Luminance, the doc analysis AI company, made £2.78m ($3.69m) revenues globally last year, but with losses of £4.4m ($5.84m). Its average revenue per client, based on 250 clients in December 2020, was £11,112 ($14,753) – which is lower than in 2019, the company’s latest accounts show.

Overall, the results are a mixed bag, with some positives along with some systemically challenging issues, e.g. low average revenues per client and also limited growth in some markets.

First, Luminance is a growth capital funded business, so it’s not unusual to have a loss. The question is whether a loss this large after launching back in 2016 is of concern, even if the loss is less than in 2019, which was around £5m.

Should there be allowances made for Covid’s impact? The reality is that most of the first quarter of 2020 was ‘about normal’, then Covid really hit and this did impact Q2. But transactional activity really picked up after that, and arguably by the end of 2020 deal teams were rushed off their feet by the volume of work. So, although it no doubt had some impact for several months, the commercial legal world arguably did well overall last year.

The accounts for 2020 also state under the subject ‘Going Concern’ that ‘The directors have….obtained a letter of support from its immediate parent undertaking, Luminance Holding Limited. Luminance Holding Limited has also obtained a letter of support from a related undertaking, ICP London Limited.

‘Both letters of support indicate that the Company and Luminance Holding Limited, respectively, will be provided with the necessary financial support for the foreseeable future, being at least 12 months from the date of approval of the Company’s financial statements.’

In 2019 they raised $10m – although this round was led by Invoke Capital – the fund closely associated with Mike Lynch, who remains listed as a Director of ‘Luminance Technologies Limited’.

Cash in the bank and ‘in hand’ had dropped at the end of December 2020 to £1.3m, down from £5.2m at the time of the 2019 accounts.

Another aspect is the client base. Luminance has gained a very large number of smaller firms across Europe and APAC as clients, which looks good on marketing materials, but as seen in the revenues, doesn’t always translate into equally massive growth.

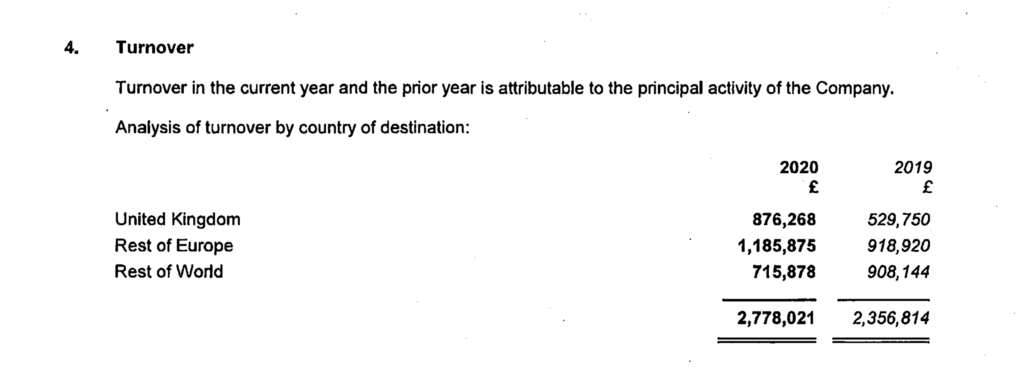

The UK did see notable improvement, going from £529,750 in revenues to £876,268 – which suggests that at least customers in the UK are using the system for doc analysis. In the ‘Rest of Europe’ revenues also increased to £1.185m up from £0.9m.

But, for the ‘Rest of World’, which includes the US – the largest legal market – and also where Luminance had its CEO for a time after Emily Foges left to join Deloitte – saw a decline in revenues from £908,144 to £715,878, or a drop of around 21%.

One other aspect that really stands out is the average revenue per client, which is actually lower in 2020 than in 2019. Part of that can be attributed to more clients, hence a bigger denominator, but still….if clients are actually using a doc analysis tool for client work at scale, rather than just paying an annual licence fee, then one would expect revenues per client to rise due to usage levels.

Using the 2020 revenues and divided by 250 clients, that gives a revenue per client of £11,112. In 2019 Luminance estimated it had around 200 clients by the end of the year. Based on that number, this gave an average income per client of around £11,700 ($15,500) based on data that year.

The last point is whether revenues of £2.778m are out of step with market expectations? The answer is: it depends on who you talk to.

Despite the recent wave of interest in legal tech from the broader market after a series of IPOs, and even an article saying we will see ‘hyper growth in legal tech’, the reality is that for every large company going public there are dozens and dozens of legal tech businesses that make in the single millions (or less) in revenues and likely will keep at that level for a long time to come.

Conclusion

The data shows a company that is winning new clients and growing its revenues overall, and that should be welcomed. But, low revenues per client, weakening revenues for the ‘Rest of World’ (which includes the US), along with stubbornly high losses each year, are not so great.

As to the future, we will have to wait to see what the data for 2021 shows. We will also be looking out for another major funding round, given that the last one was in 2019. And some market observers will no doubt be wondering if 2022 is the year that Luminance is bought by another party. We shall see.

2 Trackbacks / Pingbacks

Comments are closed.