LexisNexis Legal & Professional is building out a machine learning doc review and analysis capability via a joint venture with Knowable, which was spun off from Axiom Global in February 2019.

The move marks an interesting turn for LexisNexis, which has not acquired a legal AI doc review system of its own. Now, it’s moving into the space via a JV.

Mark Harris and Alec Guettel, Axiom’s co-founders, are leading Knowable as CEO and CFO respectively. Knowable will operate independently, but will benefit from access to LexisNexis’ resources and infrastructure, the company said.

Knowable says of itself: ‘Knowable gives corporate clients revolutionary visibility into the contracts that govern their businesses. By combining proprietary machine learning with purpose-built tooling and scalable facilities for human QC, Knowable enables a full contracts intelligence solution for the enterprise.’

At present, Knowable is working with Dell, GE, and Nestlé USA, among others, to provide machine learning-enabled contract data analytics and related contract intelligence solutions, said LexisNexis.

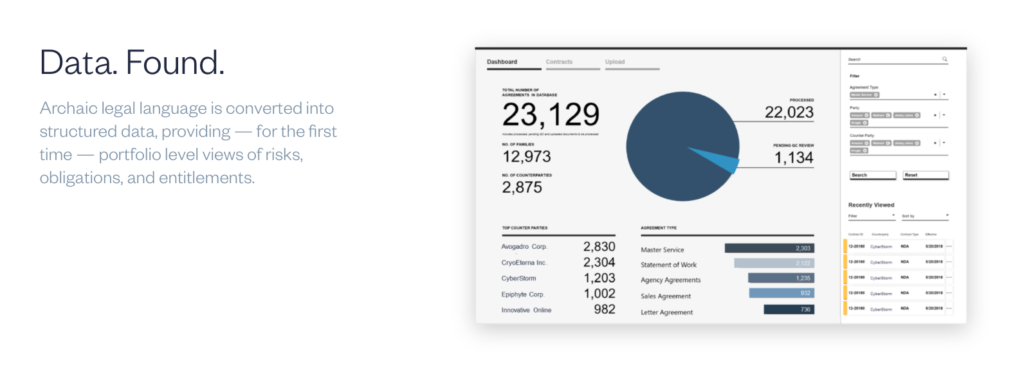

The short version is that Knowable appears to help extract key data points and file information from large contract stacks.

They explain it like this: ‘By converting legal language into structured data, Knowable helps its clients understand what’s in their contracts, providing a global view of risks, obligations, and entitlements.’

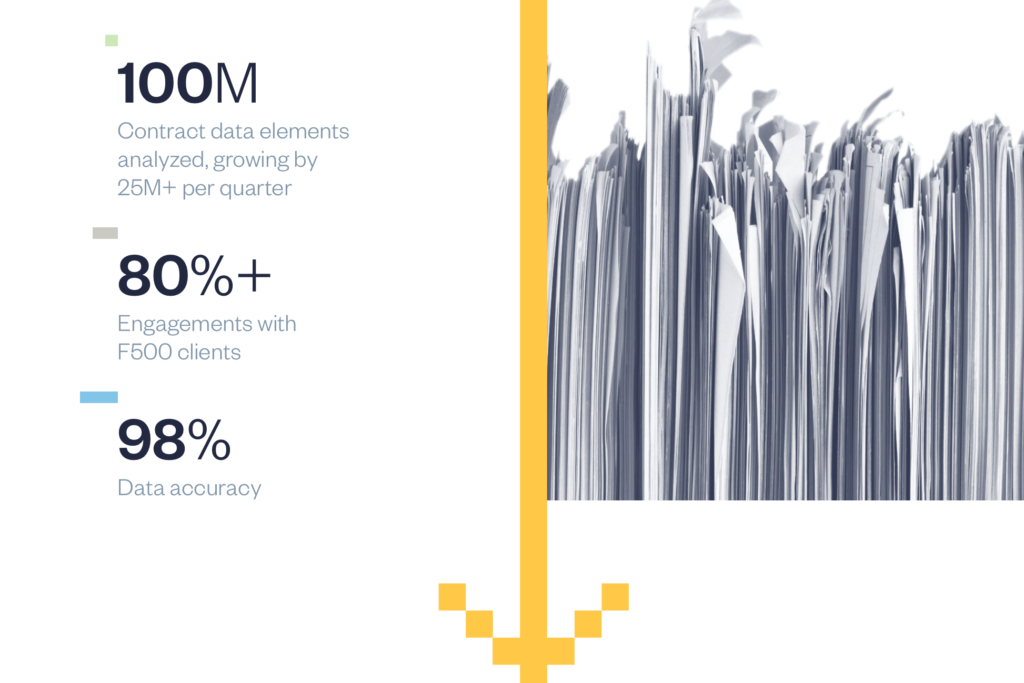

They add that they are currently analysing 25 million data points each quarter – which suggests the client base is giving them a huge doc volume.

Commenting on the JV, LexisNexis Legal & Professional CEO, Mike Walsh, said: ‘Data and analytics are integral to the future of the practice of law and Knowable is widely recognised as a leader in the contract analytics space.’

‘We are delighted to enter into a joint venture with Knowable to bring new decision-insights to lawyersand to work with Mark Harris and Alec Guettel, who have been at the forefront of innovation in the legal market. Bringing this expertise together with our own strengths in AI, machine learning and natural language processing, as well as our vast content sets, will enable us to deliver new and unmatched innovations that will transform the way our customers work,’ he concluded.

Mark Harris, CEO, Knowable, added: ‘I think this match is close to perfect. In LexisNexis we’ve found a partner who believes what we believe about the future of this space and the way in which it will be reshaped by structured data.’

Is this a big deal? Yes and it’s a curious one. But, also one to be welcomed.

Plenty of intriguing questions on this one.

More tomorrow on what this all means and more info from those involved.

But, here’s a few thoughts while we’re here:

- They’ve moved into doc analysis just when Thomson Reuters has sold off its MLS group to EY, which used legal AI tech for contract review work.

- They’ve chosen not to buy a well-known legal AI company, and instead gone down the JV route.

- The move follows the decision by Axiom to list on the stock market, which triggered the spinning off of Knowable and also the Axiom Managed Solutions arm.

- How much of the client work the company mentions is work that came over from Axiom is not clear. But, likely some of it is.

- Why did Knowable do this? One answer is they want the marketing boost that LexisNexis will provide. Lexis also has tonnes and tonnes of legal data that can be used to improve the ML of the contract analysis system. And, in these times of platformisation it perhaps makes sense to offer clients a unified front with other applications available across the JV.

- The timing is also interesting – some hours after the Thomson Reuters/HighQ deal. That could be coincidence – but given that TR and LN are fierce rivals, it probably was not just chance.

4 Trackbacks / Pingbacks

Comments are closed.