Investment bank UBS is now providing regulatory know-how modules on PartnerVine, the Swiss-based platform that offers informational products usually from law firms, such as Simmons & Simmons, or the Big Four, such as PwC.

It’s a big step for PartnerVine, as UBS is usually a client to law firms rather than providing know-how to the legal and compliance world. Although, the bank noted that they primarily are expecting inhouse legal teams to use this information. That said, one can’t help but assume that law firms that advise on these matters will find the content very useful.

In this case, the focus will be on the Swiss Financial Services Act (FinSa), the Financial Institutions Act (FinIA), and the revised Collective Investment Schemes Act (revCISA).

‘The products have been prepared by UBS to provide access to the elements of UBS’ regulatory knowledge and the UBS knowledge collection consists of 630+ questions and answers which have been developed for Swiss financial service providers,’ the company said.

‘With the Q&As as its core element, the know-how collection includes decision trees, glossary, tables, graphics and cross-references to related topics. With access to this know-how, financial service providers in Switzerland can tap into UBS’s knowledge on Swiss regulations. This information is made available in English,’ they added.

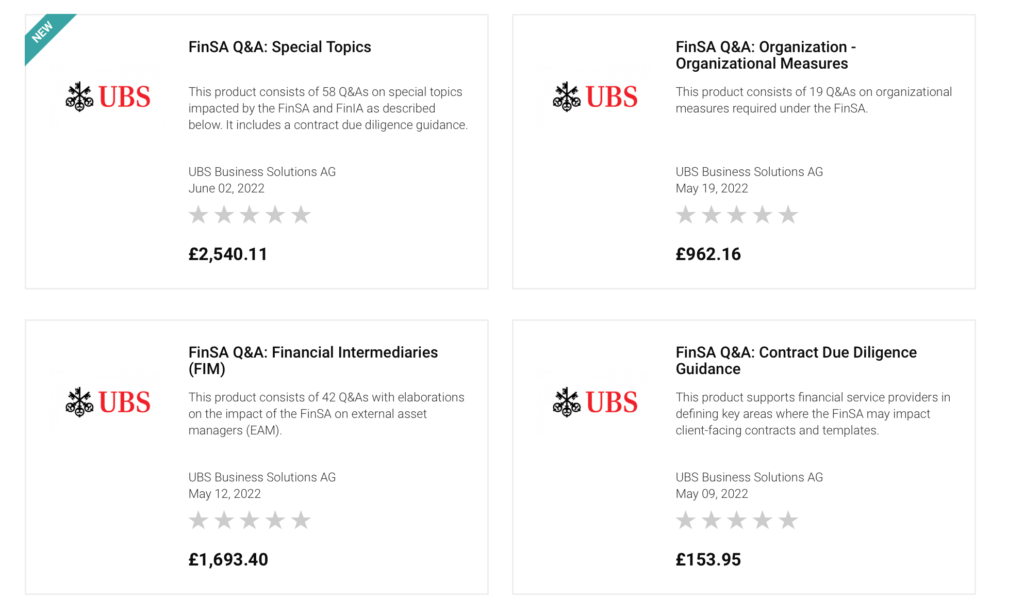

See an example of what’s on offer below:

Artificial Lawyer asked UBS some more about this. These are their institutional responses below.

– Why do this? UBS is usually a client of lawyers, not a provider of information to lawyers.

‘This content is tailored for other legal departments, not law firms, as the regulation is applicable to financial service providers (banks, (external) asset managers), and financial institutes like portfolio managers, trustees, managers of collective assets, fund management companies.

In addition, the reasons for doing it are innovation, digitization, and simplification:

- highlighting UBS Group Legal as legal experts and an innovative function, which is a plus when retaining and attracting talent

- knowledge sharing with others who face the same challenges in the interpretation of a new regulation, strengthens the Swiss financial market

- easy to read and understand legal service through a digital platform for legal, compliance, business risk and client advisors à could be a legal delivery service and legal repository model for others as well.

- New way of publication of legal know-how: Traditionally you would publishing this know-how as legal commentary in from of a book, prose text in German, through a traditional publisher, today we publish ourselves on PartnerVine Q&As, decision trees and graphs & tables – which is faster and more business friendly

– What is the extent of the information you will be sharing?

Regulatory know-how (legal commentary, but as Q&As, decision trees etc.) regarding three key regulations in the provision of financial services in Switzerland, (see above).

These include complex conduct duties where best practices are still developing and the information can serve as a good basis to build on or double-check existing processes. It can also be used as a know-how database for Legal & Compliance, Risk functions and client advisors. Currently, the offer (due to the topic) is limited to Switzerland.’

—

Jordan Urstadt, CEO of PartnerVine, added: ‘It is much easier and cost-effective especially for smaller Swiss financial service providers to plug in to UBS’s knowledge than develop it themselves. Because it is the first time that a large company has provided comprehensive access to their legal know-how, it is a major milestone for legal operations globally.’

And, Barbara Koch-Lehmann, Group General Counsel COO at UBS, concluded: ‘PartnerVine’s platform allows us to share our legal know-how on regulatory matters with other Swiss financial service providers helping them to navigate the complex regulatory environment.

‘PartnerVine’s platform offers either full access to the complete package or topic-specific access to separate smaller bundles focused on specific issues like Scope, Client Classification, Information Duties & Communication and Documentation & Delivery of Documents as well as selected subtopics such as e.g. material or personal Scope.

‘The types of forms in the packages include, among others, client classification forms and the client communications that UBS’ Group General Counsel has developed to comply with the requirements of the Swiss regulations. The guidance and forms are delivered as pdfs ‘as is’, i.e. as static documents.’

So, there you go. It’s great to see clients getting involved in information sharing like this. Let’s hope we see more large banks and corporates doing this as well.