By Raymond Blyd, CEO, LegalComplex.

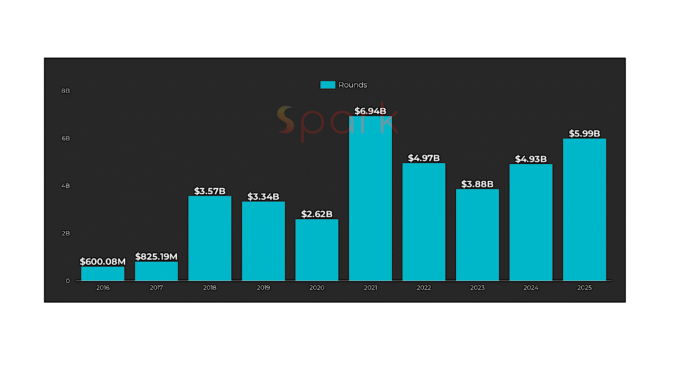

Legal tech funding in 2025 reached $5.99 billion and featured fourteen $100m+ rounds, with extraordinary valuations and remarkable revenue growth – for some companies. But, not all. At the same time, Robin AI ran into funding troubles. Meanwhile, dozens of other legal tech companies globally, which had raised capital between 2020 and 2023, have not raised capital again since then.

Venture Funding

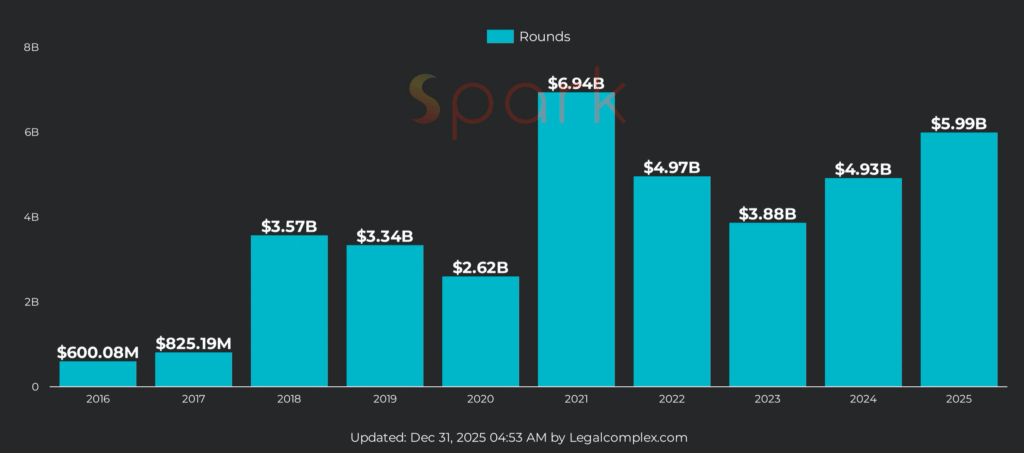

The venture funding numbers below exclude debt financing by public legal tech companies such as Wolters Kluwer. I also disregard legal tech funds raising capital to invest in companies.

There is also an elephant in the room: ‘Compliance’. Companies like Awesome Compliance operate in a space that collectively raised $27 billion in 2025 alone. Governance, Risk and Compliance (GRC) is a space with fierce competition from Vanta, Verisk, OneTrust, TrustArc, and, of course, Palantir.

Considering these caveats, here are the 2025 numbers compared to 2024:

- Total raised: $5.99 billion, up 22%

- Number of companies: 292, down -27%

- Number of investors: 539, down -31%

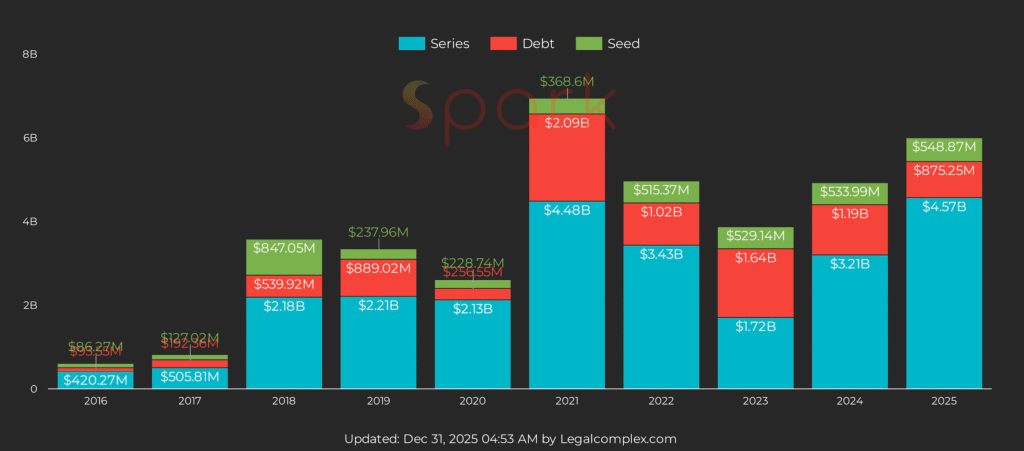

This year alone saw Harvey raise four venture rounds totaling $818 million. They announced their $8 billion valuation on October 29, just hours after Legora announced its $1.8 billion valuation along with a $150 million Series C.

Yet both were dwarfed by Clio’s two massive venture and debt rounds totalling $850 million, following their $900 million round in 2024. These rounds almost made us forget that Filevine ($260m), Peregrine ($190m), and EvenUp ($150m) also raised outsized rounds in 2025. Will we see more investment in 2026 of the same scale?

Valuations vs Exit value

While valuations are vague indicators, actual exit values are a more tangible measure of value. Unfortunately, only 10% of acquisition announcements (6 out of 59) shared prices.

Here is a summary:

- Total exits: $2.29 billion, down -39% from 2024

- Top exit: vLex, $1 billion

- Top ROI: Libra achieved a 90x return on investment from a $105 million exit on a $1.17 million investment

For context on the valuations attributed to top startups versus actual acquisition numbers: Manus AI was acquired for reportedly $2 billion by Meta. They went from zero to $100 million in annual recurring revenue (ARR) in eight months. Their AI orchestration is arguably superior and also usable for legal professionals. Better yet, lawyers have used Manus to ‘vibe code’ major legal AI features for free. Yet Manus AI is valued less than Harvey and has a lower ROI multiple (23x) than Libra. Do these numbers reflect a realistic value of Legal AI?

Recurring Revenue

This year I also saw startups proudly sharing their recurring revenue. Libra’s revenue jumped from $2 million to $3 million in a matter of weeks. Similarly, GC AI reported revenue growth from $1 million to $10 million in one year. Harvey reported $100 million ARR within three years of existence. For context, it took Clio 17 years and Litera 30 years to reach a reported $300M+ ARR. Clearly, the rate of legal AI revenue growth is unlike anything we have ever witnessed in legal tech. Are these exponential growth numbers sustainable?

These questions require some soul-searching within our industry, especially since law firm expenses fuel vendor revenues. On January 22 in Madrid, I’ll be exploring these themes and more. Feel free to sign up at Legalcomplex.com to join me in a one-time single-day workshop.

—

AL Note: many thanks to Raymond for continuing to track legal tech investment data. LegalComplex generally uses a wider definition of ‘legal tech’ than this site. Either way, the overall trends remain the same.

Discover more from Artificial Lawyer

Subscribe to get the latest posts sent to your email.