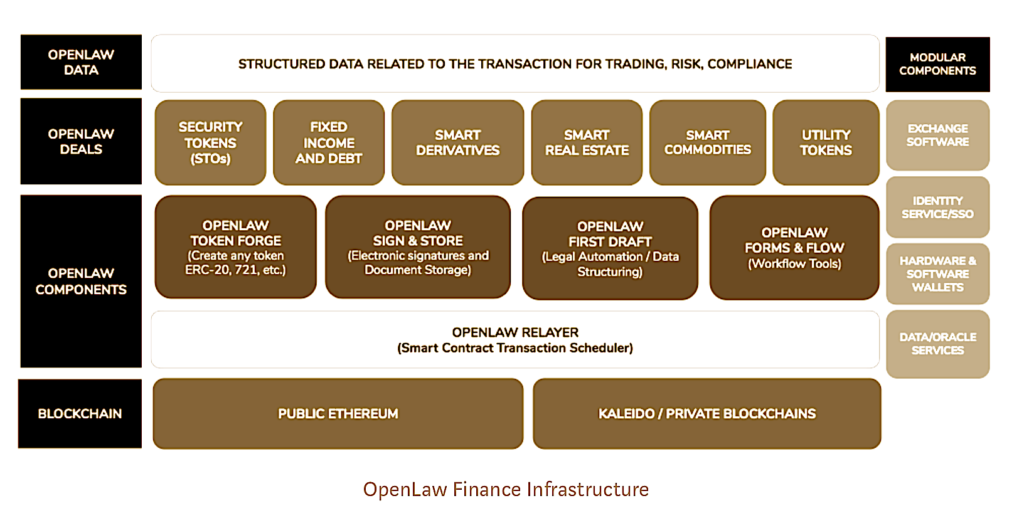

Smart contract pioneer, OpenLaw, has launched what could be seen as a type of ‘DIY investment bank’ that can help you to launch your own legally compliant tokenised financial products operating via the Ethereum blockchain and the tech company’s digital contracts.

With OpenLaw Finance you can create ‘legally compliant tokenised securities, fixed income products, tokenised real estate, and smart derivatives’ using OpenLaw smart contract forms that complete template documents.

The New York-based company sees this as a major step forward in decentralising the world of finance. Although the market has been able to buy crypto currencies for several years, more complex financial products have generally been out of reach, unless you went to an investment bank willing to create a special product for you.

With OpenLaw Finance you can make a wide range of financial products, although naturally these are functioning via the blockchain and cryptocurrencies/tokens, although they could be linked to/denominated in fiat currencies as well.

(It’s really recommended that you check out the very informative video below, which sets out what you can do and how to do it.)

In a statement co-founder, Aaron Wright, and team, said: ‘We’re bringing these early efforts together into one comprehensive offering, enabling anyone using OpenLaw Finance to create and issue security tokens and tokenize commodities like carbon credits.’

‘Our new vertical is a leap beyond what exists in the market today — with existing blockchain-based financial platforms primarily focused on a narrow swath of the financial services industry (like real estate or security tokens), even though the act of creating and sending a token is about as exciting as sending an email in mid-1990s. Our initial offerings have some sample transactions, but OpenLaw Finance is infinitely extendable. Adding a new transaction or deal to OpenLaw finance is a snap. We provide generic tools to expand the types of deals involving digital assets,’ the team added.

Is this a big deal? For OpenLaw it is and for those seeking to develop more sophisticated uses of blockchain tech and crypto currencies and/or tokens. As noted above, while the world of crypto assets has tended to focus on relatively day to day financial matters, such as currency trades, or simple transactions, OpenLaw Finance allows a way into building quite complex financial products with a legally compliant smart contact backing that operates via a blockchain.

You might well ask: so what? What is the benefit here? One answer is simply cost. Try getting an investment bank to build and then issue a financial derivative for you, and see how much that costs.

One key aspect here is that it allows businesses of all sizes (including law firms if they ever wanted to….) to create financial instruments and trade them in an open market. Normally, only the ‘big boys’ of the corporate world get involved in such kinds of business. OpenLaw helps to democratise the sector.

Of course, much depends on whether people use it. But, perhaps this is a case of ‘build it and they will come’. There is certainly a lot of interest still in the financial community for crypto assets. The mass consumer-driven surges in crypto coins come and go, but the idea of value (whether in a simple currency, or complex tokenised product) being represented in a digital entity, is not going away any time soon.

4 Trackbacks / Pingbacks

Comments are closed.