The way that the legal tech sector handles the announcement of funding news and valuations looks like it’s going astray. While the market in some ways has ‘come of age’ as Artificial Lawyer wrote in June 2021, some parts of it are still growing up when it comes to the big money news.

Let’s consider three examples. They are not egregious, but as more IPOs eventually come along, as more money flows into the sector, and more wild valuations arrive in the years ahead, we’re going to need a bit more transparency about things, otherwise legal tech could end up in quite a mess when it comes to financial reporting in this market.

Claiming You’re Worth $1 Billion

It seems like a growing number of legal tech companies want to be ‘worth $1 billion or more’ these days. That’s understandable, who doesn’t want their business that they have built with years of hard work to be considered as a ‘Unicorn’?

The problem is when such statements are not backed up with any public facts it tends to add an unhealthy spin to the market, even if that is not the intention of the company involved.

We have already seen in the last couple of years crazy valuations for legal tech companies, both long before and in their lead up to an IPO, and that kind of frothiness just leads to ‘irrational exuberance’….which inevitably then leads to disillusionment and investor disappointment. In the worst-case scenarios it could lead to serious problems at the companies involved and the loss of jobs as investors realise the projections are from Disneyland when a certain company cannot deliver.

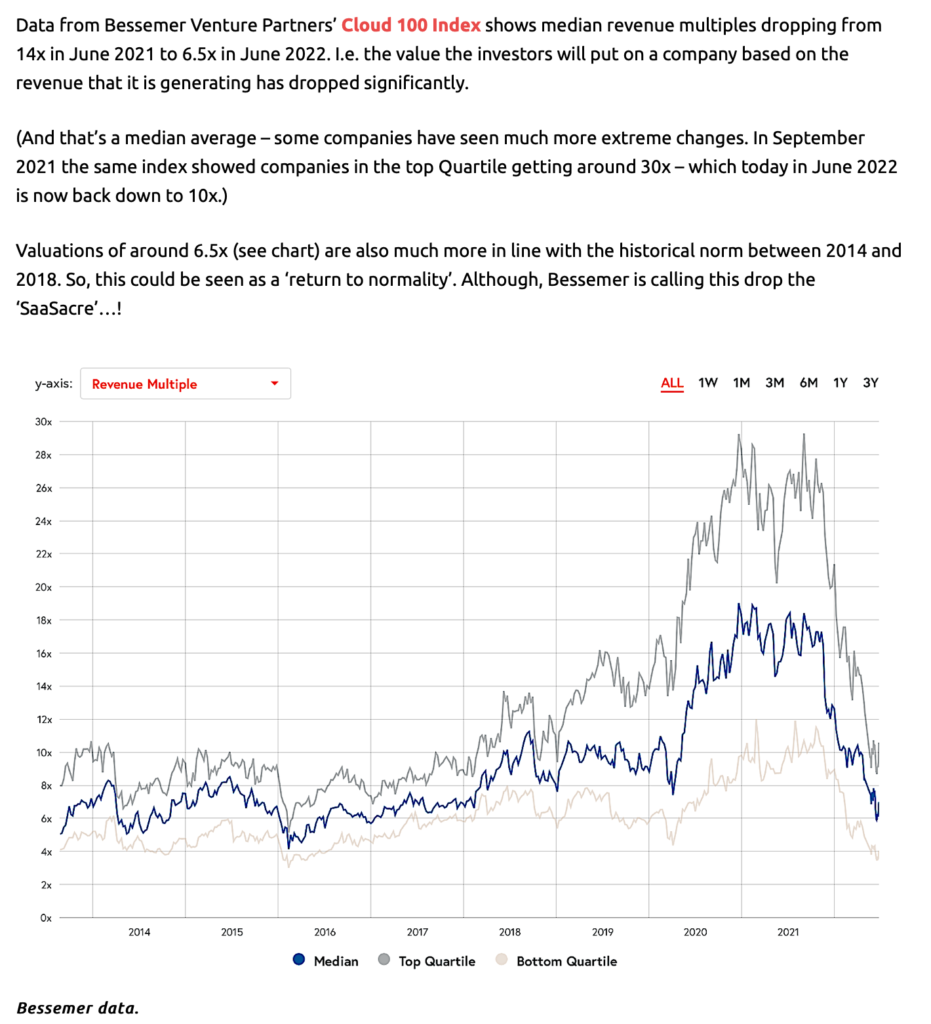

A recent example of a $1 billion valuation claim was from Exterro, which told this site that it was heading for an IPO in 2023 after some new investment and was now worth in excess of $1 billion. However the company would not say exactly how much the investment was, what its revenues were, nor would give any indication of how that figure was developed (e.g. the revenue multiple used) – even when market valuations for tech companies have collapsed from the wild highs of 2021. I.e. in today’s market, it really feels necessary to try and explain things and to show how you got to certain numbers.

Now, Exterro, and any other company, is totally free to withhold financial information if they want to, that’s their right as private businesses. They could never make a single public mention of their income or their investments if they wanted to. That would be totally fine.

The problem is when a company makes a major claim, but won’t back it up. This tends to then encourage other companies to do the same. Left unchecked the legal tech world’s financial picture would eventually turn into a game of guesswork and wild valuations without any public data-sharing. And that is not healthy.

So, ideally, this site would like to see companies do one of two things:

- Say nothing and keep their financial news to themselves.

- Or, if they make major announcements in public (often in the hope of generating positive PR spin for their business) to at least explain those figures and give as much financial information as they can as a sign of respect to everyone else in the market.

This site for one will be underlining any obviously missing data from now on so that readers are not swayed by unsupported claims.

Timing Is Everything

The valuation of SaaS companies – and legal tech companies as well – has collapsed since 2021 (see article and below).

In June this year The Legal Tech Fund announced that it had gathered together a mass of capital from a range of businesses that it would use to invest in legal tech startups. So far, so good, and plenty there to applaud.

The problem was that the fundraise actually closed in November last year when the tech market was still bubbling over with super-high valuations and people were getting a bit irrational about the prospects of how fast companies would grow. In turn, those who were contributing capital to funds were also very excited about the benefits they would receive one day.

If a fundraise closed in November 2021, then it likely started some months before that – when the market was great. Then in June 2022, with indicators showing a drop in values and a decline in the belief in crazy-fast growth, a fund says it’s raised a load of money – but it didn’t raise it in Q2 2022….it raised it during a very different market environment.

The challenge is that the oddly-timed announcement caused some confusion, (and no doubt it helped to stir fresh investor interest in contributing capital to the fund). Social media lit up with the ‘good news story’ – despite it having very little to do with the current climate.

Again, this kind of approach just feeds an atmosphere where market participants cannot be sure where things stand and that is not healthy. This site sought to point out this unusual timing and the reality of the current market conditions in the news story about the announcement, but it was hard to compete with the desire of people to focus on the ‘good news’ part of the picture.

This site will also from now on ask companies and funds that provide very delayed news about investments to please explain why they have done so. (And this site did ask the Legal Tech Fund about the delay at the time of the news, but the response was minimal and didn’t really explain the reasoning.)

Cash Splash Contest

Jim Wagner, the legal tech veteran, noted in a piece for Artificial Lawyer this month that there had been a ‘cash splash contest’ at CLOC this year.

What this refers to is a number of CLM companies holding back their funding announcements to get maximum PR impact during a major event for such technology. Now, each of the companies that took part in the cash splash frenzy did it without knowing the others also planned on doing the same timing. But the end result was that we got one announcement after another….which then led to some people in the market understandably getting a bit frustrated with the deluge.

Now, is this an egregious thing? Nope. But, it’s another example of what should be fairly dry financial news about companies gaining more capital ending up as a frothy experience.

Moreover, so many CLM companies announced funding that week at CLOC that even this site can’t remember for sure which ones raised and which ones didn’t – maybe they all did? And if the goal of all those ‘splashes’ was to bring attention to one particular company then the strategy failed, as even I can’t remember who got what and from whom. There was just too much information all at once.

As this site mentioned at the time – maybe try and co-ordinate (confidentially of course) with the other companies at the next CLOC, so not everyone announces at the same time?

Any road, this third one is not a biggy at all, but as noted, it just adds to a wider atmosphere that feels irrational and overly exuberant.

Conclusion

None of the above examples are terrible things, but they just contribute to a way of acting in relation to financial information that feels more like the legal tech market is going through its teenage years, rather than having reached adulthood.

The market may have come of age, but it’s still growing up. A little bit more restraint and a lot more transparency would help.

By Richard Tromans, Founder, Artificial Lawyer, July 2022.

[ Photo credit: RT, picture of ‘The Charging Bull’, near Wall Street, New York. ]