Ediscovery company KLDiscovery has filed its S-1 form with the SEC for an IPO in the US. This makes it the sixth legal tech company to head for a public listing in recent times, following: FiscalNote, an AI-driven legal and regulatory data platform, and also DISCO, Nuix, LegalZoom, and Intapp.

The full financial details have not been disclosed yet. There is a nominal ‘$100m’ figure stated in the form, but this is just standard SEC procedure and is a ‘holding value’, with the real IPO value to be announced at a later date.

Interestingly, the company already trades some of its shares via the Over the Counter, or OTC market, i.e. a market that is not open to all and is used primarily by a network of dealers. In this case it is traded on the OTC Pink Open Market under the symbol KLDI. In that market its share value has been dropping steadily (see below). In fact, the OTC share value over five years has dropped by 61%…!

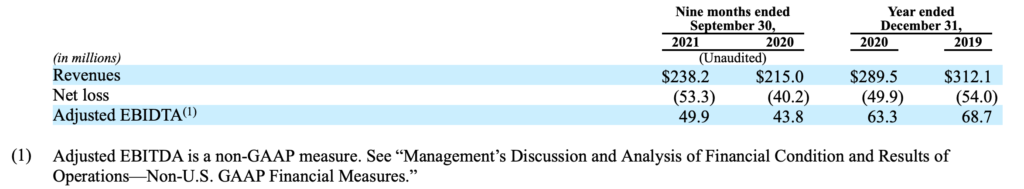

KLDiscovery has 33 locations, nine data centres and 18 data recovery labs across 18 countries, they said. The S-1 form also states that its revenues for 2020 compared to 2019, fell from $312m to $289m, although the first nine months of 2021 were better than the same period for 2020. That said, these don’t appear to be stellar numbers.

Why KLDiscovery wants to go to an IPO now is perhaps more about being part of a wave of such moves, especially in the eDiscovery segment, e.g. DISCO and Nuix.

This is what they said as to the ‘why’ of the move in their SEC filing: ‘We believe we have a strong runway to capture a greater percentage of our large and growing market opportunity. Our unique combination of proprietary software and technology-enabled services, coupled with our full stack, scalable platform that covers the full EDRM life cycle, best positions us to tackle our clients’ “big data” challenges.

‘Moreover, we believe our proprietary Nebula offering, unlike other existing solutions, offers broad flexibility in deployment methods, cost efficiency with customisable pricing models, and optimised accuracy with its underlying AI / ML technology. We see further opportunity to grow our sales among new and existing clients, scale internationally, and extend our technology leadership.’

Is this a big deal?

In terms of the big picture what this suggests is that eDiscovery companies are seeing themselves as businesses ‘that need to go public’ and each new IPO seems to trigger another one.

Will all that new capital change things? It gives them a war chest to buy up smaller rivals and grow their business. It also may mean that we end up with just a handful of very large publicly listed eDiscovery players that dominate the market because of their size. Time will tell.

But IPOs are not magic – as Nuix will tell you – and they can also create new problems. Just because you are listed doesn’t mean clients will buy your products and services more. You still have to get that right. But, in a world where there are a lot of very similar products, having that extra capital may help in terms of the marketing battle to capture as much of the client wallet as possible.