Checkbox, a legal front door pioneer which launched in 2016, has raised a Series A round of $23m, with Jerry Ting, the former CEO of Evisort who sold the business to Workday, also investing alongside other angels. (See AL Interview below with Checkbox CEO, Evan Wong.)

The round was led by Touring Capital, with several other large investors. Meanwhile, Ting is currently VP, Head of Agentic AI, at Workday. The contract AI company Evisort, which he co-founded, was sold to the major enterprise platform back in 2024.

The new cash for Checkbox will be used to expand its AI-driven offering, which is designed to ‘replace fragmented, manual legal intake with intelligent, automated workflows across the enterprise,’ they said.

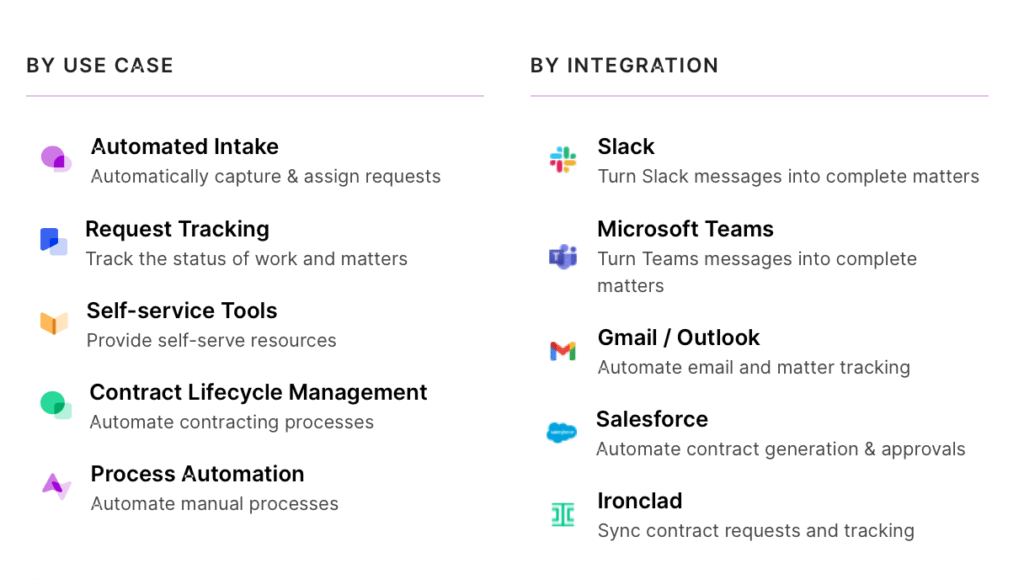

It connects to a range of well-used tools lawyers and other professionals inside corporates already rely upon, and provides plenty of features to handle work management. See image below.

Checkbox ‘captures legal requests from business users right where they already work: in email, Slack, Teams, Salesforce, and intranet portals,…..the platform’s AI Agents turn everyday conversations with legal into automated workflows, from drafting contracts to approving conflicts of interest, and everything in between. This powers self-service for routine work while routing complex, high-risk matters to the legal team, who manage their matters directly on Checkbox,’ they explained.

Checkbox is already used by over 100 organisations including SAP, Hitachi, PepsiCo, and other Fortune 500 companies, they added.

James Han, Co-Founder and Chief Product Officer, commented: ‘The Series A funding will fuel Checkbox’s vision to build a system of intelligence for legal work, turning everyday requests into institutional expertise. This institutional expertise can then be leveraged by AI to help teams move faster, deliver more consistent work, and reduce dependency on outside counsel.’

It’s interesting to see Checkbox – and also some other ‘older’ companies – now bagging plenty of new cash after a relatively restrained approach to VC investment. I.e. in this case they started in 2016, but only now are hitting their Series A. One would guess that this is due to both the surge of interest in legal AI, as well as the opportunities it now affords those companies that can scale.

And as noted yesterday, there has been a flurry of investment announcements this week, showing that legal tech remains a very popular area for VCs. Why they all wanted to go public this week in particular is a mystery 🙂 Maybe it’s something to do with the stars aligning?

AL Interview with CEO, Evan Wong, who is based in New York.

What does this major funding mean for you on a personal level?

On a personal level, this moment is incredibly meaningful. Over the past few years, we’ve been focused on growing Checkbox into a truly global company, with a strong and expanding presence in the US market. We’ve always believed that the challenges in-house legal teams face are universal, and from the beginning, our ambition was to build something that could operate at the center of the global legal ecosystem.

This funding represents more than growth capital, it’s strong validation that what we’ve built resonates in one of the most important legal markets in the world. It reinforces the direction we’ve taken as a company and the long-term vision we’ve been working toward since day one.

Most of all, it’s energizing. It gives us the opportunity to keep investing in the product, the team, and our customers globally, and to keep pushing forward on our mission to fundamentally improve how legal teams operate at scale.

How do you see Checkbox in relation to the market now, and how will this funding help you compete?

Most legal tech tools focus on pieces of legal work — contracts, documents, or point solutions that still leave legal teams stitching together email, Slack, forms, and manual triage.

Checkbox is different. We’re building the AI Legal Front Door — a single system that captures all legal demand as it enters the department, without requiring IT-heavy implementations. Every request, question, and outcome becomes structured data.

That structure is the real advantage. Over time, it creates a living knowledge base — a digital brain of how legal work actually happens. With this funding, we’ll accelerate product development around intelligence, automation, and analytics so legal teams can not only respond faster today, but fundamentally scale further with the business without necessarily adding more legal headcount or increasing outside counsel spend.

And, AL has to ask: ‘What are your thoughts on vibecoding?’

We think vibecoding is an interesting way to describe something that’s been coming for a long time: empowering the people closest to the work to shape the software they use.

In many ways, no-code is the original version of that idea. Checkbox was founded on the belief that legal teams shouldn’t have to wait on engineers to design, adapt, and improve their workflows — they should be able to do it themselves.

Where we think this really becomes powerful is when that flexibility is paired with structure and governance. You get the speed and creativity of experimentation, but with the reliability, permissions, and consistency that an enterprise function like legal actually needs.

That’s exactly what we’re enabling for legal teams: the ability to move fast, adapt workflows, and use AI creatively, without sacrificing control or trust.

Thanks Evan, and congrats on the raise!

—

More about Checkbox here.

—

Conference News

Legal Innovators Europe – Paris – June 24 and 25 – tickets now available.

Discover more from Artificial Lawyer

Subscribe to get the latest posts sent to your email.