In the latest ‘State of the UK Legal Market’ report, Thomson Reuters has found legal tech adoption among many clients remains at the very early stages. For example, only 18% were using a contract management solution. However, the flip-side of this is that there is a massive opportunity for growth…..(got to look for silver linings, right…?)

First, some context. It’s worthwhile considering that a few years ago the figures would have been much lower for anything more advanced than eSignature among many inhouse legal teams. Also, look at the sample size – it was just 34 companies in the UK, and we don’t know the scale of the businesses that responded. I.e. FTSE 100 giants, banks and large insurance companies are more likely to have invested and implemented a lot more of the tech below than others. But, we don’t know how many of the 34 were in this top-level ‘high-implementer’ bracket. One would guess it was only part of the sample.

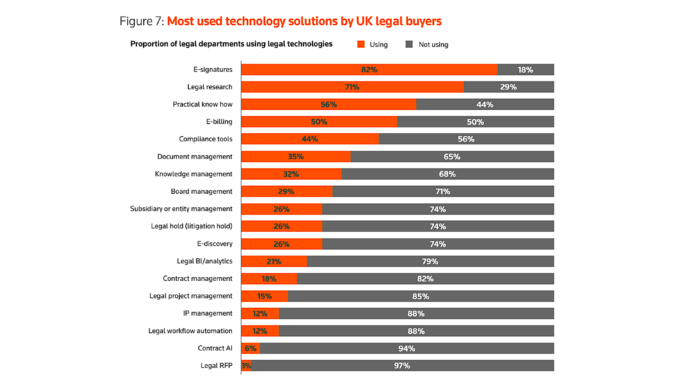

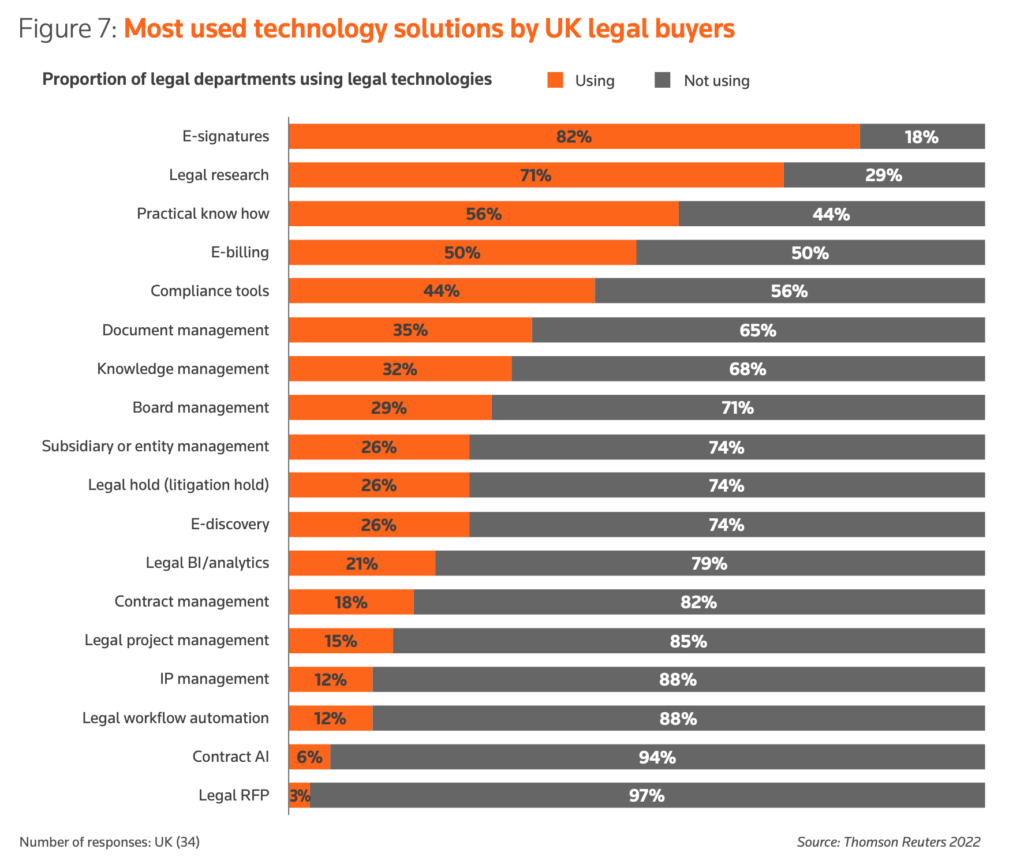

Any road, let’s look at the results below in ‘Figure 7: most used tech solutions by UK legal buyers’, i.e. tech that inhouse legal teams have bought and are using.

So, what does it tell us? As mentioned, expectations have to be put in context. Expecting more than the most rudimentary tech solutions to see wide adoption across the whole inhouse sector would be to get carried away.

Contract AI tools are at 6% (or 2 companies out of 34), and that is no surprise. In fact, at the moment 2 out of 34 is actually quite good. Yep, that is how things are right now…or rather still are.

Contract management – which presumably connects to the broader group ‘CLM’ – is at 18%, or 6 companies out of 34. Again, this is not a stunning revelation. After talking to plenty of inhouse teams in recent years it’s clear that the digitisation of the legal function is, even in 2022, only just getting started for the majority of companies.

And even when it comes to what many would see as basic hygiene for inhouse teams, i.e. document management and compliance tools – we have only 35% and 44% respectively.

What does this show? It shows that the inhouse world is a massively untapped, unimplemented market for legal tech tools. It also suggests that if in 2022 this is still the current state of the market then there are some serious structural issues holding things back.

I.e. most of the tools mentioned in the table have been around for some years now. If use is very low then there are good reasons for it…well maybe not ‘good’ reasons, but barriers that will need a lot of navigating. (And of course, some of the tools may not be as easy to use as the vendors hope…)

It also shows that when people get excited about the ‘much larger corporate market for legal tech’ they need to be realistic. There are indeed 10,000s of more companies than large law firms, but how many are buying anything? That is the question.

In the UK there may only be 50 to 70 law firms that want your AI-driven tools, or have the kind of volumes of business that require them. There may also be many companies that could benefit from what you offer – but most of those companies have no experience in onboarding legal tech solutions, while in many cases the legal team is still allowed to generally operate as it did in the mid-1990s, and there is very little C-suite pressure to really change how it works beyond ‘please can you try and save some money this year?’. Some companies and their GCs are way ahead, for sure. But, as a general sample, the above data rings true.

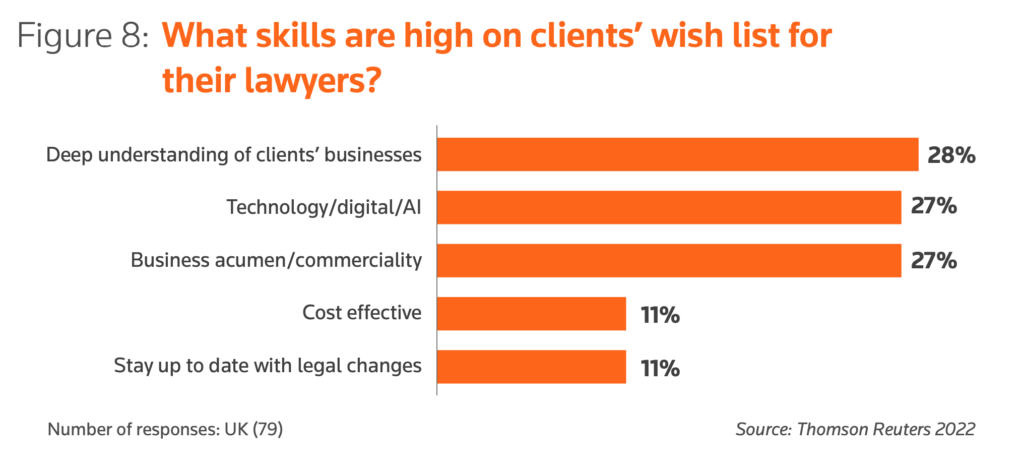

One other thing…..What skills do clients want from their external lawyers? See the table below.

In this sample of 79, people said that ‘tech/digital/AI’ came second to ‘understanding the business’. This site has to say that it’s unclear what this really tells us. Do the clients really want law firms to have tech skills? Really? It would be great if that were true – but if it is true then why the table above which is less than inspiring?

Is this just rhetoric and posturing, with perhaps the clients saying this because they feel they ought to say it?

One thing is certain, the inhouse teams that do actually want change need help with this. And perhaps they will look to law firms for this help, which leads to more consulting on legal ops and tech more broadly.

So, perhaps the main conclusion is this: inhouse teams really need more help on change management.

P.S. the report also found that lawyers were very busy in 2021, but we kind of knew that. The next piece on the report will cover other aspects, see shortly.

P.P.S. because of the Good Friday and Easter Monday holidays, Artificial Lawyer will be back on Tuesday. Happy Easter everyone!

3 Trackbacks / Pingbacks

Comments are closed.