A new report by LexisNexis has outlined just how far the Big Four’s legal arms have grown in recent years. What also has changed is their strategy.

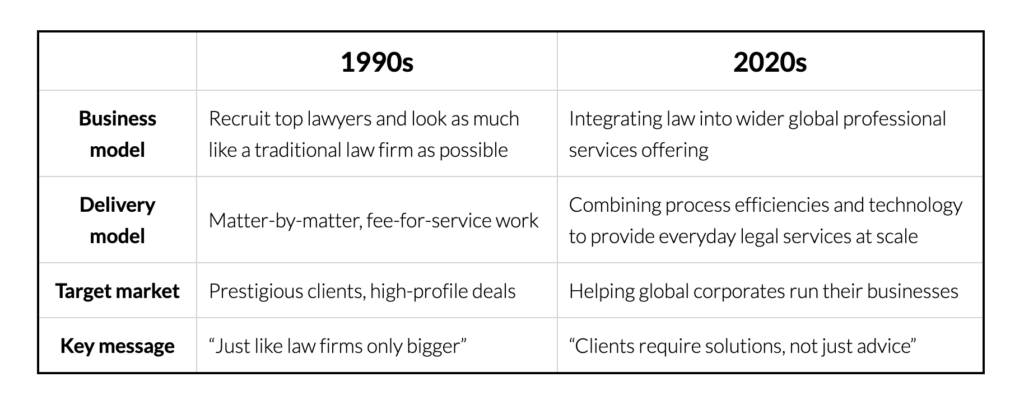

As Harvard Law School’s David Wilkins explains in the study: ‘The last time they tried to enter the legal profession in the 1990s, their strategy was ‘we’re just like law firms only bigger’. But that’s not their strategy anymore. Their strategy is: ‘we provide a different kind of offering, moving from a fee-for-service model to an integrated solutions mode’.’

So, a new strategy, but how far have they grown? First, let’s look at a couple of the key charts. Table one compares legal services revenue, primarily in the UK, at PwC vs KPMG from 2016 to last year.

As you can see, while there are differences in the scale of the two, the story is the same: solid growth. For PwC it went from just under £50m to £100m, so around 100% growth in five years. For KPMG, it went from £12m to £45m, or just under a quadrupling in revenue – albeit starting from a lower base.

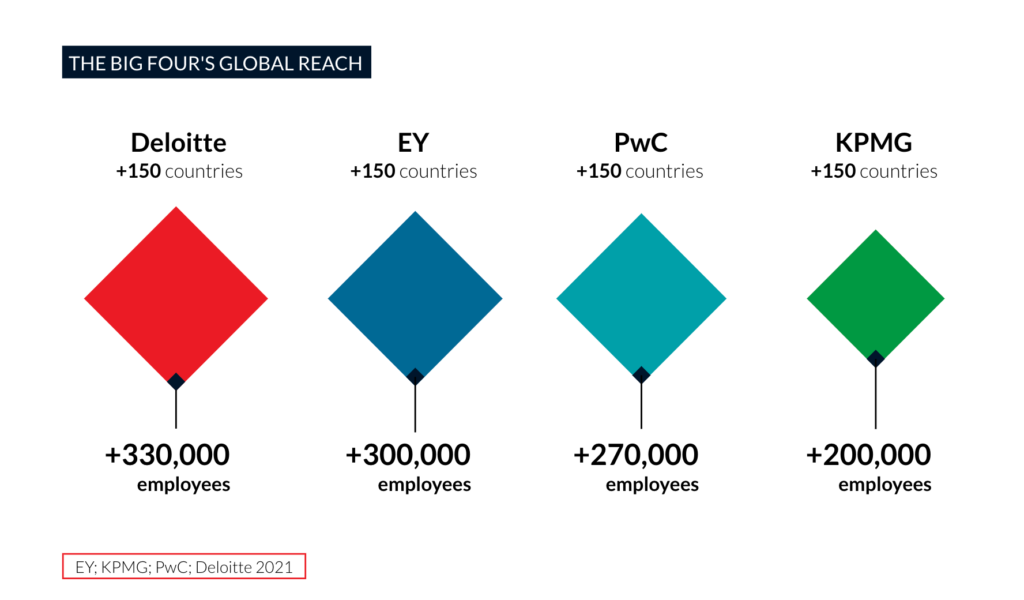

Yet, these numbers are still ‘small’ when compared to most well-known commercial law firms. But, this data only shows part of the picture. The Big Four legal arms are global, they also engage in a lot of activity that is not regulated legal advisory work and estimating ‘Big Four legal revenues’ is more an art than a science given the spread of services they provide that overlap and link to ‘legal work’.

There is a growing legal managed services (LMS) / process work capability that operates without the need to be regulated by local Bars across the world. There is also plenty of consulting, from legal ops to legal tech input, that may also not always be strictly seen as ‘legal work’. And, this is where their real growth opportunity is.

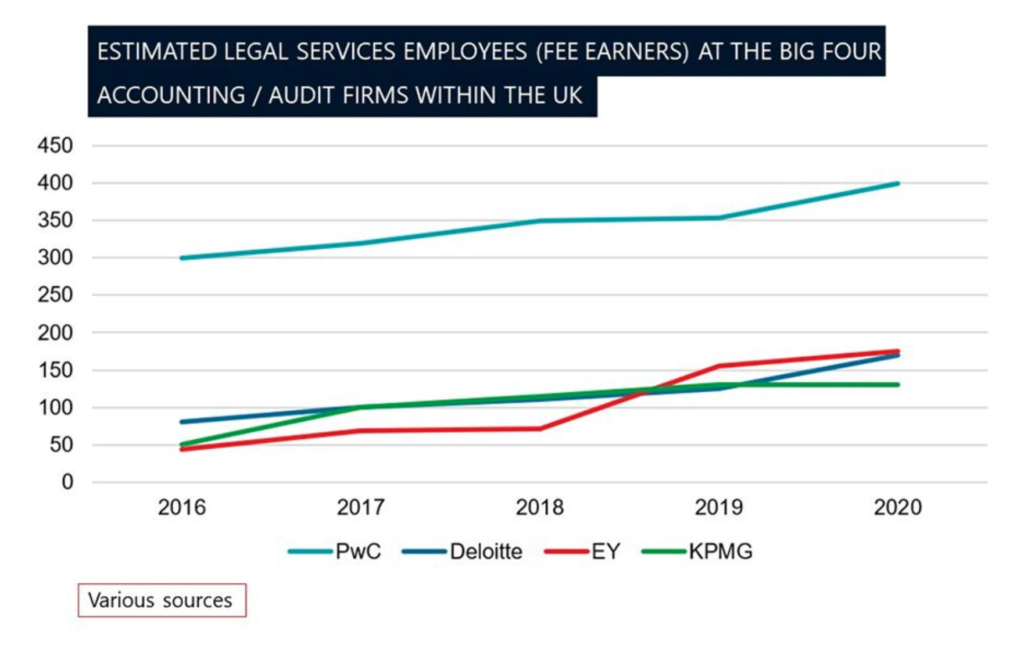

The second table shows the growth of staff in Big Four ‘legal services’ – which as noted can sometimes be a bit blurry as a designation – that are in the UK.

Here, PwC is clearly out in front, with about 400 staff. The other three are all around 100 to 150 staff. Again, these are not numbers that would normally scare the major law firms.

Friend or Foe?

Now comes the inevitable discussion about friend or foe. The Big Four are not going to knock the top firms off their perches in the UK or elsewhere. In fact, right now probably all four of them are working on several deals hand-in-hand with a range of leading law firms. I.e. their relationship with law firms is symbiotic, as it is with other ALSP-type providers.

Law firms need the Big Four and the Big Four need law firms. But, will that remain the case? That is the question.

The report goes into its own analysis here. But, from Artificial Lawyer’s perspective, the opportunity for the Big Four is to work really closely with the larger corporates on – to put it simply – driving efficiency and reducing risks created by outdated processes in the legal and contracting teams. That is what they do elsewhere in the business.

That said, they don’t necessarily have a huge advantage over some law firms that have built their own LMS/process/consulting/legal ops groups. Obviously law firms know their clients really well, (well…..most do), so groups such as Ashurst Advance or Norton Rose Fulbright’s Transform group and its Hubs, and many others, have just as much chance of succeeding.

In fact, if you think laterally about it, who has the best and widest range of expert lawyers? Law firms.

Can these law firms also offer excellent LMS, process and legal ops support? Yes, if they put money and time into developing it and are committed to real change in their clients.

So, in fact, the Big Four don’t really have any special or unique ability here to just steamroll their way in. They have some advantages in that they are used to bringing together lots of skill-sets: from tech, to consulting, to advisory. But, law firms can do that too now – if they really focus on it and see it as central to their future.

Crunching process is a skill, for sure, but it’s not impossible for a wide range of players to be in this game, from a dozen or more other ALSPs, to law firm process groups, to tech companies that are now in some cases evolving into professional service providers as well. It’s an open market. No-one owns legal process yet – and maybe there are so many players now no party ever will dominate it completely.

So, for this site, when people start on the old cliché about ‘the Big Four are coming for our jobs’ it just seems out of touch with reality. All the major law firms, together with the ALSPs and other organisations in this market, can compete with the Big Four’s LMS strategies just fine. The larger firms can also usually beat the Big Four legal arms on high complexity work.

Moreover, the overall demand for legal process and better contracting services is growing steadily – see the rise in the demand for CLM systems as an indicator, for example.

In short, seeing this all as a kind of zero sum game, where Big Four growth = demise of everyone else, is really way too simplistic, and frankly that old view is just not how things are evolving these days. Moreover, their success, as explored above, is by no means certain.

Conclusion

As you can see from these two tables above, legal is really just a very small part of the whole. PwC may have several hundred staff in their UK legal arm now, but the firm has global revenues of $37.2 billion. This is a business which has many other strategic priorities, and legal slots into that, but seeing these numbers and going: ‘Ah, so it will be easy for them to take over the legal market’ is a leap of logic that in the real world makes little sense.

The legal services sector is not an ‘easy market’ – at any level. You can’t just walk in and take market share, like slicing big pieces out of a cake – even at a consumer level. It’s a hard slog. And in the more sophisticated world of large corporates it’s an even harder slog.

These large companies who are their clients have known both the law firms and the Big Four for decades. The buyers are demanding and smart people who don’t just abandon tried and trusted providers. They know who is good at what. They try to avoid taking risks. They need a really good reason to change how they do things.

In such a market the Big Four act as a tremendously positive catalyst that helps drive innovation on the provider and the buyer side. But, at the end of the day, they are just one group of players in the legal / legal process market among many others and don’t have some kind of magical power to win market share more than anyone else does. They are simply part of what is today a much more diverse sector in terms of providers. And that’s a good thing, but it is no reason to panic.

The full report and its interviewees’ views can be found here.

1 Trackback / Pingback

Comments are closed.