A report commissioned by Thomson Reuters on ‘Governance, Risk and Compliance (GRC)’ in large financial institutions found that risk officers are becoming increasingly focused both on AI tech and the impending (…?) roll out of blockchain tech into the mainstream commercial world.

This included a survey conducted by Celent and published in the report ‘Achieving Integrated GRC in an Interconnected Digital Age’, which gathered feedback from 30 Tier 1 financial groups around the world.

The main conclusion is this: ‘[At] a fundamental level, the report indicates that risk operations are having difficulty developing agile capabilities and continue to be hampered by inflexible technology.‘

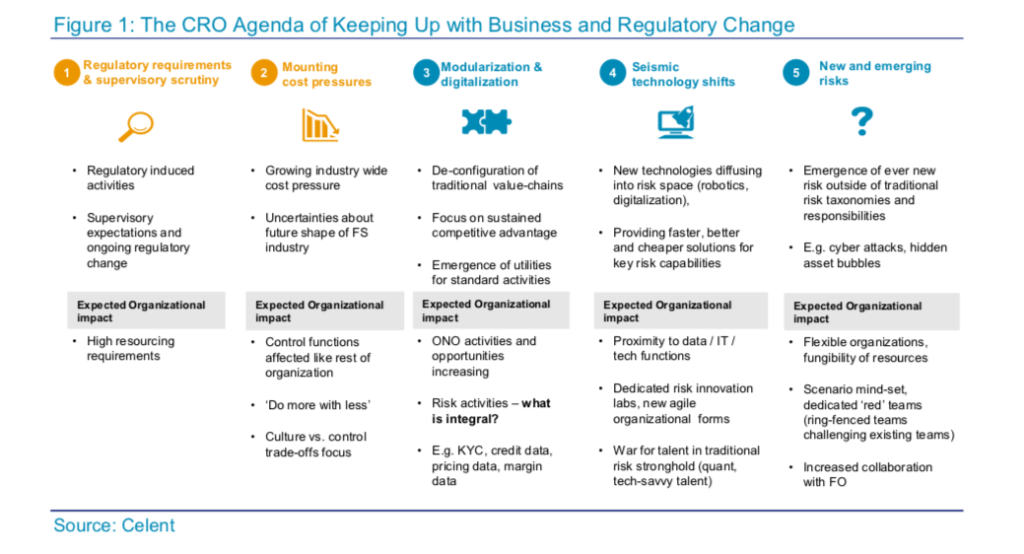

They are also, to put it prosaically, a little bit freaked out by the level of potential change this new wave of technology may have on GRC issues. Or as Cubillas Ding, Research Director at Celent, puts it: ‘As regulatory scrutiny and cost pressures intensify, risk and compliance professionals will need to adapt quickly to advanced technology that could adversely impact their overall business models.’

‘A next-generation risk infrastructure should therefore be modular and agile, where data and information are congruent across different risk activities with strong reporting capabilities,’ Ding concluded.

You can download the full report here.

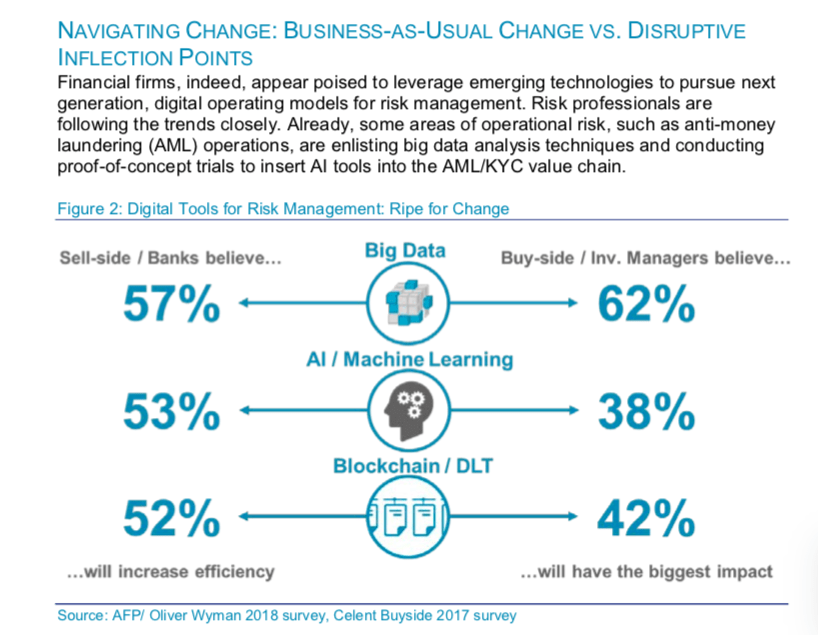

But, if you’d like the TL/DR version, check out the great graphics courtesy of Thomson Reuters and Celent, which cover the changing landscape GRC professionals face and also how they feel about AI and blockchain tech and its impact.

And, also:

But, what does all of this mean? In short it suggests that risk and compliance staff in the financial sector see a world where they are much ‘closer’ to all the data zooming through their businesses, but also that the thought of the new ways this data will be stored, moved and crunched by automated systems, is already giving them sleepless nights.

Early days, for sure, given the impact levels of this new tech among banks is limited so far. But, perhaps this is a picture of what is to come. Thanks Thomson Reuters and Celent for this research.

1 Trackback / Pingback

Comments are closed.