The share prices of Thomson Reuters, LexisNexis’s owner RELX, and Wolters Kluwer have experienced what AL is calling a ‘Claude Crash’, after Anthropic announced it was moving into legal tech. However, selling off shares in legal data titans seems an irrational response.

Let’s look at what has happened – and an important caveat, markets really are irrational and all the share prices of the companies mentioned here may have rebounded by the end of the day.

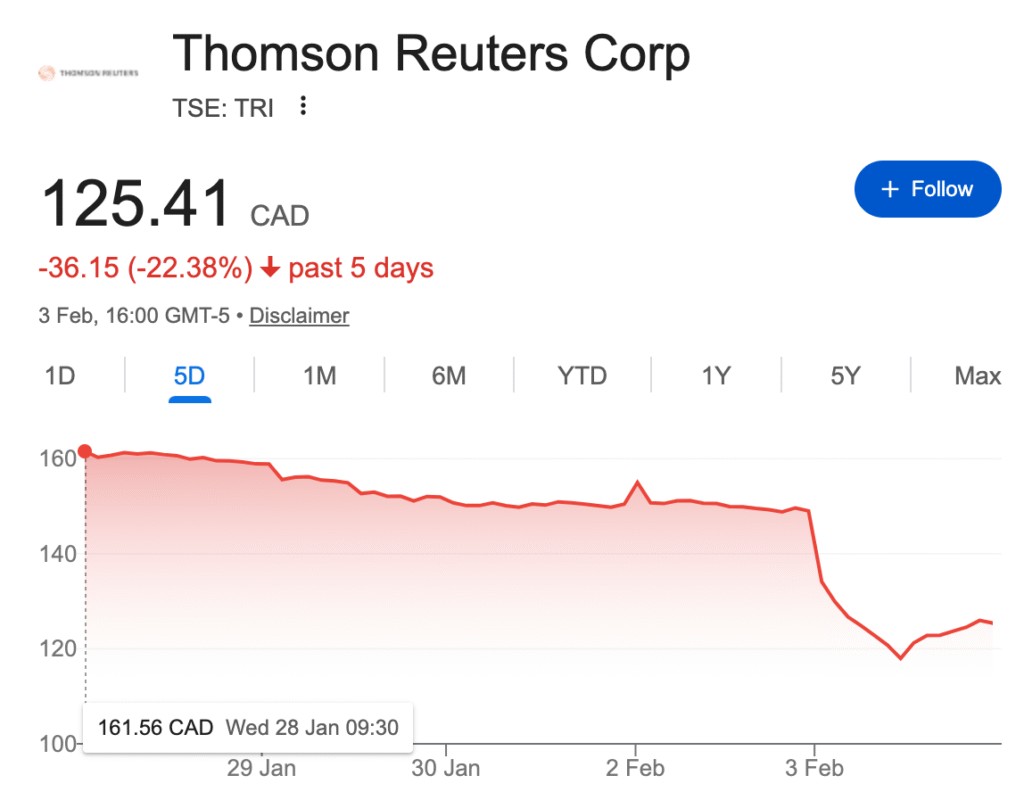

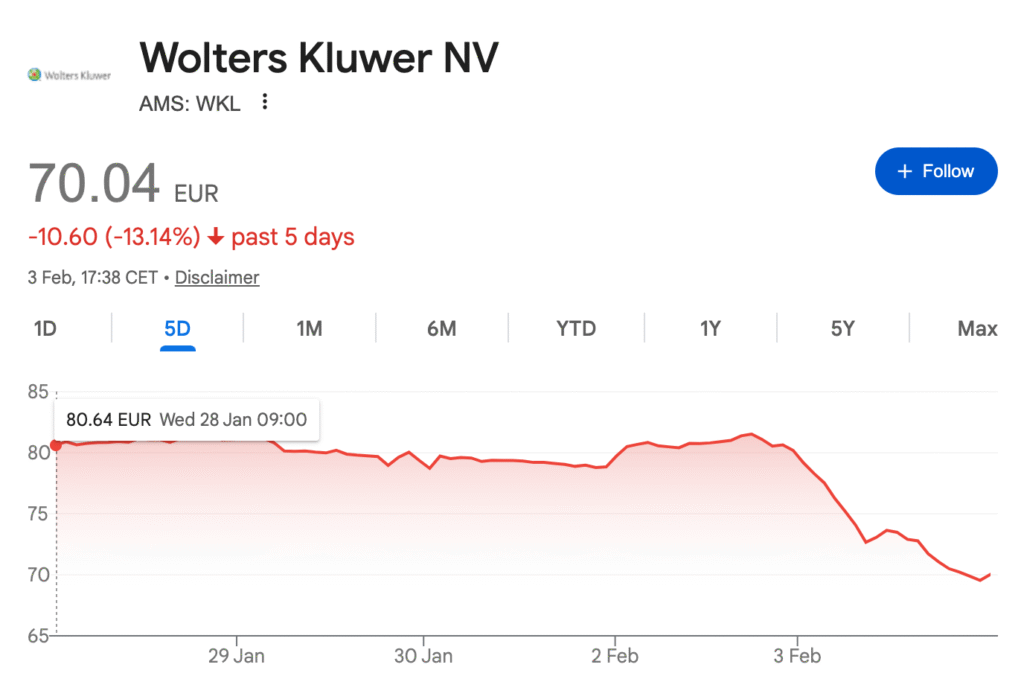

First the stock prices – as you can see, TR, RELX which owns Lexis, and WK, all saw major share price drops this week after the markets digested the news that Anthropic is offering a range of dedicated AI skills for legal – which AL covered on Monday morning – see here.

TR, for example, was down 22% compared to its price 5 days ago, with RELX by 20% – and you can clearly see the dip on all the charts from Feb 3rd, all happening at the same time.

Even LegalZoom experienced a dip, and they are really very different to the above three companies. And that shows this is perhaps more of a sector sell-off than a careful strategy.

So, what’s happening and why is selling off TR, RELX and WK stocks such a strange move? (Note: AL has no shares in any of the companies mentioned.)

First, the plugins that Anthropic is offering are not super easy to use ‘out of the box’, and any law firm or legal team would likely need an enterprise licence to safely use them and some tech team help. So, that limits uptake.

Then comes the question of whether any firm would use them at scale, especially when they already have deals with a range of very sophisticated legal AI companies.

Next, and this is the key point really, TR, Lexis and WK are at heart legal data fortresses. In many ways they are the most secure of all legal tech companies because of the proprietary data – case law and contract data – that they hold, and have spent decades curating and making searchable. And they are now connecting that data to a range of AI skills. Those data collections cannot easily be copied by anyone else in the market, hence they have an incredible moat.

What the plugins do, e.g. mostly vanilla contract review, has very little in common with what a huge legal data library offers, even if there is some overlap when the data giants offer contract review as well.

Where the plugins do have an impact is where they are competing with relatively simple and commoditised legal tech tools – i.e. the ‘wrappers’ as they’ve been called. But, that’s not the above legal data giants, which are tying any of their additional AI skills back to their legal research or contract libraries.

So, Where Will The Claude Crash Have A Real Impact?

As noted, it’s on the basic end of legal tech where Anthropic may have the most impact, e.g. a legal team that perhaps already uses Claude or OpenAI models a bit, and perhaps uses a legal tech tool for contract review – but not a great one, and does not use a major platform with tons of additional capabilities. They look at the plugins and say: ‘You know what, let’s just get our tech team to set this up for us, and then we can drop this older, more basic contract review tool that we use.’

Companies in that bucket – which mostly are not listed on the stock market – could see a hit to their valuations, as well as a reticence from VCs to invest.

But…..if a tool is super-sophisticated, or provides a very broad range of connected skills, or is linked to very useful data that no-one else can control in the way they do, or all three at once, then why give up on all of that for a relatively basic plugin? All of the more complex tools are tapping LLMs already, but bring a lot more with them. Why jettison what they bring to the party?

Moreover, we don’t know yet if Anthropic is really going to push hard with legal and other enterprise verticals. Maybe they will stop where they are? If so, such tools will seem even more limited as time goes by.

Of course, there are law firms such as Freshfields, which has gone all in on a vibe-coding strategy and works with the Google suite to build whatever tools its needs, as and when it needs them. But they are almost the exception that proves the rule. Most law firms like the security of buying in trusted legal tech brands – with founders they can talk to about their complex legal needs.

Overall, most large law firms and legal teams just don’t have a huge driver to dump what they currently use.

Conclusion

Anthropic’s move into legal tech is massive, in that we have been waiting for years for Big Tech to make such a move and now it’s happened.

But, its impact will not be that of a sledgehammer. Rather, it will impact a range of tools in different ways, and mostly those that are not offering customers much beyond what general LLMs can offer already. Those weaker, more shallow offerings – AKA the ‘wrappers’ – are in trouble. Even if they don’t lose customers now, investors will believe they soon will.

The broad offerings that are very hard to replicate, the ones that really pioneer innovative approaches, and the data giants (or a combination of all three) – those are the ones that a handful of plugin skills can’t really impact that much in the real world.

But, then, as they say, the stock market is irrational.

–

Important note: this is not financial advice, this is just my personal opinion on what’s going on.

Discover more from Artificial Lawyer

Subscribe to get the latest posts sent to your email.