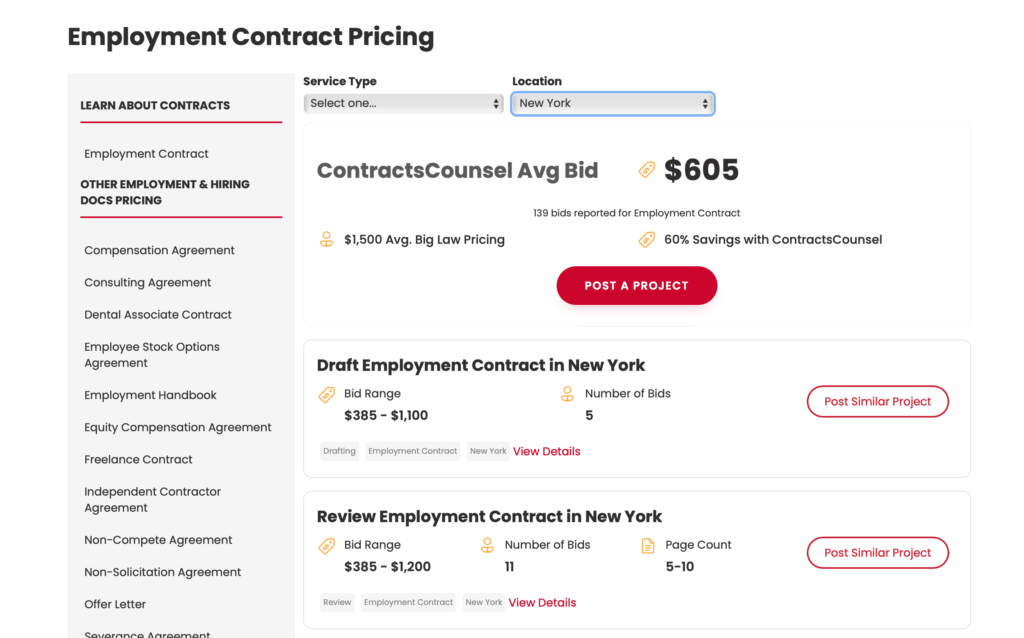

ContractsCounsel is a legal marketplace that helps clients to find lawyers for a range of productised needs. It’s also a great move towards ending the information asymmetry of the legal market. Its secret sauce is how it has collected data on what prices its lawyer members offer, providing buyers now with a clear median price and a comparison to Big Law rates so that they can make a more objective choice.

Take a look at the image below. It shows the median price for an employment contract in New York on the platform.

Or, as Ray Allen, founder of ContractsCounsel explained: ‘The pricing and project details section on our site will allow you to find document and task types, and show you our median bid data, with the number of bids reported. We’re starting with roughly 90 doc types and this number will also grow.’

Artificial Lawyer was intrigued. It’s often said that pricing legal work is tough – but Allen has done it and done it very transparently as well. So, this site put some questions to him about the platform.

– Why choose the median price? (i.e. rather than the mean or modal average?)

We chose the median price since it will be closer to what the user will experience on the platform. Bid distribution curves are right-skewed since outliers are typically higher bids, which drives the mean up. We want to show data that will set user expectations well so we can deliver on those expectations.

More on pricing – on the surface, there seems to be a high degree of pricing variance – though I think it requires a bit more thought than just what the numbers say. For example, 59% of projects have a bid spread of over 2x (highest bid is over 2x the lowest bid) and 32% of projects have a bid spread of over 3x. In thinking about this, it isn’t surprising since most lawyers price flat-fee projects based on how many hours they believe a project will take them to complete. One lawyer may think it will take them 2 hours to complete an assignment ($500 at $250 per hour) because they already have a good template or good knowledge on the type of work, while another may think 5 hours to complete ($1,250 at $250 per hour) if they think they will need to do a bit of research and draft from scratch.

Certain types of technology (i.e. doc automation technology) can also reduce drafting time for lawyers, which can make them more competitive while still realizing a high hourly rate based on their actual time spent. We know some lawyers participating in our marketplace use these types of technologies or have invested a lot of time in setting up a good template bank to pull from. We want to eventually build these types of technology offerings to provide to lawyers working on our platform to make them more efficient which may lead to a higher realized hourly rate and more affordable rates for consumers.

– Have you seen what the clients prefer? e.g. do they tend to accept the median price that is listed?

About 50% of clients accept the lowest bid. The remaining 50% typically accept the median. We do see some clients accept the highest bid, even if the bid is over a 3x multiple of the lowest bid offered. I think this comes down to client budget and whether it is a business-related expense versus a project for an individual. I can’t say that for certain since it would take more analysis.

– Is this having an effect on the lawyers? e.g. are you seeing a tightening of the distribution curve over time? i.e. as people become more aware of what is ’the norm’ the other lawyers all start to pitch for that median price and so the spread becomes more narrow (which is a good thing.)

Our platform currently provides lawyers with pricing data if a client moves forward with another lawyer. It sends them the number of bids, bid range, whether or not the client selected the lowest bid, and how many words the lawyer used in their cover letter that was awarded the work. We get good feedback on this feature and we have seen pricing change in response to this feedback (typically bids coming down and lawyers doing a better job on pitching themselves). We haven’t run a solid analysis on bid distribution changes over time. Given our data will become more available moving forward, we’ll look to do this in the future to see how transparency impacts pricing.

– This is for US lawyers / clients?

The marketplace is primarily made up of US lawyers and US clients. We have seen a surprising number of international clients hiring US lawyers to do work which is mostly related to companies accessing the US market in some way. This makes sense since most of them do not have a relationship with a US law firm and we serve as a good solution for them.

We do have a handful of international lawyers that have registered with us that have worked on projects, but we do not market international lawyers yet. We are seeing international users looking for lawyers within their own country (typically where English is a major language – i.e. a UK client looking for a UK lawyer), but will fall out of our funnel when it becomes apparent we are only serving the US market at this time. So we do believe there is demand elsewhere.

– And last question: what is the largest / highest value matter that you have received median pricing for?

Generally, the largest projects are related to M&A (asset purchase agreements, business purchase agreements, share purchase agreement, etc) and corporate formations (C-Corp formation, S-Corp formation – likely because there are multiple docs and filings in scope). Private placement memorandums have the highest median bid, but we have a lower amount of data on them at this point.

Thanks Ray, and great work!