By Richa Kaul, Chief Strategy Officer, ContractPodAi

In all matters of law, every single detail of every legal document counts. But the sheer volume, velocity and complexity of information make it challenging to keep track of — let alone manage — the details that matter most.

Legal technology is here to help lawyers manage those contract details in an automated and robust way — and with the legal and compliance rigor that legal teams require. This leaves lawyers more time to focus on their more strategic work. Over the next few years, legal technology budgets will grow three times as digital transformation and technology adoption increase at an accelerating pace, according to Gartner. In fact, more than 50 percent of all legal work today will be supported by one form of automation or another.

Contract lifecycle management (CLM), in particular, is a growing pillar of the legal tech market. CLM systems let in-house corporate legal departments streamline the contracting process. They help alleviate manual workloads and improve turnaround times, in addition to reducing overall business risk via higher compliance and automated risk review.

At its outset, a CLM search can feel overwhelming for corporate counsel. After all, legal tech is a relatively nascent industry, with a flurry of new vendors. And most legal teams have yet to take the lead on the evaluation of software for their organizations.

So, when it is time to assess the different solutions in the market, it is useful to have a framework to review CLM vendors holistically. The framework below uses five distinct dimensions to support a complete review. Product functionality, of course, should be top of mind. But perhaps just as important is the implementation support vendors provide — not only regarding their software deployment, but also their legacy contract migration, legal AI engineering, and enterprise software integration. Given the nascency of the CLM space, other dimensions should include vendors’ value delivery and customer retention, as well as funding level and business history.

1. Product Functionality

Clearly, the power of a CLM product is of utmost importance. So, when conducting any CLM search it is worth considering the breadth and depth of product functionality available. This is true even beyond your immediate use case. You may be interested in contract review today, but the product you choose should provide you opportunities for incremental digital transformation and increasing value generation through a wider set of features.

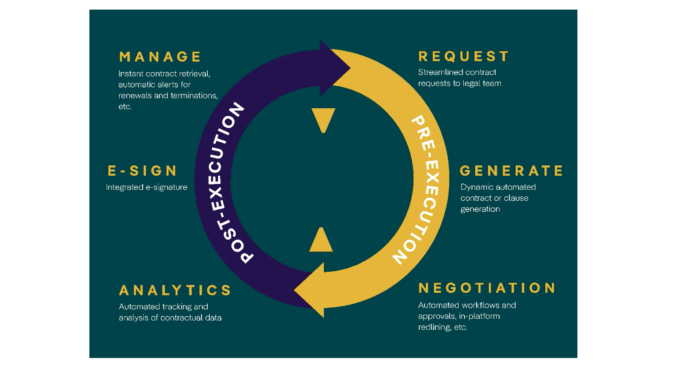

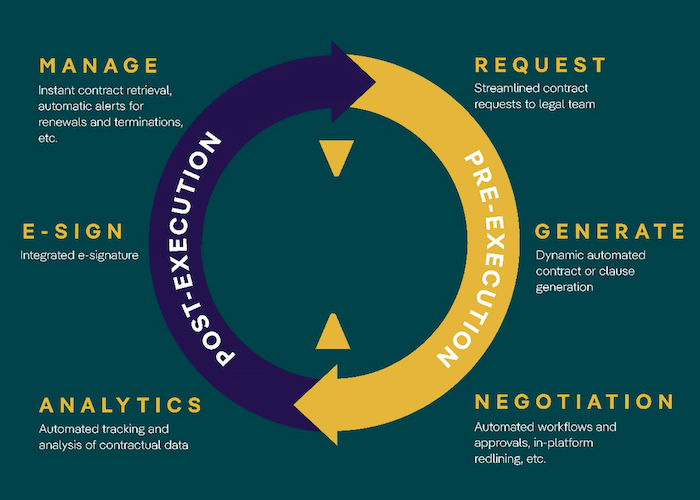

You can use the graphic below to frame the full functionality of CLM offerings in the market. Then, overlay a way to assess the depth and value of functionality between vendors — based on use cases (e.g. legal, procurement, and sales, etc.), and the operational, analytical, and strategic needs of your business. (Read the previous article, How Legal Teams Should Think About the Contract Management System Market.)

The competitive landscape, on the whole, is made up of providers that offer either point solutions (one specific part of CLM functionality), partial solutions (a few parts of CLM functionality), and full end-to-end solutions (all parts of CLM functionality pre- and post-execution):

2. Implementation Support

Quite often, implementation support is one of the biggest concerns customers have during their CLM searches — and rightly so. Maximum customer value is based on the successful implementation of the solution, which is not only dependent on software deployment and user training, but also on other key factors:

- Legal AI engineering — The training of artificial intelligence capabilities, to configure them to your use case (in addition to out-of-the-box AI)

- Contract migration — The uploading of legacy contract records into the CLM solution, to achieve the most value from analytics and reporting, etc.

- Enterprise integrations — The linkages between your CLM and other enterprise applications, to allow legal and contract data to ‘speak to’ other databases, and to maximize CLM solutions, in terms of user impact, efficiency, and quality of insights.

3. Value Delivery

When considering actual value delivery, pricing should be paired closely with return on investment (ROI), along with a CLM provider’s tactical plan to help you achieve that return — and their overall commitment to your success.

Too many CLM customers abandon their chosen CLM solution because they experience a failed implementation. Or, shortly after the implement of the solution, they discover they need more functionality beyond their initially chosen CLM vendor’s capabilities. Avoid this scenario by keeping in mind:

- Differentiated value of CLM solutions: There is a significant increase in ROI when levelling up from an operational to an analytical value solution, and then another step change when moving to a strategic CLM partner. Accordingly, pressure test the ROI models provided by your considered vendors.

- CLM vendors’ commitment to value delivery: Failed CLM implementations are common and often come at a high, one-time cost. A CLM vendor may use a templatized implementation model for every client. And this inevitably results in sub-optimal value generation, as functionality and adoption are low in this case. To prevent this, compare the different implementation support models provided by many vendors. Also, read reviews from current clients or request references. There is a higher likelihood of value delivery if the vendor has ‘skin in game.’ That means they are able to make financial or other commitments on the basis of implementation success or — better yet — the achievement of your business outcomes through the CLM implementation.

- Scalability of CLM solutions: The first step in a legal digital transformation is always the most difficult. Sometimes, customers choose a vendor with this first stage of transformation in mind but do not consider further transformations. As such, it is worthwhile to consider solutions with functionality beyond what you need in the immediate term. That way, you will have room to grow with a particular vendor and will not need to shop for another CLM solution for at least the next few years.

4. Customer Retention

In today’s market environment, customer retention averages 60 percent and falls as low as 40 percent for even well-recognized players. Failed implementations are a common source of customer churn in the CLM market. The lack of functionality — for continuous contracting process improvement — is a close second. So, when it comes to determining risk, customer retention should be considered very carefully, as well.

Of course, it can be challenging to obtain reliable data from CLM vendors. Most providers will cite retention rates of 90 percent or higher. And references and reviews, though extremely helpful, may not be representative of the typical user and their experience.

However, there are proxies for customer retention. The customer lifecycle time of vendors’ clients provides a sense of the vendor’s consistency of customer support. You can request this on reference calls or ask the vendor for this information directly. Models of customer support — think designated versus shared resources, and cadence of interaction — give you a strong indicator, too.

5. Funding Level and Business History

As stated above, the contract management systems industry is still nascent, and there is a significant number of new entrants. That means funding level and business history should be other key considerations when reviewing CLM vendors.

Based on your own risk tolerance, assess newer vendors by asking the following questions concerning long-term business viability.

- How much funding does the company have? (Many vendors are supported by outside funding, given the nascency of the space and the number of new entrants. A relatively new entrant should have at least $40 million in historical funding for the viability of the business.)

- How long has the company been in business? (Vendors that joined the CLM space firmly more than five years ago will be more stable, while those that are less than three years old bring the standard risks of new start-ups.)

- How many customers does the company have — and how many are a similar size to you? (A relatively mature vendor in the CLM market should have more than 100 clients — the majority of which should look similar to you.)

Time to Lead Using Contract Management Solutions

To in-house corporate legal departments, time is a precious commodity. Fortunately, a contract management tool, like a unified CLM platform, simplifies the complexities of everyday legal life. It gives you the freedom to focus on higher-value, strategic work. It affords you that time to lead — and overcome any challenges in your organization.

About the Author

Richa Kaul is the Chief Strategy Officer at ContractPodAi. Prior to joining ContractPodAi, Richa Kaul was a Managing Director at the Virginia Economic Development Partnership, leading the growth of the technology and professional services sectors across the state of Virginia. Previously, she was a management consultant at McKinsey & Company, supporting companies in their digitization best practices. Read her most recent white paper, ‘How to Choose a Contract Management Solution‘.

[ Artificial Lawyer is proud to bring you this sponsored thought leadership article by ContractPodAi. ]

1 Trackback / Pingback

Comments are closed.