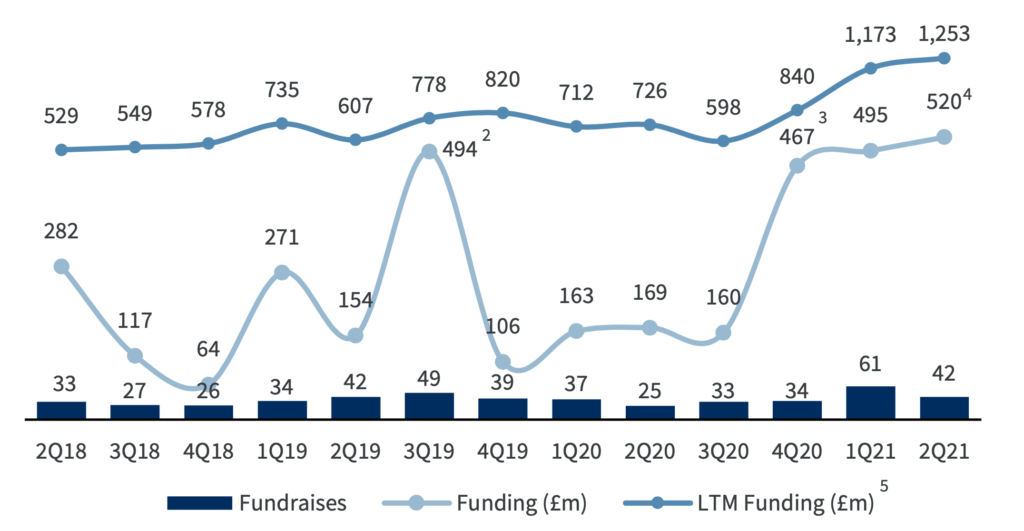

The latest survey of legal tech and ‘NewLaw’ businesses by Raymond James shows an incredible last six months, with investment at £1.015 billion ($1.41 bn), while M&A in these linked sectors hit an all-time high with 87 deals from January to June 2021.

This is more funding in these sectors in the last six months than for the whole of 2020. Part of this can be attributed to held back deals that the pandemic had delayed, but even so, these figures are extraordinary.

Another factor was more mature companies receiving huge late stage rounds, e.g. Clio’s $250m Series D, and RocketLawyer’s $223m Series E. And of course, this data doesn’t include the several legal tech companies heading to IPOs that we have seen recently, such as Intapp, DISCO and LegalZoom, which also indicates a new stage of growth for legal tech companies.

The table above also shows that we have seen 103 funding rounds in the legal tech and NewLaw sectors since the start of 2021, up from 62 for the same H1 period in 2020.

The values, as noted, have also shot up dramatically. But, even if we take out the mega-fundings of Clio and others, we still have an investment trend picture over the last six months that is extremely healthy.

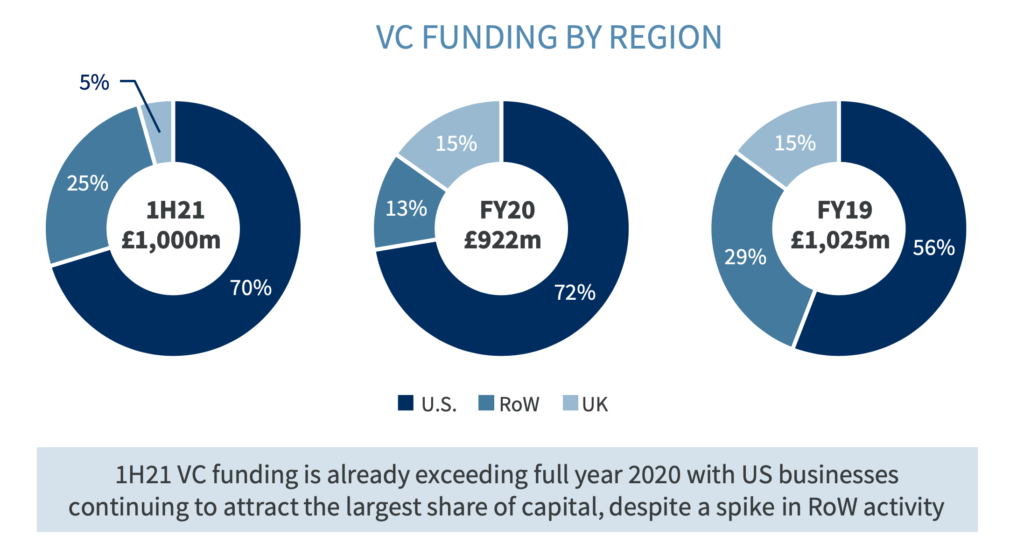

And as the regional tables show, the US had 70% of this VC funding activity, with the UK showing 5%. The rest of the world, such as Western Europe and Australia, represented 25% of the funding. Why the UK figure is small isn’t clear, but it’s perhaps because the US figures were relatively so high. This suggests that although funding kept going in the UK, many of those rounds were for earlier stage companies.

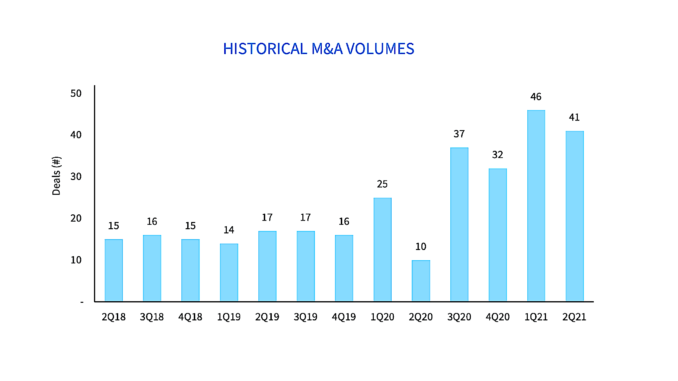

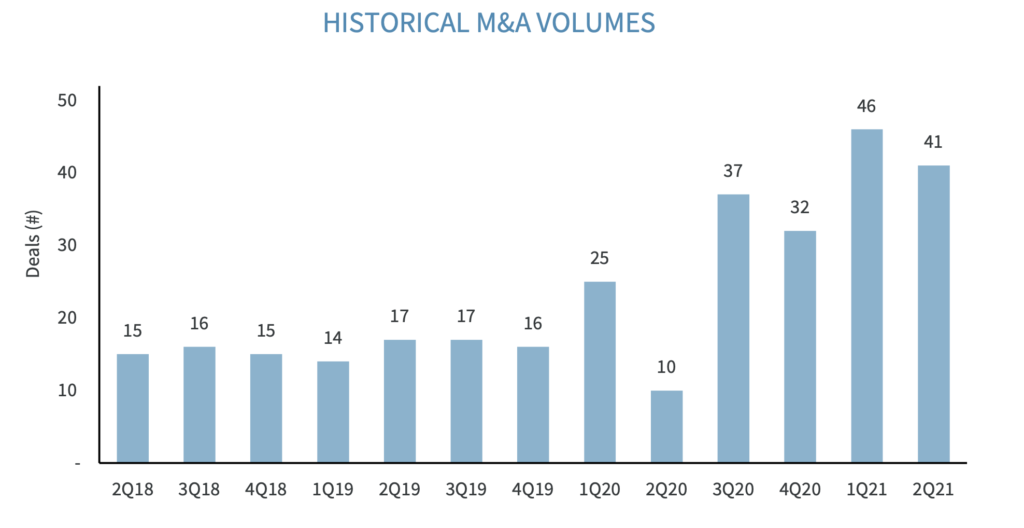

Of equal interest is that M&A volumes have hit a new record, with 87 deals in six months. The previous six months, i.e. H2 2020, saw 69 M&A deals.

If one looks at 2018 – which was a good time for NewLaw and legal tech as well, we only saw 31 deals across H2, while in 2019, H1 also 31 deals. So, broadly we can say that the rate of M&A in these sectors has more than doubled now, or thereabouts.

This is further proof that the consolidation wave in the legal tech world is indeed a real thing, and also that there are plenty of deals to be had. We may see a dip as we go into 2022, but the longer term trend is more and more deals between vendors.

This comes at a time of increased platformisation, and also close partnership deals between legal tech companies and ALSPs, which one could argue is inspired by the same need, but results in a different strategic outcome.

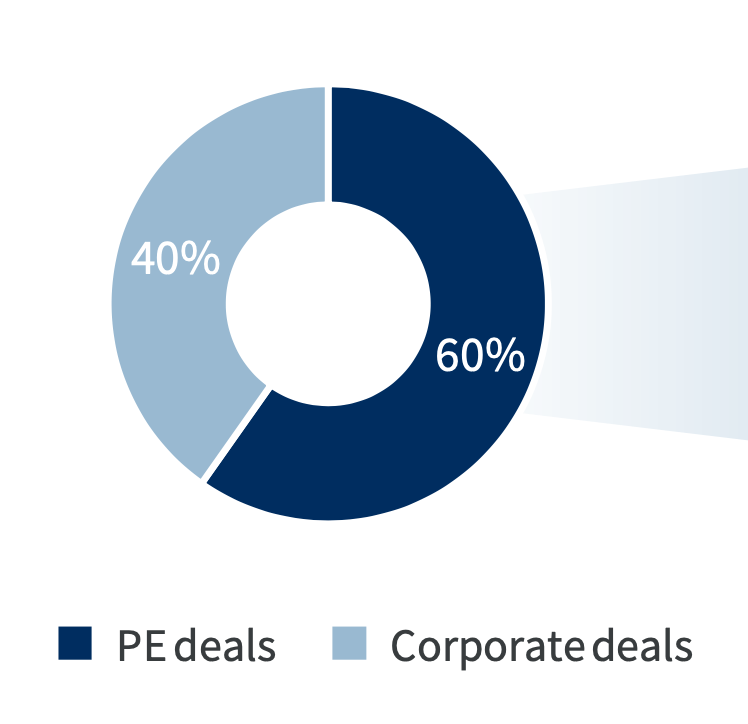

And finally, the power of private equity cannot be ignored. 60% of the M&A deals in 2021 so far had some form of PE component, and in many cases these large funds were buying companies outright, sometimes from other PE owners. For example, Eagle Tree Capital, which owns the American Lawyer, bought ALSP Integreon from NewQuest Capital Partners, another private equity firm.

Conclusion

What does this tell us? Part of the surge can be explained by delayed deals caused by the pandemic. Some of the huge late stage funding rounds have also made the table spike. But, even if we remove these, the longer term trend is toward more money flowing into legal tech and NewLaw, and more M&A deals. And, as mentioned, then we have to add the move into IPOs as well, which this report doesn’t detail.

Moreover, new legal tech companies are coming into existence every few weeks, and more lawyers are engaging with software designed to help them in their work. For now at least, the legal tech – and ALSP – world is on a clear and very healthy growth trajectory.

–

Many thanks to Junya Iwamoto, Director, investment Banking, for the data. You can find the full report here.

(Note: added the top line figure for H1 2021 incorrectly, as noted, this should be £1.015 billion, not £1.150 billion, which is $1.4 billion in US dollars.)

3 Trackbacks / Pingbacks

Comments are closed.