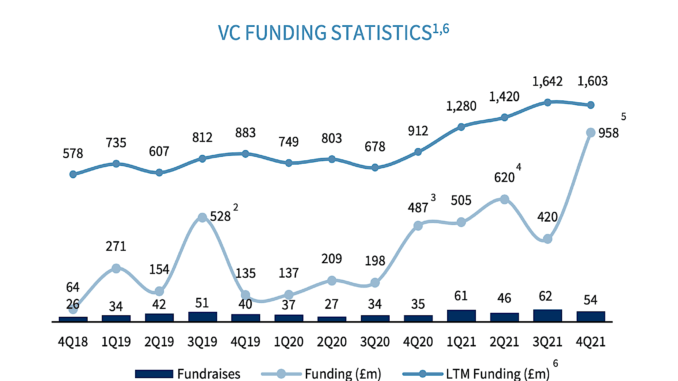

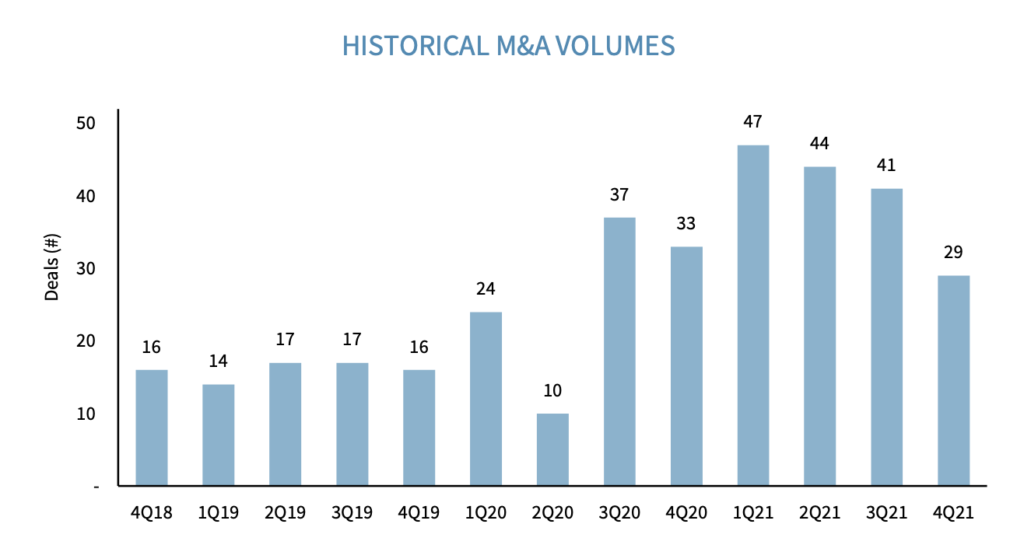

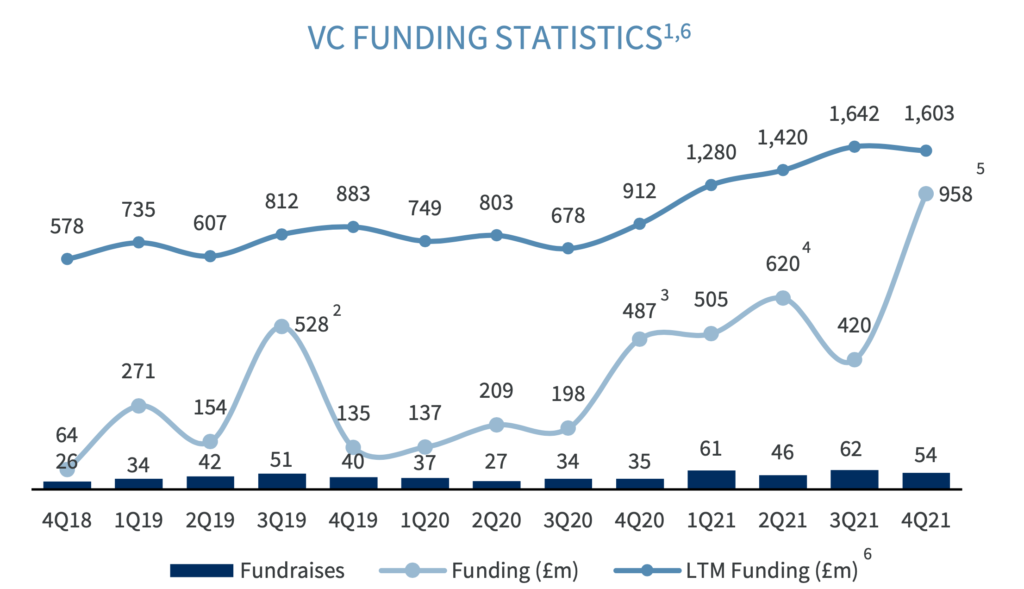

Data from Raymond James shows that 2021 was the busiest year ever for legal tech and NewLaw investment, as well as M&A activity, with £2.5bn in total funding. There were 161 combination deals, plus 223 notable fundraisings last year – which is a record for this sector.

In comparison, M&A in 2020 totalled just 104 deals, meaning that we saw about a 55% increase in combinations across legal tech and NewLaw companies in 2021. Private equity was once more very present in many of these deals, suggesting that investors of this type see the long-term value in legal tech as much as VC funds see the opportunity to take equity in startups, scaleups and more mature legal tech companies.

In terms of VC investment, we saw just 133 notable funding rounds in 2020, showing that last year experienced a 68% increase in money flowing into the sector in terms of the number of fundraises.

Total VC fundraising soared in value to around £2.5 billion last year, with Q4 2021 seeing an enormous series of rounds that came to £958m across those three months (see below).

So, what is driving this?

One key factor is that deal activity in 2020 was suppressed by COVID. It’s seems hard to remember now, but at the start of the pandemic some companies were really struggling to get funding. Now, the situation has gone into reverse and it feels like money is actively searching out targets.

The arrival of legal tech IPOs no doubt has also increased the attention of investors, meanwhile the global legal tech market keeps on expanding just as the demand for legal services keeps growing.

The number of M&A deals suggests that consolidation is accelerating, although it’s driven by a handful of big players, such as Litera.

That said there are still hundreds of legal tech businesses across the planet, so even super-acquisitive platforms like Litera can only make a limited impact. Although they can target market segment leaders, and add them to their platform, which perhaps increases their impact in terms of consolidation being felt by law firms and inhouse teams that may rely on these larger brands, e.g. Kira Systems.

Overall, the data presents an image of rapid deal-making and investors increasingly open to funding legal tech. Although, some of the high funding figures are the result of bumper rounds for legal tech companies that have now reached a level of maturity. I.e. not all of this cash is going to two-person ‘garage startups’, rather it is often large legal tech companies that have reached a very solid financial performance and are now bagging equally very large investment rounds. That in turn pushes up the figures.

I.e. while a Seed round legal tech start up may be looking for £500,000 to £1m in VC funding, larger companies may be seeking funding in the hundreds of millions of pounds.

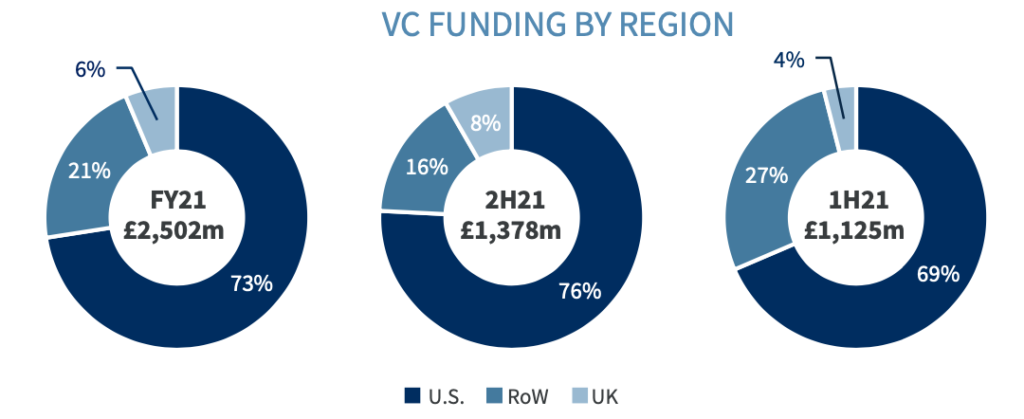

Also, the majority of the investment – and deals – took place in North America, with the UK taking a notable, but far smaller share.

But, however one cuts the data, 2021 was a record year for legal tech. And it’s been very good for NewLaw as well.

—

(Note: all data and charts courtesy of Raymond James.)

(Chart reference notes: Source: MergerMarket, Pitchbook, company websites, Raymond James analysis

Note: 1. Only Western Europe & Nordics, Israel, North America, Japan and Australasia ‘developed markets’ considered; 2. Includes Clio $250m Series D, 3. Includes FiscalNote $160m RAYMOND JAMES INVESTMENT BANKING 7 development capital; 4. Includes RocketLawyer $223m Series E, Verbit $157m Series D; 5. Includes Ontra $200m Series B, Everlaw $202m Series D, ZenBusiness $200m Series C, Verbit $250m Series E; 6. LTM funding analysis excludes exceptional large funding rounds (>£100m), but have been included in quarterly funding analysis; 7. Combination of debt and equity.)

2 Trackbacks / Pingbacks

Comments are closed.