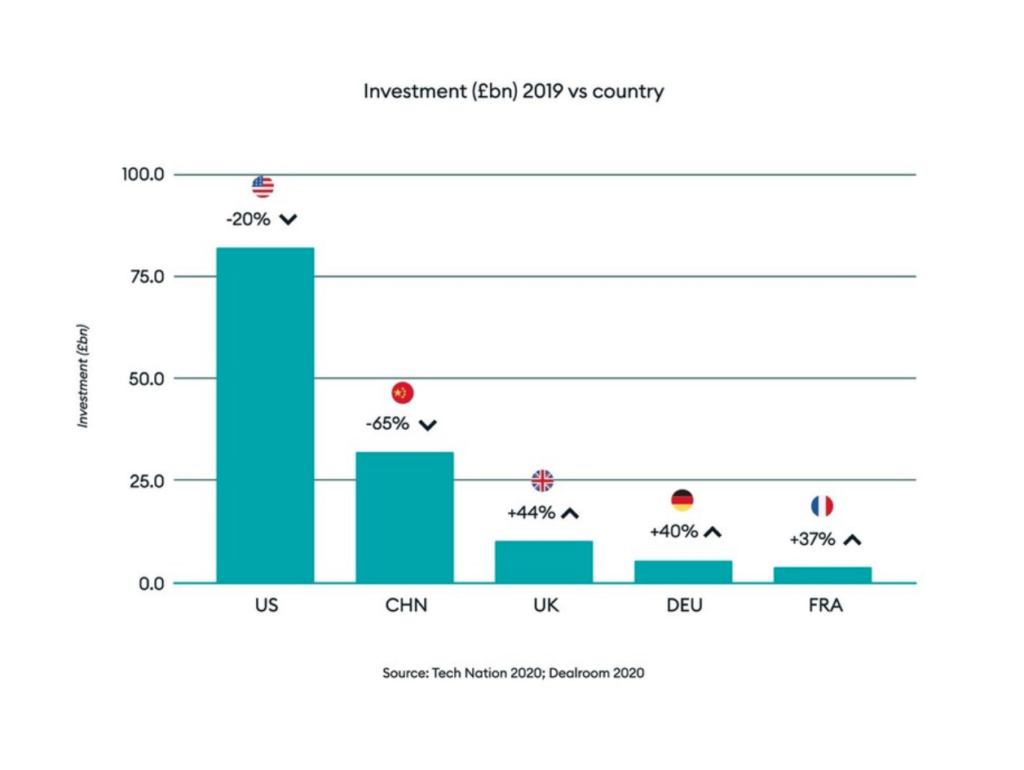

A new Tech Nation Report has found that the US continues to lead the world in tech Venture Capital (VC) investment for another year. But that in 2019 UK tech companies saw £10.1bn in investment – up 44% from 2018, while VC investment dropped by 20% in the US from 2018, and in China – the second-placed nation, VC investment dropped by 65% in 2019.

The increase in VC investment into UK tech companies (including legal tech) came despite 2019’s then ongoing Brexit debacle. Of course, how things will look across 2020 in the UK and globally because of the Covid-19 pandemic remains to be seen. We’ll only know in early 2021, when the real impact has been measured across the sector.

Cities for Tech Investment

10 global cities alone raised 44% of the total emerging tech funding from 2015 to 2019 – 70% of those cities were in the US: San Francisco, New York, Santa Clara, Mountain View, Pittsburgh, San Jose.

Although, San Francisco, Santa Clara, Mountain View and San Jose all connect to or overlap with the same West Coast tech-focused/Silicon Valley region.

Beijing leads in Asia, and London leads Europe. London received almost a quarter of the total emerging tech investment made in Europe, with most of this investment being channeled into AI development.

Eigen Joins Tech Nation’s Future Fifty 8.0 programme

Tech Nation has also announced the 28 companies joining its Future Fifty 8.0 programme. The Future Fifty is Europe’s longest serving programme for late-stage tech businesses and has a focus on networking and mentoring. Eigen Technologies with its focus on AI-driven doc analysis in the legal and financial sectors is one of the companies to join.

The news comes days after Eigen announced it had received $5m from ING.

Gerard Grech, Chief Executive, Tech Nation, said: ‘The US continues to lead the world when it comes to VC investment into US tech companies. I am pleased to see the UK performing well, raising considerable amounts of tech investment in 2019, up 44% on 2018, and the sector continuing to transform the UK economy – with 2.9m people now employed in technology in the UK.‘

‘Furthermore, I’m pleased to announce the 28 new companies joining our Future Fifty 8.0 programme, the longest serving and most successful late-stage programme for tech companies. We hope to see these companies become household names in the US market, shining a light for some of the UK’s key technology strengths, including Fintech and Healthtech.’

Dr Lewis Liu, Co-founder & CEO, Eigen Technologies, concluded: ‘There is real momentum right now in the European tech sector. From a global perspective I believe European tech as a whole has come of age in the last couple of quarters. We’ve seen the likes of Lakestar, Atomico, Balderton, and Northzone raise big funds, showing greater ambition than ever before. European tech, with London leading the way, is now starting to compete with the likes of Silicon Valley and Shenzhen.’

—

P.S. Most people clearly know this already, but if you don’t, it’s worth underlining that Venture Capital (VC) is distinctly different to other forms of capital raising. VC investment is all about backing relatively young companies and taking high risks, with a focus on rapid growth and scaling up. The funds that invest in such escapades are often quite distinct from funds with other investment strategies that are better suited to already mature companies. Often these funds break into their own niches focused on different stages of growth, from Seed, to Series A, B, C and so on.

Moreover, not all new companies, such as new ABS law firms in the UK, for example, would take VC investment just because they are young – nor would VC investors want to offer funds. They may self-finance, take bank loans, and/or assemble a group of long-term angel investors who are not looking for the rapid growth and expansion of scale we see often demanded by VC funds for tech companies. Law firms that list on the stock market, as we have seen in the UK, while perhaps taking a risky strategy, would clearly not be classed as involved in a VC-type capital raising either.