ComplyAdvantage, a legal & compliance tech company focused on anti-money laundering (AML) solutions, has bagged $50m in a Series C funding round, bringing its total funding to $88m. This again shows that investor money is there for scalable software products in, and connected to, the legal sector – as well as highlighting the demand for compliance solutions.

The company said it will spend the new cash on ‘rapid product and market expansion’ across the US, Europe, and the Asia-Pacific region. It already has bases in New York, London, Singapore and Cluj-Napoca in Romania.

The Series C round was led by the Ontario Teachers’ Pension Plan Board, one of the world’s largest pension plans on the planet. Existing ComplyAdvantage investors, Index Ventures and Balderton Capital, also participated in the round.

The company has a proprietary database derived from millions of data points that provide dynamic, real-time insights across sanctions, watchlists, politically exposed persons, and negative news.

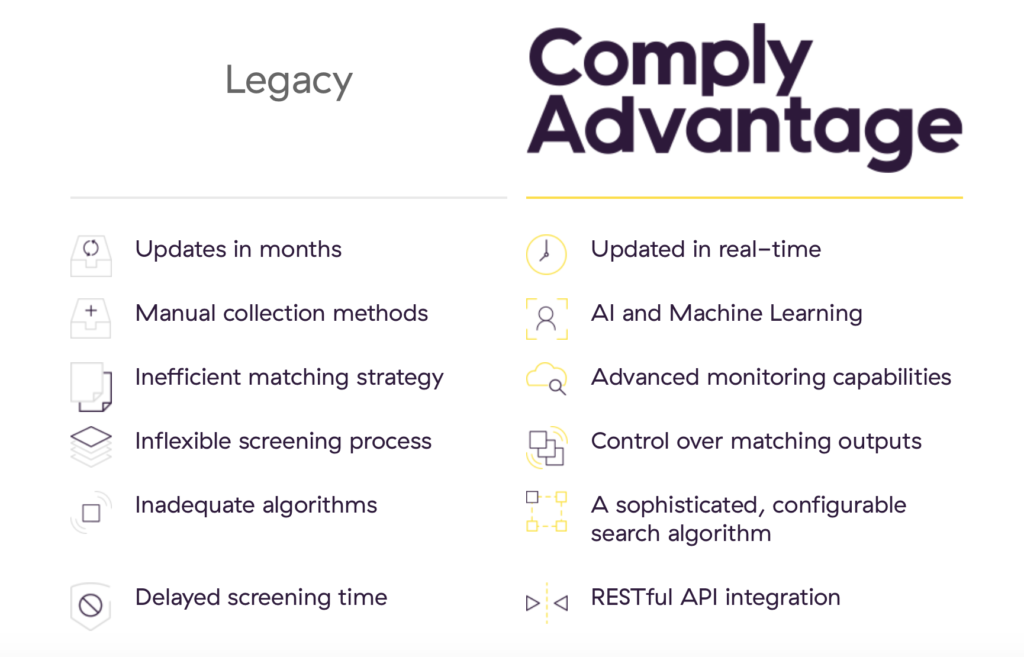

This reduces dependence on manual review processes and legacy databases by up to 80%, and improves how companies screen and monitor clients and transactions.

Jan Hammer, Partner at Index Ventures – one of the investors – said: ‘Detecting financial crime in billions of transactions that take place around the globe has become nearly impossible without the application of data science and machine learning.

‘It is this approach that has made ComplyAdvantage into a leader in the category, and the go-to partner for organisations who seek to automate what are still very often manual or inadequate processes.’

Meanwhile, Charles Delingpole, CEO of ComplyAdvantage, pointed out that: ‘Organisations across the world continue to fail to detect and eliminate financial crime.’

He noted that recent examples show just how large a problem it is:

- ‘The recent and ongoing Wirecard scandal which has seen $2 billion vanish from a company’s accounts.

- Carlos Ghosn, former Nissan chairman and an international PEP, made a daring escape from house arrest in Japan. Ghosn achieved this using a previously unknown cache of wealth to finance his escape.

- The conclusion of an EY whistleblower’s story when they uncovered a huge money laundering operation in Dubai. Gold was being smuggled through the Middle Eastern city, which has become a global hub for gold trading.

- The 1MDB scandal continues to unfold in 2020. Billions of dollars were illegally disbursed from the fund to multiple criminal actors including many [important people] who have since gone on trial.

If only 1% to 3% of financial crime is ever caught [as is the case at the moment], consider the examples above and then imagine the undetected and undeterred. At its best, this industry faces a 97% failure rate. There is work to be done.’