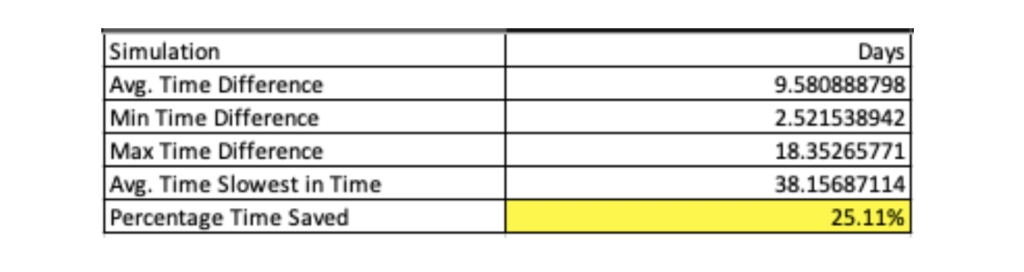

I used the above example because its results come very close to the results produced by a simulation of 1,000 due diligence exercises. Over the course of 1,000 simulations, the average time taken in the Slowest in Time paradigm was 38.16 days and the average time taken in the Real-Time paradigm was 28.58 days, an average time savings of 9.58 days. In other words, a 25.11% compression of the due diligence timeline can be achieved simply by communicating in real-time rather than Slowest-in-Time.

I want to emphasize that the overall reduction in time spent in due diligence is with respect to calendar days – it has nothing to do with the absolute amount of time actually spent on the exercise. That means that deal professionals could continue to do work in the exact same way and at the exact same rate that they do today (meaning the exact same amount of billable hours), and yet can reduce the number of calendar days that due diligence takes by 25%. The only requirement is to communicate in a faster, more efficient way – i.e., communicate in Real-Time.

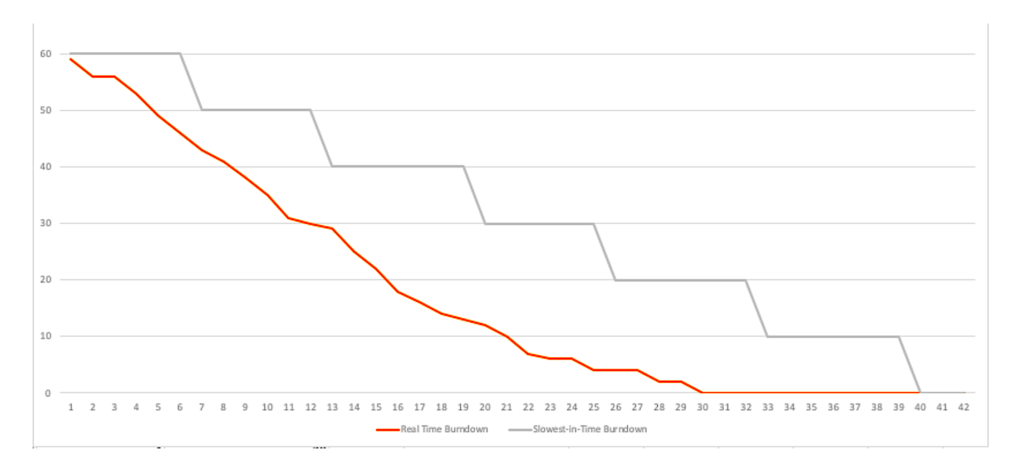

To hammer home this point, the graph below shows the ‘burndown’ rate of the 60 Units of due diligence work (10 domain experts, exchanging 6 Rounds of requests and responses). Notice how much more quickly and steadily the orange line, representing Real-Time Communication, descends in comparison to the gray line representing Slowest-in-Time Communication (the number of calendar days in the exercise is along the bottom axis).

The obvious question is: why does the current process exist? There is, after all, no doubt that deal professionals want to serve their clients well, and as efficiently as possible. As someone who used to do this exact thing as a big part of my job, I think there are a couple of explanations.

The first is that ‘this is the way the work has always been done’. In the 1980s and earlier, prior to email and digital communication, Slowest-in-Time Communication would have been the only reasonable way to conduct this exercise. Certainly it would have been silly to send a separate mailing for each domain expert to ask questions and receive answers. And what has always been done is the most likely thing to continue to be done today.

But I think the real reason this process continues to be carried out using Slowest-in-Time Communication is that using email communication to transmit small subsets of requests/responses for the volume of requests and responses involved in a complex M&A deal, all flowing through a central administrator, would be impossibly unwieldy.

Under the Slowest-in-Time paradigm, the administrator needs to send just two emails in order to distribute spreadsheets housing the latest requests/responses received from the other side, and then to send her/his team’s requests/responses back to the opposing side after compiling them. Two emails for each round of communication; that’s it.

In order to implement Real-Time Communication using existing deal technology (email and spreadsheets), by contrast, the administrator or the domain expert needs to send a separate email each time a round of requests/responses is sent back to the opposing side.

In essence, for n number of domain experts on an administrator’s side, the number of additional emails that needs to be sent to the other side to facilitate Real Time Communication is n-1, or in our example, 9 additional emails. Over 6 rounds of requests/responses, that’s 54 additional emails that would need to be sent for the exercise. Things would get lost in the shuffle very quickly.

There is no doubt work quality would suffer; Real-Time Communication using email and spreadsheets is simply not an option when it comes to reviewing the risks, liabilities and finances of a business your client is contemplating buying. So, because email and spreadsheets are an unwieldy way to manage a real-time exercise, in the absence of another piece of deal technology more suitable for faster communication, the Slowest-in-Time paradigm persists.

There are a number of goals we set out to achieve by starting dealWIP, among them better project management, improved security, and greater transparency in transactional diligence. But perhaps none is as fundamental as our goal to reduce the time to closing transactions, which dealWIP does by facilitating Real-Time Communication in due diligence.

We think unblocking this latent efficiency is one of those problems that requires the tech to come first; it also requires adoption by an industry that has at times been slow to change.

By helping deal teams consistently compress the number of calendar days required in the due diligence process by 25% — and hopefully saving some deals that might otherwise die of due diligence fatigue — we think the right incentives are in place for both transaction advisors and their clients.