Foundy is a new company that wants to shake up the way the M&A sector works, at least for fellow startups, with a marketplace approach for buying and selling young businesses that can move ‘four times faster’ than traditional methods – and is a lot cheaper.

The UK-based company has also just secured £1.25m ($1.5m) in an oversubscribed Seed funding round led by Fuel Ventures.

So, how does it work?

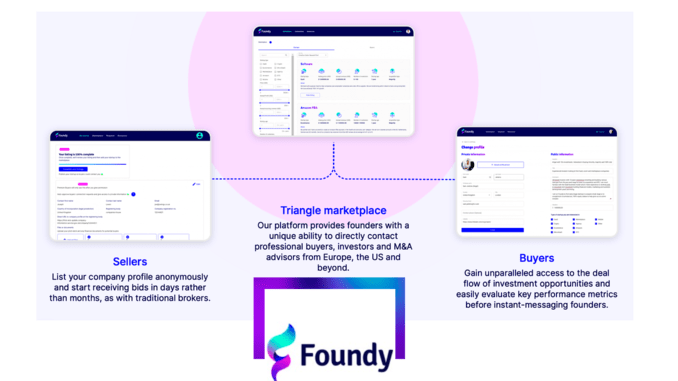

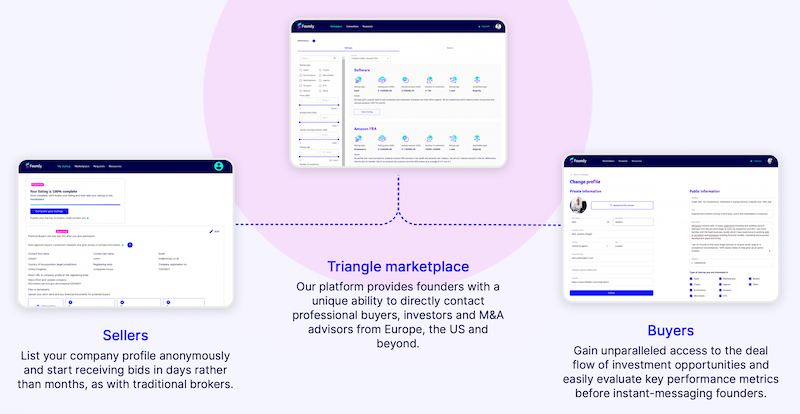

Sellers can list their companies anonymously and get bids ‘in days rather than months’ with the platform connecting buyers with sellers, including via instant messaging. The focus is very much on speed and simplicity.

The idea is aimed at creative founders to allow them to rapidly and easily exit their startups, (or sell chunks of equity), thereby allowing larger businesses to take over and lead the startup to the next stage of growth.

Of course, many founders may want to hold onto their creations for as long as they can and ride the wave all the way up to becoming a major corporate. However, there are clearly plenty of founders out there that don’t want to hold onto the businesses they’ve created for longer than five years or so. For this second group, Foundy could be really handy – and one can think of many of legal tech companies both now and in the past that might have benefited from this approach.

Below is an example of a prop tech company for sale, which has six years under its belt. It wants $1m for a full sale and has revenues of $200,000, so a 5x valuation based on income – which seems realistic in today’s market. This allows the founder(s) to cash out and move onto their next project (unless they’re sticking around), while a larger business with the right resources can then really scale things up.

But will this impact the legal world? Here’s some thoughts:

- If the sales process moves faster, then lawyers – and all the other advisers involved – will also have to move faster to keep pace.

- If buyers and sellers get used to a more ‘frictionless’ and digital approach to M&A, then it’s reasonable to think that they will also want similar benefits in relation to the legal input that goes into such deals.

- At present this is aimed at smaller companies, as it fits this marketplace model, but platforms like this could grow and influence larger deals eventually.

- The Foundy site does not mention any links to legal tech / transactional tools, but it seems that building a close working relationship with software companies that help with the legal docs needed for deals, or that can support more rapid due diligence, and also give transaction management help, could be useful here if the pricing met the expectations of those who buy and sell via Foundy (who are probably not using the likes of Slaughter and May and Kirkland & Ellis for $1m deals.)

Any road, here is what founder and CEO, JP Lewin, said after the fundraise: ‘My investors, advisors, team and I have all learned how unnecessarily inefficient, complex and expensive a traditional M&A process can be from previously scaling and exiting startups.

‘Together, we are on a shared mission to modernise the end-to-end process for startups to sell equity by matchmaking them with buyers and investors as well as providing them with the necessary support and resources they need to complete rewarding deals.’

And, in an earlier post on the company website, Lewin added: ‘As a repeat startup founder, I have learned many helpful lessons about not only scaling a tech company, but also how to navigate the complicated fundraising and acquisition processes.

‘After having built my last company, an urban transport rental marketplace, to over 30 staff and winning contracts worth seven figures I finally sold the company, but over a year after we were first contacted by potential buyers. The whole M&A journey was a nightmare. My first-hand experience is what has fuelled my passion to create an accessible, easy-to-use marketplace for founders, buyers and investors.

‘Because, ‘this is the way it’s always been done’ is not a valid reason to keep doing things the old way. It is 2022! We are in the digital era now where founders of businesses, regardless of their size, need to have access to the right buyer pool and support infrastructure to complete life changing deals. No longer should the M&A industry be largely set up to serve the needs of $30m valued businesses and above.

‘There is now an easier, simpler and faster way to sell a business. And it starts with Foundy; your go-to marketplace for buying, selling or investing in a startup. We are here to support everyone from bootstrappers to post series A startups to seamlessly connect with buyers and advisors to help complete mutually lucrative deals.’

And the company then provides several key lessons about the M&A market. Which are:

‘Lesson 1:

We found: The traditional M&A market is broken: unnecessarily drawn out, mystifying and expensive.

So, at Foundy: Our technology streamlines the process, delivering results without the stress, complexity and cost.

Lesson 2:

We found: Reaching out to direct competitors creates risk and vulnerability for your shareholders.

So, at Foundy: All listings are anonymous, meaning you* decide when to share sensitive information.

Lesson 3:

We found: Smaller startups don’t have access to quality buyer pools and support infrastructure.

So, at Foundy: A large network of screened Buyers is ready and waiting, along with professional 3rd party M&A advisors, our internal team and dedicated resources to guide you through every step of the journey.

Lesson 4:

We found: The secondaries market doesn’t support smaller companies.

So, at Foundy: Our platform opens up secondaries to shareholders in startups of all shapes and sizes to liquidate some or all of their stock to reduce risk. This is an increasingly sought after feature from investors, as some of them may not want to wait for a full exit which may be 5 to 10 years away or might not come at all.

Foundy is here to serve the rapidly growing community of “buy then build” entrepreneurs, institutional buyers and investors who recognise the clear logic of investing in proven businesses rather than starting from scratch.’

—

So, there you go! At a time when it seems more and more legal tech companies are looking to sell up, and when funding is tight, perhaps Foundy is the way to go? Let us know if you try it out. This one may also be of interest to all the lawyers out there who advise the startup market, plus legal tech companies looking for new allies in the transactional world.