Legal governance, risk & compliance (GRC) company Exterro has bought AccessData for a reported ‘nine-figure sum’, i.e. $100 million-plus. The digital forensics investigation company will now become part of Exterro in what is yet another consolidation move in the legal tech sector. Meanwhile, yesterday, Artificial Lawyer shared the news that Nuix – also part of the eDiscovery landscape – is set to publicly list in Australia with a valuation of $1.3 billion, a move that could well end up funding the company’s own particular acquisition plans.

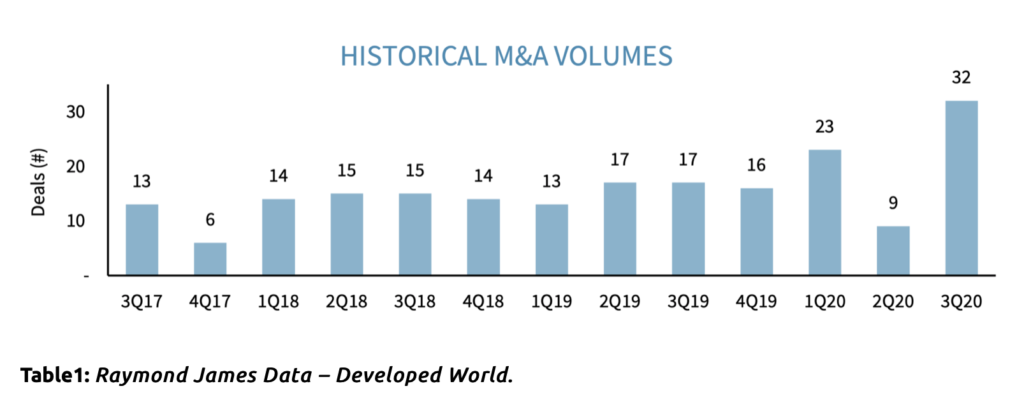

The new M&A deal is more proof, if any were still needed, that the consolidation trend is not letting up. As seen in a story by this site, M&A volumes have seen notable highs in 2020, especially last quarter. We’ll have to wait until year end to know how Q4 has gone, but the Exterro/AccessData combo will certainly be one of the key deals of this quarter.

As to the logic behind the Exterro deal, it is explained like this: ‘By combining forces with AccessData, Exterro can now provide …. the only solution available to address all Legal GRC and digital investigation needs in one integrated platform.’ Or, at least that is the stated goal.

Bobby Balachandran, (pictured above), CEO of Exterro, said: ‘Converging market forces in DFIR, eDiscovery, privacy and information governance are the driving factors behind this acquisition.

‘With the acquisition of AccessData, Exterro combines [multiple] capabilities in a single, integrated platform.’

The company also highlighted that the combination of AccessData’s forensic tools and Exterro’s Incident and Breach Management solution will help organisations ‘conduct faster, more targeted HR and compliance investigations in a single solution’.

You get the idea: multiple capabilities, coming together to serve similar clients, using a single platform. You get economies of scale, cost synergy savings, and increase customer connections via multiple service lines.

Looks like the platformers are winning the argument at the moment. That said, these things often go in alternating waves and the trend back toward point solutions may well happen soon enough.

P.S. For all the deal geeks out there, it’s worth noting that in 2018, Exterro received a reported $100 million in what was a major investment from private equity fund, Leeds Equity Partners. At the time, Exterro had about 250 staff, so, if one were to gauge company size vs funding scale, then that investment must have been for a very significant stake in the company. Back then it was called ‘a strategic investment’. Leeds Equity Partners also has investments in Barbri, the legal education company, and Simplify Compliance. Generally they specialise in knowledge industries and also have several investments in the wider education sector.