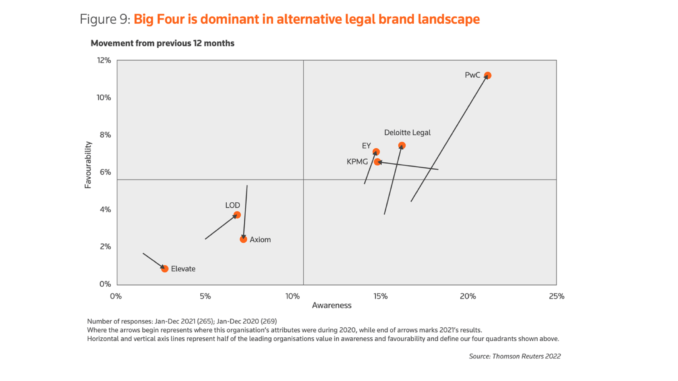

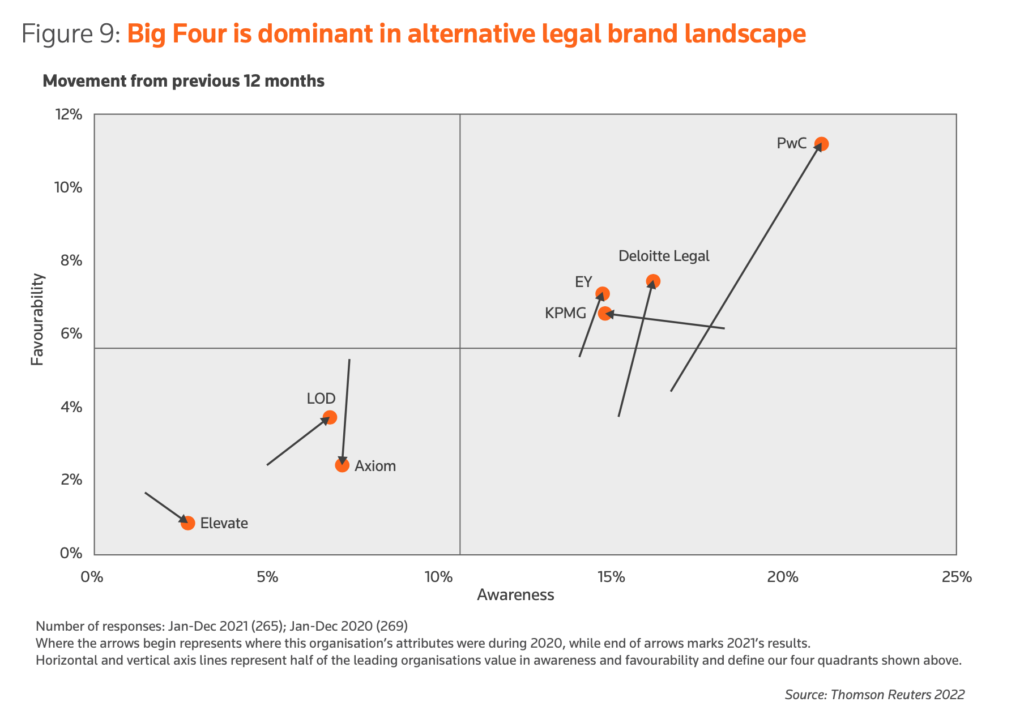

Another aspect of the ‘State of the UK Legal Market’ report by Thomson Reuters is that when it comes to clients seeking ALSP-style input then it’s the Big Four that are seen most favourably and are most well-known – with other ALSP groups and law companies doing noticeably not as well.

Across a sample of 265 inhouse lawyers, it was clear that the Big Four, i.e. PwC, Deloitte, KPMG, and EY, were doing better in terms of broad recognition and favourability than Axiom, LOD, and Elevate. As to why, see below.

But, first it’s worth adding that this data presents a picture of minimal awareness in general. I.e. even awareness that these businesses had ALSP-style offerings is 15% or less for all but PwC. That suggests many in the sample were not very large companies and hence didn’t really know much about this kind of thing, nor had that much need for it, as their businesses didn’t have the volume of work. It’s hard to think that there are many companies’ inhouse teams in the FTSE Top 50, for example, that have not even heard of LOD.

So, we need to take this data with a hefty pinch of salt. That said, it does still offer some indicative views of the ALSP market.

So, what does it tell us? The simple answer is that the Big Four’s much greater brand recognition outweighs the marketing efforts of groups such as Elevate and LOD. But, this is to be expected. Even if their ALSP arms are small still, their marketing reach to companies is huge because, well…the Big Four are huge and provide a raft of other services to those companies already. Also, the Big Four (it is believed) do a very good job of cross-selling their capabilities.

That PwC and Deloitte have greatly improved their positions makes sense. Both have hired in talent and expanded their legal ops, tech consulting and broader process/ALSP/managed legal services capabilities – and they also have good old-fashioned legal advisory capabilities in the UK as well.

That EY has only gone up by a bit after previously buying Pangea3 and also Riverview, suggests that despite these moves they are now facing strong competition from their rivals and the initial advantage they had may now have been lost.

KPMG however seems to be going backwards – at least in the UK – and it’s fair to say that they have been a lot quieter over here than in places such as Germany.

On LOD, Axiom and Elevate, it makes sense that Axiom has dropped in favourability given that several of the core parts of the group, e.g. Factor, have spun out. Why Elevate is not that well-known and has even seen a small dip in favourability is unclear. Across the market in general they appear to be as well-known in the UK as LOD, for example, and have been expanding their offering considerably. It could just be because of a small sample and so Thomson Reuters has come to this result, but the team there will no doubt find the chart intriguing.

Either way, what this tells us overall is that the Big Four have a clear advantage, and apart from KPMG, they appear to be making ALSP hay while the sun shines. The others will clearly have to up their marketing efforts if they want to compete more with their larger rivals.

You can get the full report here.

P.S. because of the Good Friday and Easter Monday holidays, Artificial Lawyer will be back on Tuesday 19th April. Happy Easter everyone!