Apex Litigation Finance (Apex) has today announced its entry into the litigation funding market via a partnership with legal AI pioneer CourtQuant.

The AI analysis provided by CourtQuant will act as a risk assessment tool for probable litigation outcomes. Apex can then better decide what it wants to do and where it wants to invest its funds.

The company said it will work with leading law firms, insolvency practitioners and corporates, using the AI platform to make ‘cost effective funding decisions on small to medium sized matters where litigants may not have the means to pursue meritorious claims’.

Commenting on the launch, Maurice Power, Apex CEO said: ‘We are excited to launch our new venture, in partnership with CourtQuant, addressing the needs of lawyers, liquidators, individuals and corporates, seeking the funds to pursue a claim that may otherwise be cost prohibitive. Our use of CourtQuant’s AI driven analysis platform is market leading in the sector and will inform our decision making and provide comfort for investors.’

Ludwig Bull, chief technology officer at CourtQuant added: ‘We are delighted that our partnership with Apex will be augmentative and that our platform will be fully integrated into the company’s operations and case workflow. By working directly with the team at Apex, we hope to learn more about funders’ business needs and further improve our product, while simultaneously contributing to Apex’s uniquely innovative funding solutions.’

Is this a big deal?

Yes. It’s always seemed 100% obvious that litigation finance funds and AI teams should work together – as they are doing the same thing, looking for patterns in unstructured data.

So, it’s great to see this team, which readers will remember started back in 2016 in Cambridge, developing a bot to help with basic legal issues, now working with a litigation funder.

The focus for now is on medium-size disputes, but who knows where this can go.

However, it’s not the first to try this. US funder, Fulbrook, teamed up with Metonymy Labs – see AL story here – in 2017. But, according to sources it didn’t all go perfectly.

Perhaps one challenge that all litigation prediction systems have is the sheer complexity of a commercial dispute. Even legal AI experts who run prediction platforms in the US have told Artificial Lawyer they don’t feel confident stating how a whole case will end, rather they try to focus on elements of the case, such as motions passing, legal arguments that will be used, the way a judge sees things. I.e. they try to break a case down into parts and then predict on these narrow aspects, rather than all the moving parts at the same time.

But, CourtQuant has been working in this field now for a couple of years and no doubt have made progress in modelling outcomes. And, from a funder’s point of view, anything – as long as it’s reliable – that gives an edge is very helpful.

What will it do?

This is what CourtQuant (CQ) says:

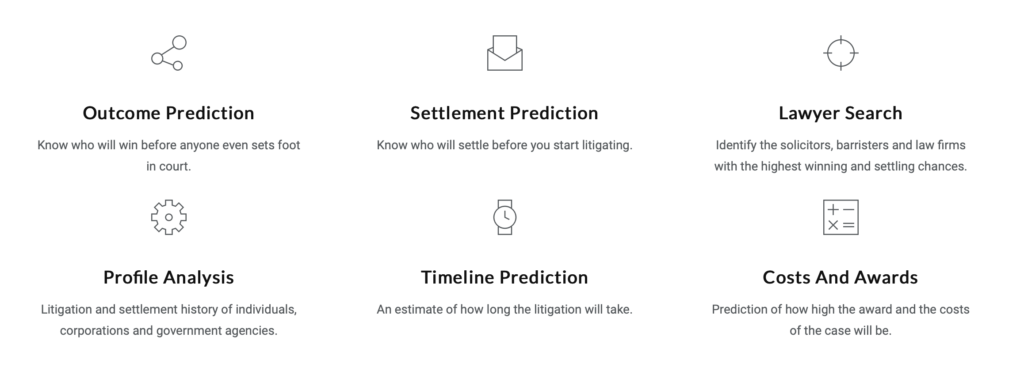

CQ makes the risk, the value and the timing of litigation transparent. CQ’s vision is to transform litigation into a clearly-defined asset and to thereby increase clients’ bottom line. This, in turn, increases access to justice. To do so, CQ leverages artificial intelligence to analyse millions of cases and predict settlements, outcomes, timelines, awards and costs of real cases. CQ also provides users with the win rate, risk appetite, timelines, awards and costs of individual solicitors, law firms, barristers, barrister’s chambers, parties and judges.

CQ licenses its analysis platform to litigation funders, insurance companies and law firms. CQ’s clients include some of the world’s largest insurance companies as well as Lloyds of London members and European governments. In the past, CQ has also worked with some of Europe’s largest publishing firms to structure and analyse their internal legal data. CQ offers a no-installation-necessary browser version of its platform, and also maintains local installations as well as an API for direct integrations.

And here are some highlights in graphic form:

Of course, the proof will be in the pudding. Does the AI system actually help return better outcomes for those with money in the fund? Time will tell. But, one would guess that Apex has done sufficient testing to feel confident.

This could also help drive more funds to do the same. Exciting times.

2 Trackbacks / Pingbacks

Comments are closed.