Wolters Kluwer has launched a new NLP-powered clause analytics platform that allows lawyers to build their own model documents and compare their clauses to ‘market standard language’ from a database of over one million individual capital markets-related clauses.

The move is also another sign of a growing movement toward more efficient document creation that may be leading to greater standardisation across the commercial legal world (see below).

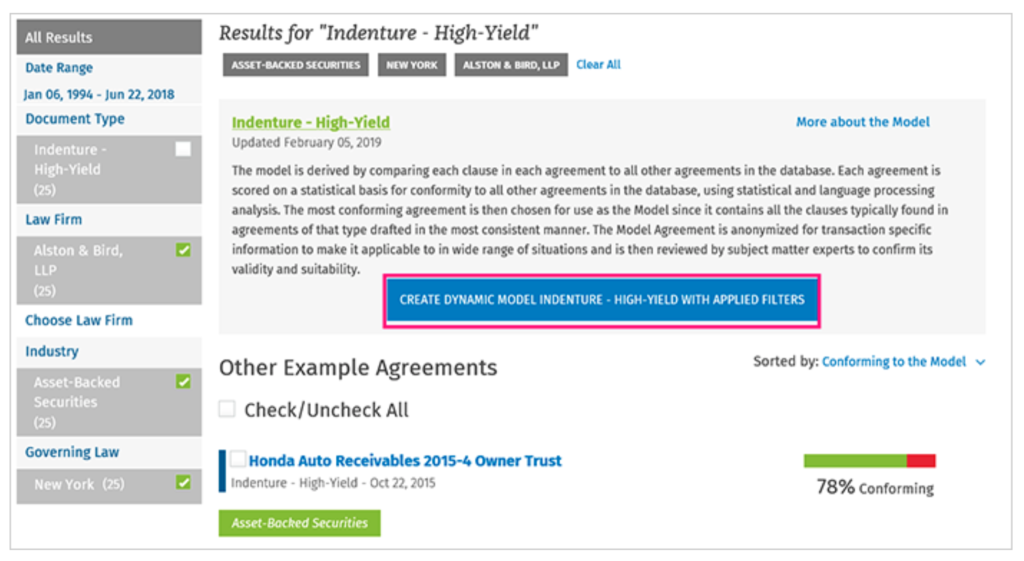

The system, Capital Markets Clause Analytics, uses NLP search capabilities to allow a lawyer to ‘analyse agreements clause by clause’ and then compare standard language to that in one’s own agreements. This covers documents related to equity deals (i.e. shares) and debt (i.e. loans and bonds) that form a significant slice of many large commercial law firms’ client work.

The move increases competition between Wolters Kluwer and the other major legal data providers in the market, for example Thomson Reuters’ Practical Law.

Although there is a review capability, its purpose is for the document creation phase, supported by a huge clause bank put together by Wolters Kluwer.

Interestingly, the database provided by Wolters Kluwer includes search tags for specific law firms and the documents they are associated with. The company states: ‘Multiple comparison tools allow you to efficiently benchmark your own agreements and clauses, providing insight of drafting techniques used by specific law firms or industries.’

The system also gives you a percentage score for how far a clause you are using conforms to certain clauses in the database.

–

Overall, this appears to be a nifty tool. But, perhaps of greater long term importance is that this tool is part of a broader trend that is leading the legal market towards greater standardisation.

As the use of digital templating/doc automation increases, and as more tools are used that guide a lawyer through an automated ‘playbook’ doc creation and amendment process, then firms and in-house teams understandably begin to produce more similar documents.

Rather than each lawyer sitting on their own with little support other than what they or their team may have produced in the past, there is now a plethora of tools to provide market standard transparency on one hand, and on the other, a much more structured approach to the assembly of documents.

The end result will likely be greater standardisation across the commercial legal market as a whole. Naturally, firms will still have their own ‘house style’ and always accommodate a client’s specific legal needs, but standardisation does appear to be more likely in today’s ecosystem of searchable databases and automated structuring tools.

Commenting on the launch of the product, Susan Chazin at Wolters Kluwer Legal & Regulatory US, said: ‘As clients continue to aggressively pursue improved cost efficiency and timeliness from legal providers, legal professionals are in need of workflow solutions that address their most critical pain points. We developed [this tool] to integrate powerful technology with our domain expertise to transform the Capital Markets drafting process, boost our customers’ productivity and improve their ROI.’