US law firms appear to have well and truly got behind AI-driven legal research, with Casetext, one of the pioneers in the sector, adding AmLaw 100 firm Blank Rome to a growing list of clients that includes: Quinn Emanuel, Fenwick & West, DLA Piper, Baker Donelson, Ogletree Deakins, and O’Melveny & Myers to name a few.

LexisNexis has also made significant progress here with its LexMachina and RAVEL acquisitions in this sector. And of course, we have ROSS Intelligence, which started out with a strong focus on bankruptcy law research, but has expanded into other areas. It’s also created EVA, which allows you to upload legal briefs for litigation analysis.

That is to say, the real story here is not so much that Casetext has bagged another large commercial law firm – which is great – but that the legal sector’s focus on AI-driven efficiency and productivity in an area such as litigation is becoming the norm.

As more lawyers make use of such systems it will become standard procedure, in turn clients – if they are not already demanding such tools are used – will come to expect them as well.

This also plays into the challenges lawyers face in conducting preliminary research when a client either will only offer a fixed fee for that element of the work, or in some cases won’t even cover what they may see as work that ought to be ‘baked in’ to any bill for litigating a matter and not added on top.

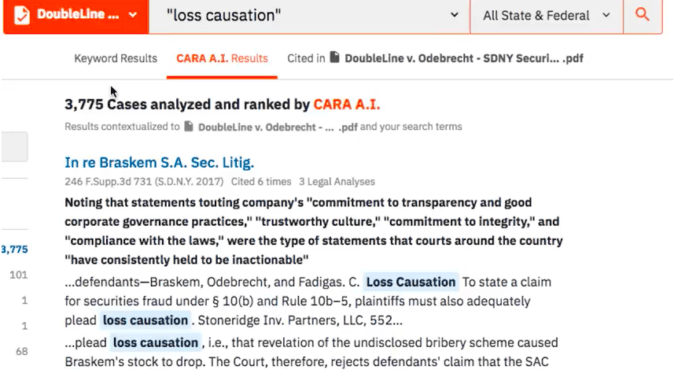

(And if you’re wondering what Casetext actually does, then please check out the video below, which does a great job of explaining how it works. Though, basically what it does is this: it reads your brief and discovers other cases that may be relevant, using NLP to read and make the connections.)

How much impact will all of this improved AI research have? That is is hard to say right now, given that if lawyers were not using a tool such as CARA they’d be using a more standard keyword system from a more traditional supplier of legal databases. My guess is that such systems are both saving time and adding new insights that might have been lost or not even attempted using more simplistic research tools. They may also be providing firms with an edge in litigation as being better prepared and/or coming to court with perhaps some additional insight into a matter that would have been hard to unearth using just keyword search, may be the key to winning the case.

But, what do the clients think?

Well, here’s what Blank Rome, Chief Information Officer, Andrea Markstrom, thinks: ‘We are excited about this partnership with Casetext and the value it adds to our clients. With our intense focus on innovation and providing our litigators with first-rate technology, we expect CARA to give us a strong competitive advantage, ultimately resulting in superior outcomes for our clients.’

There you have it. From the perspective of this Big Law firm the view is that it provides ‘a competitive advantage’ in addition to any efficiency and productivity gains. And this is another facet of using AI tools, they do indeed give a competitive advantage – or at least until everyone has them. But, perhaps even then the firms that have developed internal experts who are able to leverage the most out of such tools will become a differentiator? We will see. Early days yet.

And to conclude, here is Casetext Founder and CEO, Jake Heller, a former litigation associate at Ropes & Gray and former clerk for the US Court of Appeals, and so knows a bit about what it’s like to do legal research the old way.

‘We are proud to partner with Blank Rome who values delivering top tier client services through cutting edge technology and innovation. Our CARA AI technology will provide their attorneys the technology resources they need to deliver more efficient and effective legal research,’ he added, coming back to the efficiency/economic aspect.

Perhaps the bigger question now is: how long before every major legal market goes down this road? The UK is starting to see some activity of the same type, but perhaps not yet the flurry of activity we’ve seen in the US. We’ve also seen legal prediction systems in France emerging, but perhaps not yet with the same market-wide buy-in. But, these are early days. Much could change very quickly.