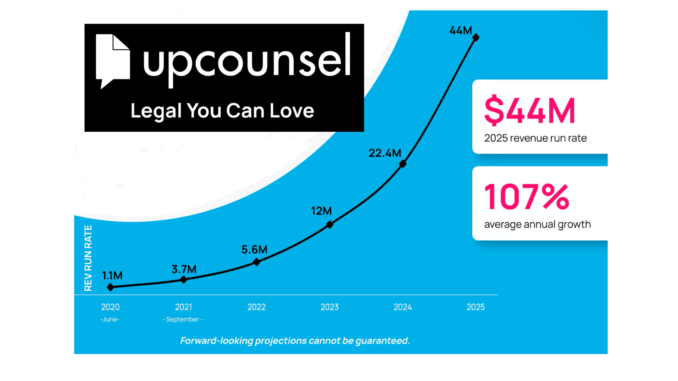

UpCounsel, the online legal marketplace, has raised $3.36m via a crowdfunding and now plans to go public in five years. Over 1,630 individual investors provided the money, which the company – reborn after the original team left for LinkedIn in 2020 – believes will power it to $44m revenues by 2025. The move is also another validation of crowdfunding for the ALSP and legal tech sector.

UpCounsel is certainly not your average startup (or perhaps we should say ‘re-startup‘). For example, take its CEO, KJ Erickson (pictured below), who was named by Rolling Stone as one of the ‘Top 25 People Shaping the Future’ and has been lauded by CNN and the Clinton Foundation. Plus, Erickson is a ‘four-time founder and a Y Combinator, Stanford and Oxford alumna’.

Interestingly, its Chief Revenue Officer is Paul Drobot, former VP of Sales at Atrium – the ALSP started by Justin Kan that blew up a couple of months before the original UpCounsel ended.

The move is all the more extraordinary as UpCounsel in its original formation effectively came to an end last year, the founders and other team members moved to LinkedIn, and many believed that was the end of that. But, new entrepreneurs arrived in the shape of investment fund Enduring Ventures, which picked up the brand and has breathed new life into it.

Now, the company has said to its many new and far smaller investors, that: ‘Our goal is to bring the company to the public markets within 5 years time. We can’t predict the future, but our management team now works for you – and we will work tirelessly to get you the best return on your investment.’

I.e. that an IPO will be the exit plan for those who have contributed money.

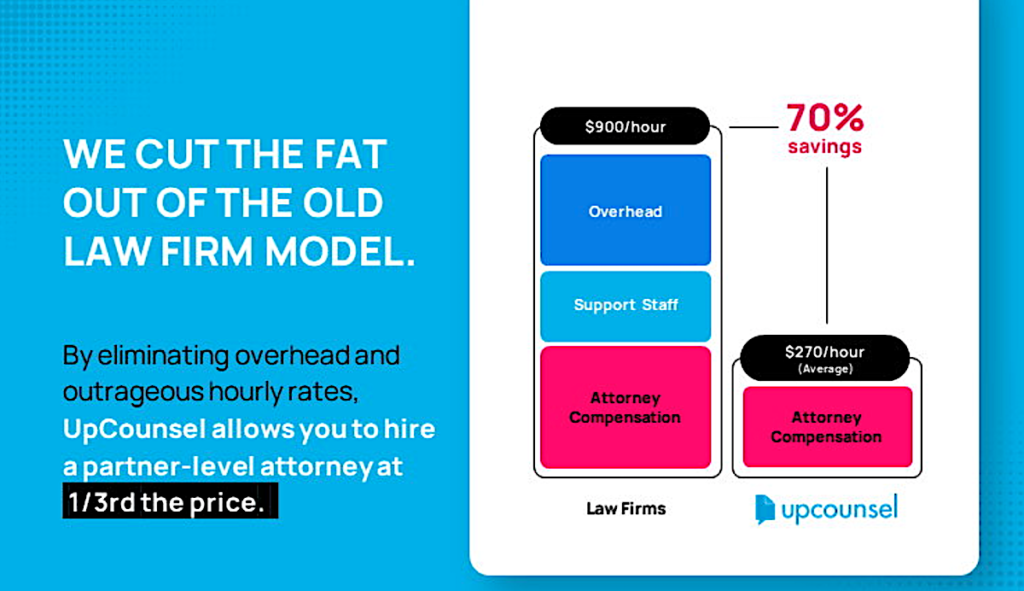

So, can this all work? On paper it does look impressive. For example, they explain that they have cut legal costs for clients by 75% in some cases by removing law firm overheads, (see diagram below).

They also explain that you can find a partner level lawyer on UpCounsel for $270 per hour, rather than $900 per hour, or in this case a saving of around 70%. That said, this site would like to see them also invest in developing some fixed fee pricing if they really want to be innovative.

They also have some fairly stunning graphs that state the number of freelance and part-time lawyers in America will rise to 73% of the total by 2025. That seems very high, but they could be right. And they also state – based on Statistica data – that the legal tech market will generate revenues of $25bn by 2025.

As you’d expect, the crowdfunding page is full of optimism and excellent growth forecasts.

Will that growth happen? In truth, no-one can actually know. Look at Atrium, for example. Or even look at the original UpCounsel.

But, on the flipside, Covid may have played to their advantage. More people work from home and want a flexible life. Digital tools for lawyers – whoever provides them – now make remote legal work much easier. And clients are increasingly getting used to ‘lawyers on demand’ services and other types of ALSP. So, perhaps UpCounsel V.2 can achieve its goals.

The last point is how this helps to encourage more crowdfunding in this sector. Ruby Datum the VDR company is also currently doing a crowdfunding, and Clocktimizer was funded in the same way before it was bought up by Litera. So, perhaps we will see more approaches like this. That said, UpCounsel is itself owned by an investment group – along with 1,630 others now, so it’s not a pure-play crowdfunding in its entirety.

This will be watched by the VC world and the legal market in general for signs of whether it is succeeding with its goals.

(N.B. the funding ends later today. Naturally, Artificial Lawyer is not providing financial advice and is not recommending that you invest. Always take independent financial advice from a professional before making an investment.)