A survey of around 200 UK lawyers by litigation finance group, Harbour, has found that many firms, both large and small, are facing pressure to reduce fees, and/or rely less on traditional billing methods. But can legal tech help?

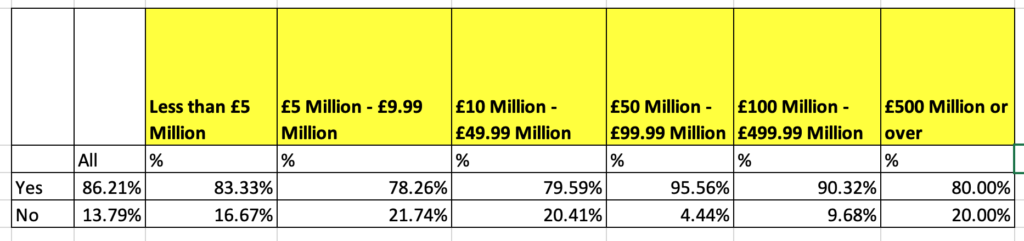

The data shows that while 86% overall faced these pressures, firms across different market segments saw similar messages from the clients, with the ‘lower to middle half of the UK 100’ or £50m to £100m revenue firms facing the most pressure at 95.6%.

The data also shows that

- Clients are taking nearly twice as long to pay bills since March 2020, with the average time rising from 23 days to 39 days – (and incidentally, this site would suggest that presumably also could mean more fee write offs.)

- 40% of firms say their primary focus over the next 12-18 months is increasing profit margins by simply lowering overheads – (and that will be hard to do if firms are also driving staff back to their offices and facing significant salary rises).

- 80% of law firms are considering making more use of Conditional Fee Arrangements or Damages-Based Agreements in the next 12-18 months.

- 89% of firms surveyed considering litigation finance in the next 12-18 months.

What of legal tech? They found that 37% of law firms are ‘investing in legal tech to improve efficiency’ – and that relatively low number is understandable given the wide range of firms sampled.

What Does It Mean?

First of all, from Artificial Lawyer’s perspective, this data is handy as it brings another view of the bumper revenue and profit figures many firms have had the last couple of years. I.e. it shows that although more cash has come into the law firms due to greater overall demand, the clients are being more careful with how they spend their money on each piece of work. So, more work to be done, but those items are getting more scrutiny overall.

That also suggests that if, or when, the current surge of work drops off and the legal world becomes more ‘normal’ again (if that ever happens…), law firms will be left with clients putting more pressure on fees just as salary costs are still rising, and as the ‘back to the office’ culture resumes (at least partly), which will inevitably see some operational costs start to rise as well. I.e. this could be a triple whammy.

Can tech help here? Here’s a few thoughts:

- If non-traditional fees are more in demand then you need to do some benchmarking. So, this brings in a whole range of ‘Operational KM’ tools, from the suite that companies such as Litera are building, to companies such as Brightflag and Time by Ping that can give better data insights into what work costs. These naturally may be used differently by the buyers and the sellers, but either way, without data to create an objective view of what things cost then real change is hard to achieve.

- If clients are putting pressure on fees for certain types of matter, then automating the parts that absorb time, but where it’s unlikely to receive much of a fee really can help. If you have, for example, lawyers doing some work that will very likely be written off, or generally is facing a lot of pricing pressure, then it makes more sense to motor through that part of those matters more quickly and then devote more time to the higher-paying work. In turn, firms can then take on more matters – which it appears they need to do at present to meet demand. I.e. not driving efficiency simply means you are busy, but in effect you are losing money compared to what you could be making.

- Examples of efficiency driving tech here are doc automation and the use of automated NLP review and analysis tools. Deal and project management tools will also help to shave away wasted time or low value tasks that eat up too much attention.

Overall, this could portend more acceleration towards re-thinking legal work production and billing methods that are client-driven and with a strong financial imperative behind them.