LexisNexis has worked with contract intelligence joint venture partner, Knowable, to launch Market Standards, a new database of publicly filed US transactions with detailed search capabilities. It is designed to compete with Thomson Reuters’ Practical Law offering, the company told Artificial Lawyer.

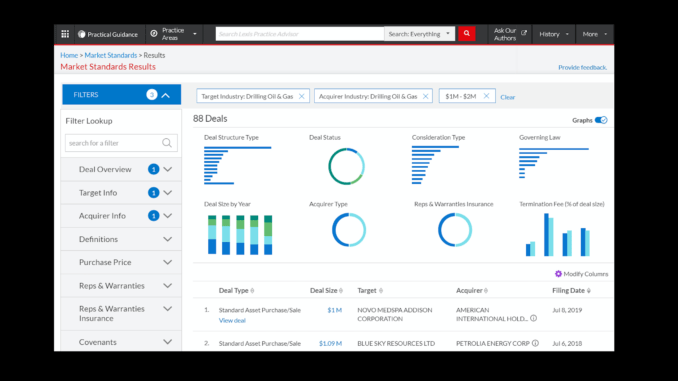

By tapping contractual information in the SEC Edgar database Lexis has started off with a market standard module for M&A that allows lawyers to search and compare transactions using detailed deal points; easily find precedent language; and see deal point and transactional trends with data visualisations. The move follows the recent launch of its new suped-up Lexis+ legal research platform.

Lindsay Bringardner, a Director of Product Management for Practical Guidance at Lexis, told this site: ‘There was content investment, we used our subject matter experts, we had machine learning input, and we also worked with Knowable.’

Knowable is a former Axiom spin-off that analyses contracts to help corporates gain a better insight into contractual obligations across the business. They do this with a mix of tech and human experts.

Bringardner added that they have had a lot of law firm feedback into the design process and five major US firms have been piloting the system to help improve the overall output, as well as the UX and UI.

She noted that they are not just providing information on what is ‘market’, i.e. the currently used terms and approaches to certain legal points, but had developed a range of analytical dashboards that tap the contract data to show what kinds of terms and deals are taking place, in short to show overall trends that can help a law firm to make decisions about what to include in a contract.

Interestingly, because the publicly filed data includes law firm names the system can show which law firms have used what terms and approaches before.

That can also help with negotiations where one party may claim they ‘would never accept that’, but you can then show that they did exactly that last year on a certain deal.

Here’s some details:

- Market Standards has 6x more deals than other offerings, with over 33,000 deals from the last ten years. This coverage enables thorough analysis of recent trends in deal points such as reps and warranties insurance coverage (including retention amounts and who pays premiums).

- Market Standards is 2x more detailed than other offerings, with analysis of up to 150 deal points per transaction. This detail allows lawyers to compare transactions using pinpoint deal data like termination fee triggers, carveouts from control of litigation in third party claims, and knowledge qualifiers in 10b-5 representations.

- Market Standards’ interactive charts bring deal data to life and help attorneys quickly see trends and patterns, such as what percentage of deals have reverse termination fee provisions.