Last night Artificial Lawyer shared the news that legal AI company eBrevia is to be acquired by the giant US financial services business Donnelley Financial Solutions.

One month ago, in November, law company Elevate bought legal AI pioneer, LexPredict (see story). And earlier this year in August we saw Seal Software combine with Apogee Legal, the NLP specialists.

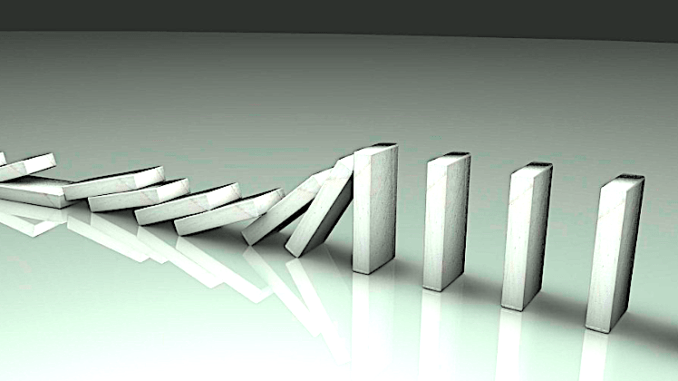

Now, that is not exactly a landslide of deals, but when one considers that of the many legal AI doc review companies that currently exist (see list of 25 in the AL 100 – plus there are others out there too) it’s not hard to see that few are very well known.

This is perhaps why the recent spate of deals is so significant: the relatively well known companies are merging. In Seal’s case this was the legal AI company buying a smaller legal AI specialist business.

Will we now see a wave of similar deals to eBrevia/Donnelley and Elevate/LexPredict? That seems very possible. But first, let’s catch up with Adam Nguyen, co-founder of eBrevia to learn some more about what went down.

Nguyen explains that the $19.5m cash payment for the company relates to the three founders and other investors. Even so, that’s still going to make the founders very happy. Plus there is a $4m work out payment in the agreement.

‘It’s a good pay out!’ says Nguyen.

Great stuff, but it’s clear that what the market is really focused on is this question: what’s next?

Nguyen paints a picture of very strong market demand out there.

‘We had multiple bids, including from a private equity firm and also other software companies. We also had an approach from an accounting firm – not Big Four – but major,‘ Nguyen explains.

He adds that they even had an approach just a few weeks ago, but the Donnelley deal was already in motion at that point.

Now, you may be asking: why is everyone going nuts about a company most of us didn’t really know well?

And that’s a fair point. Nguyen notes that 80% of their clients are not law firms. They, a bit more like Seal, have always had a focus on corporates. They are also very tight with the accountancy world and three of the Big Four are clients of their doc review technology.

Artificial Lawyer asks: were you on the market, or did the market come to you?

Nguyen replies that the market came to them. Then he explains what the Donnelley deal is really all about.

‘Basically, they own Venue, the virtual data room company. It’s one of the largest data rooms in the world. So it’s about making sense of the data room’s documents with AI,’ he explains.

So….the truth is that this deal is almost a repeat of the iManage and RAVN move in what now seems like the distant past.

But, why do that deal now? Nguyen suggests that it’s all down to President Trump…..yep.

‘US companies that benefited from the Trump tax cuts are flush with cash and there is now a lot of cash in the market with nowhere to go,’ he says.

So, while it has been impressive that eBrevia partnered with Thomson Reuters’ managed legal services arm to provide their clients with legal AI review tech, that is not why the deal went ahead. From Nguyen’s view it’s all about excess capital in the market searching for value….and where is that value? In legal AI, of course!

Legal AI is clearly a growth market. Companies with a handful of clients today could in five to ten years be global players. Corporates in the US and elsewhere are increasingly aware of the need to reduce costs in areas such as compliance. Many have tech solutions for storing and sharing data. What many lack is the means to review that data with technology.

Moreover, while ediscovery players have been in the market for some time, the ‘transactional’ type of legal AI company (which Artificial Lawyer often focuses on) is more of a recent arrival, at least in terms of market awareness, even if some companies have been around a while now.

In short: legal AI companies look attractive, have high growth potential, sit within a huge market of needs that spans legal, compliance/regulatory and more, and in some cases have very impressive client rosters.

Often these businesses are still small and for a financial services giant paying $20m to have all that lovely tech is probably seen as a rounding adjustment on a balance sheet, rather than a life or death purchase.

What next? Nguyen says that eBrevia will operate as a subsidiary. And what about him…? Ah…well…..who knows. For now he is sticking there. But, as he says: ‘In my heart I am an entrepreneur.’

Conclusion

Is this the beginning of a wave of legal AI M&A? It could be. But the number of real targets is small. Kira is not for sale, nor is it bite-size. Luminance has certain er….how can we say this……issues…..at present related to Mike Lynch and it likely is not at the optimum size the backers were looking at either.

RAVN has gone. eBrevia is gone. So too LexPredict. Ayfie has only just started to get known in the legal world. Eigen Technologies is nowhere near close to the point yet where it would likely entertain a deal – it just received a load of cash from Goldman Sachs this year…..to sell now would be weird. LawGeex…? Possible, but it has shown no public sign of wanting to do this.

One company AL could definitely see as a target for M&A would be LEVERTON, the originally Germany-based legal AI and prop tech company. They’ve been around a while and have now a new management team. There are rumours in the market regarding LEVERTON….but, then there are rumours about every legal AI company. AL once was told by someone in the market that Kira was about to be sold and they knew the buyer (this was earlier this year)….in reality Kira ended up taking $50m in investment and appears to be a very long way from selling to anyone. So….be careful of market rumours….

To wrap up: will there be more deals? Yes. AL believes there will be more deals in 2019. There is money out there and big buyers. There are several (relatively) small, high quality legal AI companies dotted around the world that may simply want to take the money after working very hard for several years.

This could signal a new beginning for the legal AI sector, with far larger players getting involved. That means more money spent on expansion, which means more clients using legal AI tools. And that is a welcome step! Moreover, if PE firms come in to buy legal AI companies they are doing so with only one goal: to grow them and then sell them…which means even more growth.

Moreover, some legal AI companies will just keep going. New ones will emerge and new steps in AI will keep the market very lively for sure (see the recent move by ThoughtRiver to build a ‘thinking AI’).

Overall, the legal AI sector has never been more in demand and more full of energy. A nice way to end the year. Congrats to eBrevia!

1 Trackback / Pingback

Comments are closed.