The Legal Services Consumer Panel (LSCP) in the UK is recommending that lawyer regulators follow the example of the food, banking and energy sectors and support standardised methodologies for describing what people are buying and what their rights are when it comes to legal services.

In a new white paper ‘Standardisation of Consumer Information in Legal Services’, the LSCP noted that aside from areas such as clear pricing information, people and organisations buying legal services should be helped to ‘better understand their rights; information ranging from how to make or escalate a complaint, to how to identify, navigate or mitigate risks. [And] for example, it is important for consumers to understand the different consumer protections available when using a regulated or unregulated provider’.

(Note: this site would add that ‘un-regulated’ providers are definitely not therefore ‘un-good’, they simply operate under a different umbrella of rules, but it makes sense to let people know this in a clear way and to understand what the differences mean. Of course, the term ‘unregulated’ tends to carry with it a negative connotation, and perhaps we can come up with a better description for responsible legal businesses that are not operating as ‘regulated law firms’? Just a thought.)

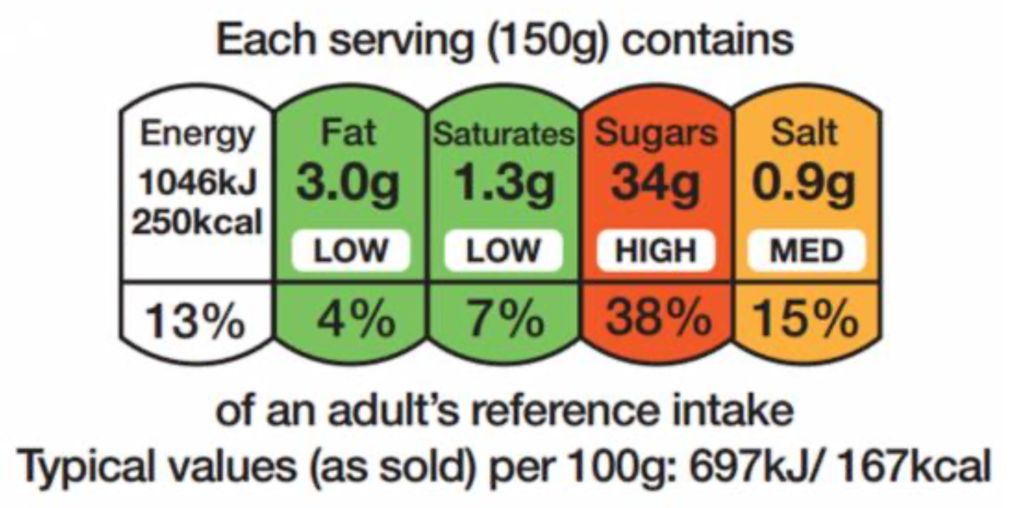

Anyway, back to the main issue here. The problem today is that every law firm in the country communicates things in different ways to new clients who are considering purchasing legal services. There is nothing akin to the nutritional ‘traffic lights’ information for food standards (see image below) that you see on most packaging in supermarkets today.

There is also no agreed approach to showing legal pricing, as we have in the UK energy sector, that would help people and SMEs to really know what they are buying and to be able to make meaningful comparisons. And there is no standard approach to sharing legal information and how to communicate a person’s rights, meanwhile consumer banking is a world that has fully embraced standards – in fact, without them it would be hard for the sector to safely operate today.

And we have Open Banking that provides a standardised approach to sharing customer data – and that also supports the consumer’s freedom of choice, e.g. to easily move from one bank to another, if they wish to.

The group noted that although standardised approaches may not be a cure-all, that they can help with addressing information asymmetry between the buyer and seller of legal services and so should be addressed where possible.

However, they stressed that just giving buyers of legal services ‘more information’ does not help in itself, rather they need to be able to compare that information versus what others are providing. And to do that, especially for people who are not experts in the law, we need a more standardised approach when communicating and onboarding clients so they have at least a realistic chance of making a meaningful comparison of what’s on offer and what these services may mean for them, along with what their rights are.

Five pages of small print on a website, written in complex legalese, which is worded differently to all the other text provided by other law firms, and missing any easy to read charts showing their rights or displaying any pricing rubrics, is arguably not very helpful to a buyer of legal services.

As a further example, the paper shows what a UK energy bill will normally show, at least if it follows the energy regulator Ofgem’s rules:

• ‘Provider’s name;

• Tariff name;

• Tariff type: standard, fixed, renewable tariff, etc.;

• Payment method: quarterly on receipt of bill, direct debit (monthly/quarterly), etc.;

• Unit rate: the cost of a single unit of electricity (kWh);

• Standing charge: price per day that customers pay regardless of consumption

• Tariff end date, if applicable;

• Whether or not the price is guaranteed until a given date;

• Whether or not the provider charges early exit fees and how much they are;

• Whether additional products or services are included in the tariff.’

Meanwhile, they note that the Office of Fair Trading has got the credit card industry to agree to use new summary boxes to present fees and charges so people really understand what level of debt they are getting into.

The paper then makes several recommendations, in particular to the Legal Services Board (LSB), the umbrella regulator that sits above the Solicitors Regulation Authority and other bodies.

Recommendations for legal services regulators

- The LSB, as oversight regulator, should ensure that standardisation is considered in relation to the ongoing work on transparency and most importantly on quality indicators.

- The LSB should explore using standardisation to address the deficiencies found with complaint signposting, as part of its review of first-tier complaint guidance.

- The Solicitors Regulation Authority, Council for Licensed Conveyancers and CILEx Regulation should consider how the price of conveyancing services can be better standardised for improved comparability.

- All frontline regulators should consider how current information requirements around consumer protection can be standardised to promote improved consumer understanding.

- We urge legal services regulators to continue to pay attention to the success criteria below (see below), without which we doubt information remedies can be successful.

And here are the ‘Information Remedies’ –

Information Remedies – Criteria for success:

1. Appropriateness test: Regulators should consider whether information remedies are appropriate and sufficient. This should take into consideration the level of risk and the ability of consumers to adequately comprehend the significance of the information.

2. Consumer testing: Consumer testing should be undertaken when designing new information remedies. In recent times, the CMA has mandated that regulators carry out consumer testing such as Randomised Controlled Testing (RCT) before implementing information remedies. The CMA has also placed an obligation on firms and service providers to participate in such research. Legal regulators should follow their example.

3. Accessibility of information: Care should be taken to ensure that information is provided at the right time, the right place and for the intended consumer groups.

4. Information overload: Too much information can make decision-making worse. Regulators should design an effective disclosure regime to help consumers understand and engage better.

5. Consumer awareness: For it to be effective consumers must be made aware of the information remedies available in the first instance. Information remedies may need to be accompanied with measures around the prominence and timeliness of the disclosure.

6. Prescriptive disclosure: Intervention may need to be prescriptive, particularly where standardisation for the purposes of comparability is an important component of effectiveness. There may be a need to dictate more precisely the format in which information is provided.

7. Segmentation and targeting: Information remedies should be varied and targeted as appropriate in line with the needs of different groups of consumers, including those in vulnerable circumstances

8. Compliance monitoring: Gaps in compliance limit the impact of any remedy, regulators should develop a system to monitor compliance whilst designing and developing information remedies.

9. Evaluation: The design process must build in at least one evaluation stage which allows regulators to assess effectiveness. This will empower regulators to adjust and improve future designs.

–

Overall, this makes a lot of sense. While sophisticated clients with their own inhouse legal teams may not need this level of informational support, many others in the market, from individuals to SMEs, may very well benefit from standardised approaches to communicating legal rights and the buying of legal services. That said, some of the ideas above could also be applied to the wider world of commercial law, and in many ways this is in tune with the broader legal design movement that seeks to drive clarity and ease of use for legal information.

You can find the full report here.