The US Securities and Exchange Commission (SEC) has hit out against an Ethereum-based blockchain company that was making use of transactional smart contracts, in a move that could unsettle some users of the technology, but perhaps also help to create some ground rules in the longer term.

A new statement on ‘Digital Asset Securities Issuance and Trading’ by the SEC’s Divisions of Corporation Finance, Investment Management, and Trading & Markets, said that a company, called EtherDelta, was now in regulatory hot water because of the way it used smart contracts.

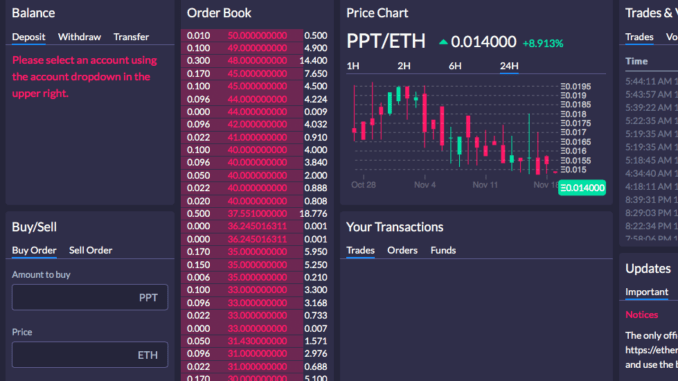

The SEC alleges that: ‘EtherDelta’s smart contract was coded to, among other things, validate order messages, confirm the terms and conditions of orders, execute paired orders, and direct the distributed ledger to be updated to reflect a trade.’

The primary reason why this upsets the SEC is because it looks to them to be a way of running a securities trading platform, and one that they believe is unregulated.

However, for lawyers who are perhaps not that interested in crypto trading, but do care about the use of smart contracts for more complex contract formation, there is now the first minor hint of some case law, at least around transactions.

The SEC goes on to explain in more detail what the problem is: ‘[There may be an issue if] an entity that provides an algorithm, run on a computer program or on a smart contract using blockchain technology, as a means to bring together or execute orders, could be providing a trading facility.’

‘As another example, an entity that sets execution priorities, standardises material terms for digital asset securities traded on the system, or requires orders to conform with predetermined protocols of a smart contract, could be setting rules.

‘Additionally, if one entity arranges for other entities, either directly or indirectly, to provide the various functions of a trading system that together meet the definition of an exchange, the entity arranging the collective efforts could be considered to have established an exchange,’ the SEC adds.

This suggests: you may not be setting out to create a securities exchange or trading platform, but if you create something indirectly that behaves like one by using a smart contract that brings different parties together, then you could be at risk of a regulatory breach.

Given that most blockchain-based transactions will involve a crypto-currency, and those currencies can be seen as securities, then it’s not impossible for a fairly innocent smart contract that involves bringing different parties together e.g. for the purposes of completing a financial transaction, such as a futures contract, could be seen as operating as an unauthorised trading system.

In short, if you have a smart contract and it helps parties to come together to transact via crypto currencies then lawyers will have to make sure they’ve got their regulatory compliance fully in synch with how the SEC sees things.

While, for those law firms that are building a new revenue stream from advising blockchain-based companies there is now some solid regulatory underpinnings to take note of when it comes to the use of smart contracts.

To conclude, the SEC also added a more positive message: ‘The [SEC] Divisions encourage and support innovation and the application of beneficial technologies in our securities markets. However, the Divisions recommend that those employing new technologies consult with legal counsel concerning the application of the federal securities laws and contact Commission staff, as necessary, for assistance. For further information, and to contact Commission staff for assistance, please visit the Commission’s new FinHub page.’

2 Trackbacks / Pingbacks

Comments are closed.