Luminance, the well-known NLP-driven doc analysis company, made £3.8m ($4.7m) in revenues in 2021 in what was a bonanza year for transactional work, along with a loss of £5.16m ($6.33m). While this shows significant growth in total income, up 38% on 2020, it also underlines just how narrow the market for these tools still is, given that Luminance started in 2016.

Moreover, it will be very interesting to see what happens to ‘traditional’ legal AI analysis tools with the rise of GPT-3 and related Large Language Model applications to this part of the market, i.e. in terms of finding clauses in a document.

Artificial Lawyer looks at Luminance’s performance annually because it is a useful bellwether for estimating the ‘hype vs reality quotient’ for this type of tool. It’s also a company that markets itself as ‘the world’s most advanced AI for the legal processing of contracts and documents’ – so, it should be doing well.

In terms of the company’s customers, it stated in January 2022, i.e. one month after its previous year end, that it had ‘over 350 customers, including leading law firms, professional services firms, and corporate customers across over 60 countries’. If that is taken as 350 separate businesses, and we divide that into the £3.8m revenue, then we get around £10,900 per annum/per customer in terms of income. The previous year it was £11,112. This suggests that although Luminance is winning new clients, the overall income for each of those is not increasing over time on average.

This matters, as many companies in this segment charge on a usage basis. That said, because Luminance is always growing its client base and providing its tech to multiple areas, from real estate, to litigation, to the core M&A due diligence use case, it’s spreading itself more and more thinly, so the revenue per client is always going to look quite small.

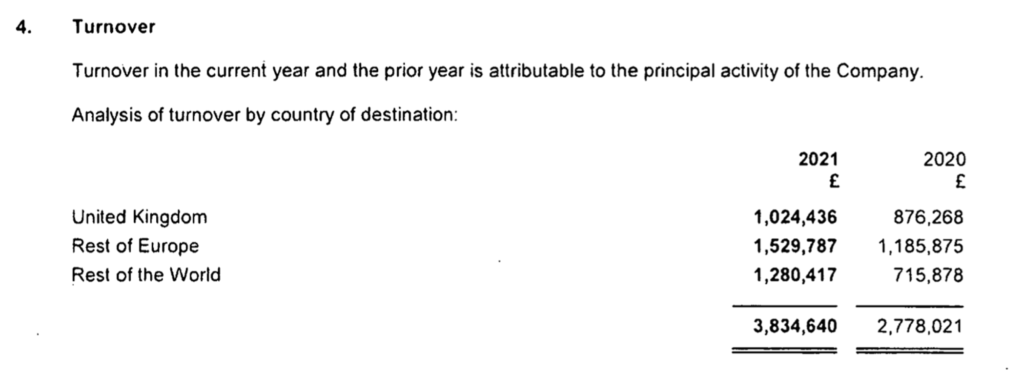

In terms of where the money comes from, the annual filing for 2021 with Companies House in the UK stated:

- UK revenue = £1.024m

- Rest of Europe revenue = £1.53m

- Rest of World (inc. USA) revenue = £1.28m

The previous year, Luminance saw income of around £876,000 for the UK, so they had an increase in 2021 of around £148,000, or a 16.9% increase. Once again, this is healthy expansion. Yet, again, £1.024m in the second largest commercial legal market on the planet is not a massive sum.

The UK 100 law firms in 2021 earned in total many billions of pounds in fees for transactional work – the kind of work where one could often apply Luminance – and yet it generated only £1.024m in its home market, and where one of its key shareholders is Slaughter and May, one of the world’s leading transactional law firms with a strong focus on M&A matters.

Even so, kudos to the team at Luminance, especially CEO Eleanor Weaver, for growing the business. The challenge now is that 2022 will have perhaps been a trickier year and 2023 will be tricky also as transactional work levels dip due to economic pressures.

Now, the loss situation. The reality is that growth capital-backed companies tend to remain loss-making for a long time. They have to spend the cash they receive to develop the product and drive growth, and then hopefully reach a point of self-perpetuating stability where revenues cover their costs without the need for lots of new ‘rocket fuel’. Clearly they are not there yet – but they are in good company in regard to running at a loss in the legal tech world, and this is par the course for many startups/scaleups.

Of course, one additional aspect here is if the shareholders ever want to sell Luminance. Given the current weak tech valuations, which will probably remain for 2023, and the fact that it still has low revenues and its losses are growing, it may be hard to sell the business for the sum the investors had once hoped for.

The company has also received fresh capital to keep going. In their statement to Companies House in the UK, it is noted: ‘The company expects to continue to invest and incur further losses before its technology and the market matures to the point that it is generating positive cash inflows from its operating activities.’

‘To date the company has been funded through share issues to its shareholders and also through convertible loan notes [i.e. debt] to some of its shareholders, of which £6.1m was received in Feb 2021 and £10m was received in May 2022 [i.e. it received £16.1m in new funds in 2021 and 2022.]’ they added.

Luminance and its accountants then noted that: ‘…the company may require further funding in the next 12 months if the timing of the revenue growth is below that forecasted which is uncertain given the current global economic uncertainty.

‘To enable the company to continue its activities and meet its liabilities as they fall due, the company will utilise cash from its revenue streams, R&D tax credits and will also require additional funding from new and existing investors/shareholders. The process of obtaining additional funding is in the early stages and these factors combined indicate the existence of a material uncertainty which may cast significant doubt on the company’s ability to continue as a going concern and therefore it may, in the absence of other funding alternatives, be unable to realise its assets and discharge its liabilities in the normal course of business. The directors are confident that either revenue growth or further funding will be achieved……’

Of course, such slightly scary notes, which in this case were written in November 2022, are also usual in accounts of this type and have to be included to show potential risks, rather than saying that anything negative is certain to happen. They’re just ‘covering all the bases’, as it were. Yet, the note does highlight an ongoing challenge: raising new capital in a tough market.

Conclusion

It’s clear that Luminance has grown and increased its total income – and by relatively large amounts compared to the year before – so congratulations to the team on that.

However, it’s still burning through a lot of cash and even during what was arguably one of the best years ever for transactional work – where Luminance can be readily applied – total revenues globally were £3.8m. That may sound like a notable sum, but if you consider that it had around 100 staff in 2021 and had spent by this point tens of millions of pounds to grow, then the reality is that Luminance remains ‘a small business’ with considerable losses.

As a comparator, Eigen, which works in legal, banking and insurance, but largely offers the same type of NLP-driven doc analysis product, generated £5.95m in 2021. We don’t have figures for Kira, especially since it joined Litera. It’s hard to know if it’s doing much better or about the same as the above companies relative to investment and staffing.

So, what does this all mean? This site has reviewed plenty of such tools and related ones, and they all work well, (at least when there is sufficient training provided…). Each have their own particular approaches, but generally they all offer the same thing: added efficiency for lawyers in the reading of contracts. That the legal market has not adopted these tools en masse remains a reminder of the law firm economic model challenges facing such companies. Those challenges are not going away anytime soon. New technology such as Large Language Models are also a new factor, and we do not know yet what impact they will have.

However, on a more positive note, clearly the use of doc AI tools is growing, with Luminance showing an increase in revenue of 38%. So, things are moving in the right direction, albeit from a very low base.