Bryce Catalyst, a VC fund co-run by Erik Baklid, the former CEO of legal AI company, Ayfie, has invested $1.75m in dealcloser, a transaction management system. Baklid told this site that it was the fund’s first deal, which is all the more significant as the US-based fund has been created primarily to invest in legal tech, regtech and cyber security.

The move follows the recent news that Jack Newton, the well-known CEO of Clio, is to become a member of dealcloser’s board. However this appointment was independent of the investment.

Dealcloser launched back in 2017, and as with what are now a growing number of transaction management systems, seeks to reduce friction and manual work in what we could call the ‘legal bureaucracy’ of closing a deal.

As to why Bryce is investing now, which is co-run by Cary Burch, Baklid told Artificial Lawyer: ‘There has also been a significant acceleration in tech adoption within these three market segments as a result of COVID. As with any uncertain times, the flow of money tends to dry up, however, we chose to take a contrarian approach and pursue various investment opportunities.’

Amir Reshef, CEO of dealcloser, added: ‘The team at Bryce Catalyst understands our vision and we’re so excited for what the upcoming year has in store. Cary and Erik have significant expertise in building and scaling software companies and dealcloser will benefit greatly from that expertise. Bryce Catalyst was created by operators for operators and I know that with their involvement, dealcloser will do great things.’

Meanwhile Ayfie is closing down its US operations – but keeping its bases in the UK and Europe. Baklid left back in April 2020, before these changes to the American side of the business.

As to why he and Burch decided to launch an investment fund, Baklid told this site: ‘We decided to create an investment fund as we saw an opportunity within our target markets – Legal Tech, Reg Tech, and Cyber Security. Our prior experiences and extensive networks within the target markets presents a unique value add to portfolio companies. Paired with market consolidation, particularly within Legal Tech, we realised that there are deals to be had.’

Burch and Baklid are also joining dealcloser’s board of directors.

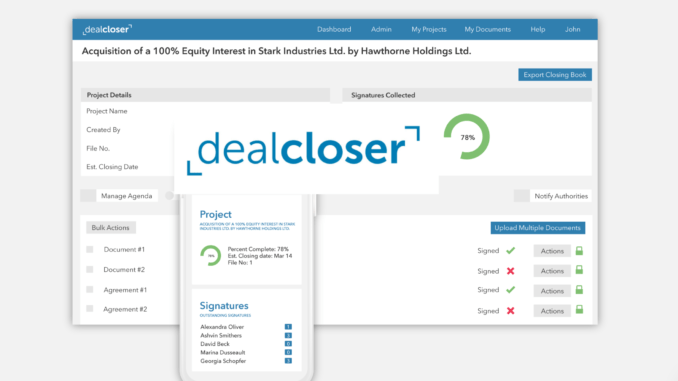

And, if you’re wondering what dealcloser does, here is some more detail. As the company explains:

- ‘Organise your deal with a project agenda. Build your deal’s closing agenda in dealcloser instead of using a static Word document. Upload documents to dealcloser and watch your clients sign in real time.

- Store your documents securely.

- Manage signatures. Use dealcloser to get all your documents signed easily and quickly. dealcloser can also generate signature pages for you.

- Instant closing book feature. Once all the documents have been signed, instantly export a closing book. You then have a fully interactive PDF closing book to download and distribute.’