Wolters Kluwer has announced the US launch of its ‘enhanced’ CLM product Legisway, which is already available in Europe. The move comes not long after LexisNexis bought CLM pioneer Parley Pro and Thomson Reuters announced a CLM-type capability via HighQ. This suggests that even the largest legal tech companies are not immune to the opportunities afforded by the growth of interest in contract lifecycle management (CLM) tools, especially in the US market.

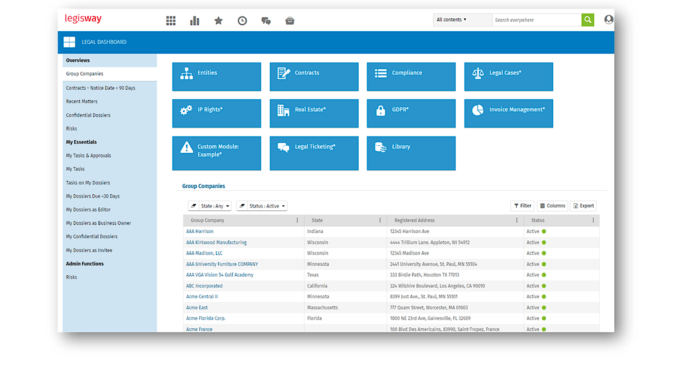

All well and good, but what is Legisway? To start with it’s a bit more than just CLM. This is how the company explains things: ‘Legisway is a configurable, modular, workflow platform, productivity tool and smart repository for small to mid-sized corporate legal departments.’

‘Legisway offers AI-powered contract lifecycle management (CLM) that enables document creation, editing and version control, as well as self-service templates and a legal ticketing system,’ they added and also noted that beyond the core CLM uses you can also leverage the system to help with a wide range of legal data collection and analysis that relates to everything from logging information on IP rights, to helping manage legal spend on law firms.

Ken Crutchfield, Vice President & General Manager of Legal Markets at Wolters Kluwer Legal & Regulatory US, commented: ‘The launch of Legisway provides our customers with a workflow-based platform that meets key needs within a law department, and provides powerful reporting, insights, and analytics to support decision making and better outcomes for the department and the broader business.’

And if you’re wondering how the company is doing these days, Netherlands-based Wolters Kluwer as a whole – which includes areas such as health and tax – hit annual revenues of €4.8 billion in 2021. It has customers in over 180 countries, of which it has bases in 40, and employs around 19,800 people.

Is this a big deal? As noted, this has to be seen in the broader context of the growth of CLM and multiple other types of contracting solutions for corporates in general, plus the increasing interest in this space by other legal tech companies.

Overall, this move and those of LexisNexis and Thomson Reuters, add more competition for the CLM ‘2.0’ players that have rapidly carved out some market share in the last few years, while for the older CLM companies it’s yet more rivals to take into account when they go into sales pitches with inhouse legal teams that now have so much choice it must be difficult to know which way to turn.

Moving this Wolters Kluwer contract management capability into the US also certainly makes sense, given the size of the market there and the huge number of potential buyers of CLM and related contract management products.