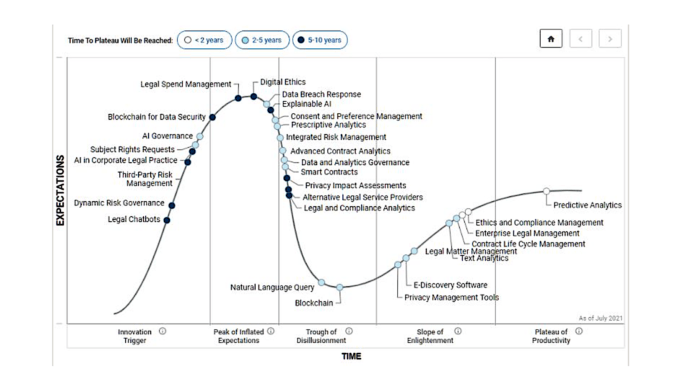

Gartner has published its annual hype cycle report for legal tech and compliance products for 2021. As with last year, this site has taken a look at the main graphic, which they have shared, and considers what it tells us.

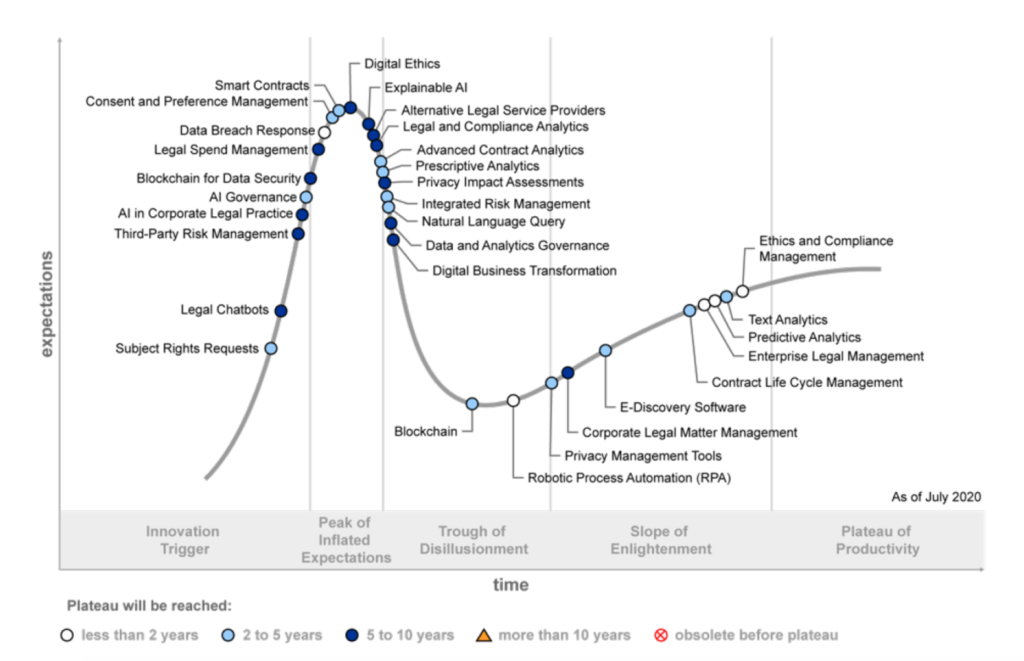

And below is the chart from 2020, which this site analysed last July – see here.

Some thoughts

First, the hype cycle has always been as interesting as it is sometimes frustrating, with product categories and uptake positions that don’t always tally with how the market seems to appear – at least from where this site is sitting. But, it certainly gets people thinking about legal tech’s development, so it’s a great help in this respect. Any road, here are some thoughts.

Legal Chatbots

They are still in the innovation trigger section, although chatbots, AKA logic gates that help you to fill in a document or access an expert system have been around for a long time now. One could argue that many no-code projects result in a ‘chatbot’ functionality, i.e. you get dialogue boxes that lead you through a process. Plenty of firms use this tech, e.g. Clifford Chance has a chatbot-type offering in Singapore to help startups create key legal documents. This site would put this in the plateau of productivity given how long this tech has been around.

NLP / AI

There are myriad references to different types of NLP and AI functions, e.g. contract analytics, text analytics, natural language query, and ‘AI in corporate legal practice’ to name a few.

It’s a bit tricky to separate these out. Several contract analysis platforms also allow natural language queries, for example Della and Eigen among others.

‘AI in corporate legal practice’ could refer to a bunch of things, but presumably refers to using NLP to analyse contracts for review and perhaps also the post-execution phase to extract key data. However, we also then have a category for CLM – where some of those companies are using NLP for data extraction. There are also several companies, e.g. BlackBoiler and LegalSifter, that are generally aimed at the inhouse world that focus on helping lawyers to review contracts with NLP approaches.

Then there is the bit about ‘explainable AI’, which just seems especially subjective. All NLP companies will try to explain what they are doing if you ask them. Some approaches to machine learning can be harder to explain than others, but is this really ‘a thing’, i.e. a separate category?

ALSPs

Alternative Legal Service Providers (ALSPs), which are primarily skilled legal service businesses, sometimes with consulting capabilities, and in a handful of cases offering their own tech stack, e.g. Elevate, were in the 2020 chart and this year they are now entering the trough of disillusionment after moving through the peak of inflated expectations.

This site would place ALSPs, which have been growing and diversifying across the world for a couple of decades now, well into the plateau of productivity. As we have seen in countless surveys, the use of ALSPs is on the rise and many law firms, as much as clients, now rely upon them for complex process-level work.

There is also a debate about whether to include them in this at all. And if you include ALSPs, should we not also put ‘law firms’ into the hype cycle graph as well…?

Smart Contracts

Now, here is a category we truly can say has not really taken off – yet – and which has experienced a lot of hype, in part because of its connection to the blockchain world.

In 2021 smart contracts are now in the trough of disillusionment after being in the peak of inflated expectations. And that sounds right. Now that Clause – the main purveyor of complex smart contracts – is part of DocuSign there is a great opportunity for real growth and substantive uptake of the tech. This follows a period of high hopes that didn’t materialise at scale in the real world. So, this category position seems spot on.

There are plenty of others to consider and no doubt everyone will have their own take on this. Not sure what the overall message is here, other than perhaps judging where a technology is in terms of uptake and development is clearly still a subjective experience. This site seems to be looking at things in a quite different way. But, have a look and see what you think.

Thanks again to Gartner for sharing the main graph on social media. If you want the full report you’ll have to buy it by becoming a client.

3 Trackbacks / Pingbacks

Comments are closed.